MADRID, 7 Mar. (EUROPA PRESS) -

The Governing Council of the European Central Bank (ECB) decided this Thursday to maintain interest rates, so that the reference rate for its refinancing operations will remain at 4.50%, while the deposit rate will remain at 4% and the loan facility at 4.75%.

In this way, the issuing institute leaves rates intact for the fourth consecutive meeting since it stepped on the brakes at its October meeting after undertaking ten consecutive increases in the price of money, which placed it at its highest level in more than 20 years.

The 'guardian of the euro' had raised rates by 450 basis points during the hike cycle, which began in July 2022, although now the markets are betting that the ECB will lower the reference rate in the summer.

The ECB's decision comes after the year-on-year inflation rate in the euro zone was 2.6% in February, two tenths below the price increase registered in the previous month. By excluding the impact of energy, food, alcohol and tobacco from the calculation, the underlying rate also moderated two tenths, to 3.1%. This reading was the lowest since March 2022.

In addition, Eurostat confirmed that the eurozone's GDP avoided recession after registering stagnation in the fourth quarter compared to the previous three months, when it contracted 0.1%.

In the case of the large EU economies, Germany recorded a contraction of 0.3% in the fourth quarter, after stagnating between July and September, while France repeated the paralysis of the previous three months, and Italy accelerated its expansion by 0.2% from 0.1% in the third quarter. Spain, with an expansion of 0.6% from 0.4%, was once again the large economy with the best evolution.

The performance of the eurozone economy between October and December was significantly worse than that observed in the United States, where GDP increased by 0.8% quarterly, although it was more positive than the performance of the United Kingdom, which entered a technical recession after lose 0.3% in the last quarter of 2024 and drop 0.1% during the third.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Sentences of up to 7 years for four police officers for illegal detention and injuries to a young man in Barcelona

Sentences of up to 7 years for four police officers for illegal detention and injuries to a young man in Barcelona They investigate in Jaén the death of a six-year-old boy whose mother shows signs of self-harm

They investigate in Jaén the death of a six-year-old boy whose mother shows signs of self-harm The judge orders Rubiales to appear in court once a month and ask for permission if he travels abroad

The judge orders Rubiales to appear in court once a month and ask for permission if he travels abroad Scotland's First Minister resigns after the breakdown of the Government coalition

Scotland's First Minister resigns after the breakdown of the Government coalition How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

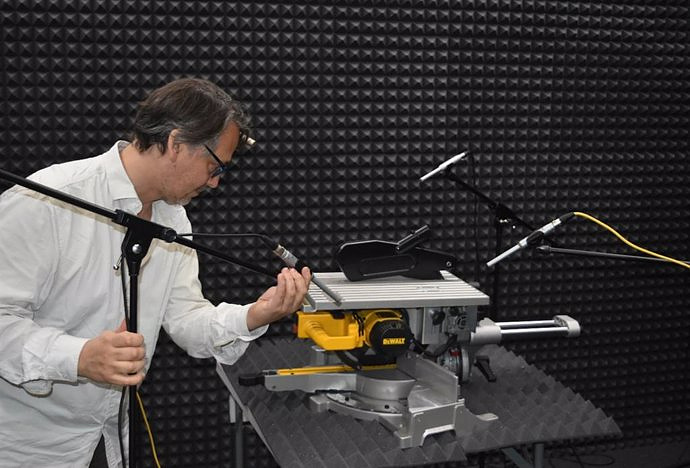

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on They create a bank of machinery sounds to prevent breakdowns through artificial intelligence

They create a bank of machinery sounds to prevent breakdowns through artificial intelligence UPV students build a prototype of a wooden house to move to Equatorial Guinea

UPV students build a prototype of a wooden house to move to Equatorial Guinea The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives

The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives ALI, virtual assistant from Alicante, internationally recognized by the OECD

ALI, virtual assistant from Alicante, internationally recognized by the OECD A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness