MADRID, 29 Ene. (EUROPA PRESS) -

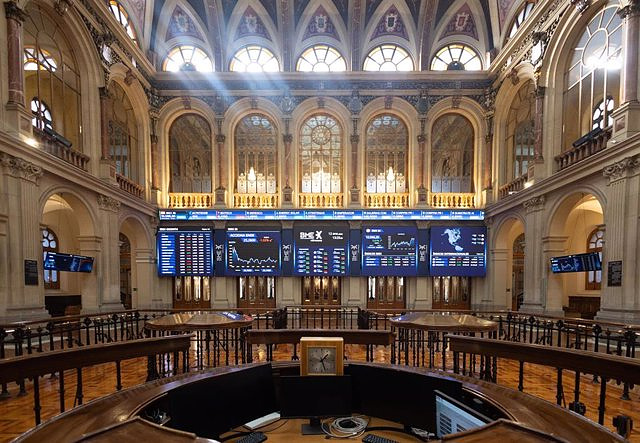

The Ibex 35 has started the week with a fall of 0.47%, reaching 9,890.3 points, in an a priori day of transition as before a week full of great macroeconomic references (meeting of the US Federal Reserve and results of Spanish banking, among others), but in which ACS has stood out as its value fell by 9.99% after a judicial setback.

Specifically, Florentino Pérez's construction company has led the declines in the Ibex 35 after the Supreme Court has rejected Abertis' claim to the State for 4,000 million euros in relation to the lane expansion works carried out on the AP toll highway. -7 in 2006, estimating only the granting of 33 million euros for the investments that were recognized by the Administration.

The selective has spent the session in negative territory and has consolidated the declines below the level of 9,900 points when it was penalized by ACS, while in the 'macro' agenda this Monday the manufacturing business index of the Dallas Fed, which fell in January to its lowest level in eight months.

For this week, investors' attention will be on the meetings of the Federal Reserve (Fed) and the Bank of England (BoE), as well as the January employment data in the United States, both the official report, which will be released on Friday, like nonfarm payrolls.

In addition, the preliminary GDP for the fourth quarter of the eurozone, Germany, France, Spain and Italy will be known, which could reflect a slowdown in the economy in Europe.

Likewise, the stock markets will be heated by the presentation of results from the Spanish banks, after Bankinter gave the starting signal last week.

On a business level, Ezentis shares were listed again on the stock market this Monday after more than a year with trading suspended and concluded the day with an increase of 72%, at 0.1538 euros per share.

Grifols has led the rises of the Ibex 35, with an increase of 4.27%, after announcing on Friday that it has filed a lawsuit against Gotham City Research, the director, before the United States District Court of the Southern District of New York. and founder of the fund, Daniel Yu, General Industrial Partners, Cyrus de Weck and their investees to request compensation for the financial and reputational damages caused to the company and its interested parties ('stakeholders'), as a result of the reports disseminated that questioned its accounting and its solvency.

Along with the Catalan company were Repsol (1.6%), Redeia (1.23%), Acciona Energía (1.08%) and Acerinox (0.93%). On the other hand, the biggest falls were recorded by ACS (-9.99%), Rovi (-5.56%), Sacyr (-3.19%), Banco Santander (-2.07%), Mélia Hotels (-1.89%) and Cellnex (-1.4%).

The European stock markets have closed with a mixed sign, although all with slight movements compared to Friday's close: Paris has added 0.09 while London has subtracted 0.03%; Frankfurt 0.12% and Milan 0.48%.

In the raw materials market, the price of a barrel of Brent quality oil, a reference for the Old Continent, fell 1.3% at closing time, to 82.47 dollars, while Texas stood at 76 $.85, 1.5% less.

In the foreign exchange market, the price of the euro against the dollar decreased by 0.42%, to 1.0807 'greenbacks', while in the debt market the interest required on the 10-year Spanish bond has closed at 3.121% after subtracting seven basis points, while the risk premium (the differential with the German bond) has stood at 89 points.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Sentences of up to 7 years for four police officers for illegal detention and injuries to a young man in Barcelona

Sentences of up to 7 years for four police officers for illegal detention and injuries to a young man in Barcelona They investigate in Jaén the death of a six-year-old boy whose mother shows signs of self-harm

They investigate in Jaén the death of a six-year-old boy whose mother shows signs of self-harm The judge orders Rubiales to appear in court once a month and ask for permission if he travels abroad

The judge orders Rubiales to appear in court once a month and ask for permission if he travels abroad Scotland's First Minister resigns after the breakdown of the Government coalition

Scotland's First Minister resigns after the breakdown of the Government coalition How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

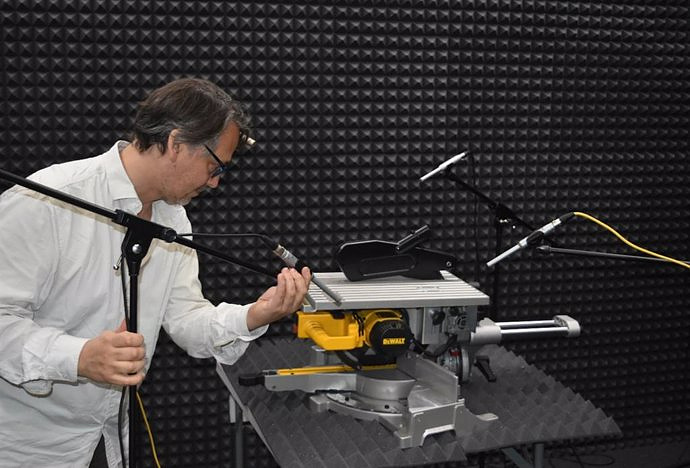

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on They create a bank of machinery sounds to prevent breakdowns through artificial intelligence

They create a bank of machinery sounds to prevent breakdowns through artificial intelligence UPV students build a prototype of a wooden house to move to Equatorial Guinea

UPV students build a prototype of a wooden house to move to Equatorial Guinea The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives

The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives ALI, virtual assistant from Alicante, internationally recognized by the OECD

ALI, virtual assistant from Alicante, internationally recognized by the OECD A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness