MADRID, 23 Abr. (EUROPA PRESS) -

The MiCA regulation, which this week received the final approval from the European Parliament, places the European Union at the forefront of the rest of the world in regulating crypto assets, according to the majority of experts consulted by Europa Press.

The regulation was endorsed by the plenary session of the European Parliament on Friday with 529 votes in favour, 29 against and 14 abstentions. However, the legal text still needs to be formally approved by the Council.

The regulation creates a legal framework to track crypto asset transfers and prevent money laundering, as well as a set of common rules on supervision and client protection.

"We have been working for years to ensure that we are the most regulated investment platform in Europe, and we are happy to see that the MiCA regulation is one step closer to coming into force. It is truly pioneering legislation worldwide, standardized regulations will bring confidence and security to the sector", said the CEO and founder of Bitpanda, Eric Demuth.

However, the Bitpanda executive has also highlighted that some problems that currently exist will continue to exist with this legal umbrella. "The application continues to focus disproportionately on the European companies that make the most effort to comply with the regulation and that does not make much sense," he criticized.

For his part, the director of Binance for Spain and Portugal, Javier García de la Torre, considers that the new legislative step "has marked a milestone in the development of the cryptocurrency and Web3 industry."

"MiCA will bring regulatory clarity to one of the largest markets in the world, making the EU, and Spain, an even more attractive place for Web3 companies to innovate and attract talent," the Binance expert continued.

In this way, García de la Torre considers that "small details will be key", but in general Binance that it is a "pragmatic solution" to the challenges facing the industry.

The regulation establishes specific requirements in the operations of providers with unhosted wallets so that they are obliged to verify transfers to or from their clients with one of these unregistered wallets.

It will also cover crypto assets that are not regulated by existing financial services legislation and its provisions cover transparency, disclosure, authorization and monitoring of their transactions.

In this way, consumers will be better informed about the risks, costs and charges related to their operations. Additionally, the new legal framework will support market integrity and financial stability by regulating public offerings of crypto assets.

The agreed text includes measures against market manipulation and to prevent money laundering, terrorist financing and other criminal activities.

"The fact that the EU has achieved a competitive advantage with the adoption of this law will become evident in the coming years, when other countries around the world use it as a model for their regulation of cryptocurrencies, the head of regulation has added. of Spectrum Markets, Alpay Soytürk.

On his side, Scope senior consultant Sam Theodore has positively assessed the fact that this standard acts as a "passport" and facilitates the expansion of crypto operators throughout Europe. In any case, he has also indicated that this new regulation "is an additional barrier" and "will lay the foundations for greater clarity on the future digital euro".

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Sentences of up to 7 years for four police officers for illegal detention and injuries to a young man in Barcelona

Sentences of up to 7 years for four police officers for illegal detention and injuries to a young man in Barcelona They investigate in Jaén the death of a six-year-old boy whose mother shows signs of self-harm

They investigate in Jaén the death of a six-year-old boy whose mother shows signs of self-harm The judge orders Rubiales to appear in court once a month and ask for permission if he travels abroad

The judge orders Rubiales to appear in court once a month and ask for permission if he travels abroad Scotland's First Minister resigns after the breakdown of the Government coalition

Scotland's First Minister resigns after the breakdown of the Government coalition How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

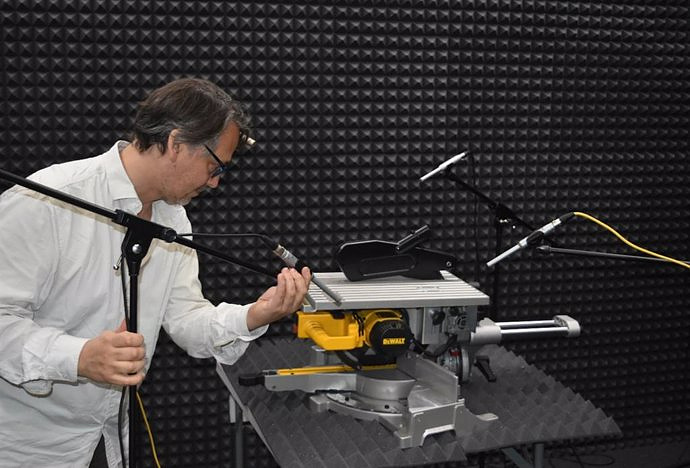

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on They create a bank of machinery sounds to prevent breakdowns through artificial intelligence

They create a bank of machinery sounds to prevent breakdowns through artificial intelligence UPV students build a prototype of a wooden house to move to Equatorial Guinea

UPV students build a prototype of a wooden house to move to Equatorial Guinea The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives

The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives ALI, virtual assistant from Alicante, internationally recognized by the OECD

ALI, virtual assistant from Alicante, internationally recognized by the OECD A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness