It foresees a moderate impact of these measures on consumption and GDP and warns of the negative impact for banks of removals or dations in payment

MADRID, 19 Abr. (EUROPA PRESS) -

The Bank of Spain has estimated at 549,000 potential households that could benefit from the temporary Code of Good Practices approved in November 2022 to alleviate the impact of interest rate rises on families with mortgages and at risk of vulnerability.

This is clear from the Spring Financial Stability Report that the Bank of Spain has published this Wednesday and in which it dedicates a thematic chapter to the different Codes of Good Practices, including the first, approved in 2012, and the other two, approved in November 2022, one that reforms the one from ten years ago and another that is a new code for families at risk of vulnerability and that will only be in force until December 2024.

In this way, the Bank of Spain points out that the reform of the Code of Good Practices broadens the criteria by which a family or mortgagor can take advantage of the different measures contemplated, in such a way that, taking into account an increase in the interest rate reference point for mortgage loans of 400 basis points (similar to that observed from the beginning of 2022 until now) there would be some 549,000 households that could take advantage of the temporary mechanism represented by the new Code of Good Practices.

"This figure represents some 404,000 more households than could have adhered to the original version of the 2012 Code of Good Practices," he reveals.

During the presentation of the report, the Director General of Financial Stability, Regulation and Resolution of the Bank of Spain pointed out that this figure of 549,000 households is different from the one the Government handled in November -- when it estimated that one million families could benefit from the measures--, since different ranges of rate increases have been taken into account.

The capital pending amortization of these households eligible for the new Code would be about 46,900 million euros, about 37,700 million euros more than with the original conditions of the previous Code of Good Practices.

In addition, there would be almost 218,000 households that could benefit from the "more structural" mechanism of the 2012 code in its amended version in November 2022, 73,000 more households than those that would have been able to benefit from the previous text. The capital pending amortization of these homes would be about 17,900 million euros, about 4,800 million euros more.

In its report, the Bank of Spain indicates that households eligible under the reformed 2012 Code of Good Practices will also be, in general, within the new temporary 2022 Code of Good Practices, being able to choose between one and the other, Therefore, it asks not to add the number of eligible households in these two modalities, as well as their outstanding capital.

On the other hand, the supervisor indicates in the report that it is foreseeable that not all households eligible for the code will request it and that, furthermore, adherence will not be effective for all applicants.

In this way, with the information available on the applications for adhesion to the 2012 code, the Bank of Spain has considered two scenarios to obtain an approximate percentage of valid adhesion applications, but which, in any case, represent "significantly lower" figures. to those of households that can adhere.

The first is "more representative of the consequences of a deep crisis" and is projected from the two consecutive years (2015 and 2016) in which a greater number of effective adherences to the 2012 code of good practices were observed.

Also taking into account a 400 basis point rise in the reference rate, the temporary mechanism in the new 2022 code would reach some 193,000 households, with a capital pending repayment of 16.4 billion euros, while the more structural mechanism of the code reformed in 2012, it would benefit some 76,000 households, with a debt pending repayment of 6,300 million euros.

In the second scenario, on the other hand, it is contemplated that the percentage of effective adhesion applications is that of the two years with the lowest number of effective adhesions (between 2019 and 2020), so that the new code would benefit some 26,000 households, with a capital pending amortization of 2,200 million euros, while the reformed 2012 code would affect around 10,000 households with a capital pending amortization of around eight million euros.

In the same chapter, the Bank of Spain concludes that the experience of applying the 2012 code shows that these measures have a "particularly relevant" role as a mechanism for absorbing the consequences of crises. However, it has a more limited function in normal situations.

In addition, it foresees that the implementation of Royal Decree-Law 19/2022 will have a "very moderate" positive effect in the short term on consumption and the level of GDP activity, since the stimulus would be "limited by the limited number of mortgaged eligible", a number that would be further reduced taking into account the effective adhesions that were made to the 2012 code.

Instead, it alerts that the measures agreed in November 2022 may imply costs for households, in the form of a higher level of indebtedness or less access to future credit. In this regard, he explains that they imply a higher level of household debt for a longer time, including the increase in interest expenses, also increasing sensitivity to potential future rate hikes.

It recognizes that some of the new measures, such as the temporary suspension of amortization commissions, would operate in the opposite direction and would allow household debt to be reduced, while the conversion of variable rate operations to fixed rates would limit this sensitivity to future rate increases of interest.

"In any case, the use of these measures by a household constitutes a negative sign of their credit quality and may harm their future access to it. The latter would make their future expenses more sensitive to disturbances in their income," he adds to the regard.

Regarding the impact that the measures may have on banks, he points out that term extensions and deficiencies can help prevent or manage and correct a more unfavorable evolution of credit quality, limiting the costs of coverage of banking entities.

On the other hand, he believes that measures such as haircuts or dation in payment -which were contemplated in the 2012 code in case the debt restructuring was not viable, but not in the 2022 measures- would, in a way In general, a net cost for the entities and would reduce "to some extent" their intermediation capacity.

Despite all this, the Bank of Spain points out that in order to extract the maximum benefits from the measures approved in 2022 and limit the costs for both households and banks, a "correct implementation" of these is important, including a temporary scope of application "adequate" and the focus of the measures on vulnerable financial segments.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

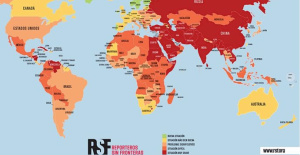

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Spain moves from 36th to 30th place in RSF's world press freedom ranking but political pressure increases

Spain moves from 36th to 30th place in RSF's world press freedom ranking but political pressure increases Spain receives 16.1 million tourists until March and registers the best first quarter in history

Spain receives 16.1 million tourists until March and registers the best first quarter in history More than 2,000 arrested during pro-Palestinian protests at US universities

More than 2,000 arrested during pro-Palestinian protests at US universities Illa advocates for a "transversal" Government and Junts rules out agreeing with the socialists

Illa advocates for a "transversal" Government and Junts rules out agreeing with the socialists How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on UPV students design an app that helps improve the ventilation of homes in the face of high temperatures

UPV students design an app that helps improve the ventilation of homes in the face of high temperatures Ivace and promotes a less invasive device for the early detection of prostate cancer

Ivace and promotes a less invasive device for the early detection of prostate cancer Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives

Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics

UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness