MADRID, 16 Abr. (EUROPA PRESS) -

The American group International Paper (IP) has reached an agreement to acquire the British packaging company DS Smith for £5.8 billion (€6.79 billion) through a share exchange, as reported by both companies.

The transaction, which could be completed in the fourth quarter of 2024, contemplates the delivery of 0.1285 International Paper shares for each DS Smith share, which values each share of the company that Europac acquired in 2019 at 415 pence.

As a result of the share exchange, upon completion of the merger, International Paper shareholders will control 66.3% of the combined company and DS Smith shareholders will control the remaining 33.7%.

The CEO of the American company, Andrew K. Silvernail, will continue to lead the combined company, while his counterpart at DS Smith, Miles Roberts, will serve as a consultant to help with the integration process.

The combined company will be headquartered in Memphis, Tennessee, and plans to establish a Europe, Middle East and Africa (EMEA) headquarters at DS Smith's current headquarters in London.

International Paper estimates that the combination of both businesses will generate at least $514 million (€483 million) in pre-tax cash synergies on an annual run-rate basis by the end of the fourth year after the closing of the transaction. .

DS Smith's board of directors has announced its intention to unanimously recommend that the company's shareholders vote in favor of the deal and have irrevocably committed to supporting the transaction with their respective stakes in the company, which represent approximately 0.06 % of issued share capital.

Likewise, the board of directors of International Paper has also unanimously approved the operation and will recommend that the company's shareholders vote in favor of the issuance of the new shares necessary to undertake the merger.

"I firmly believe that this strategic combination offers a unique opportunity and a very attractive opportunity to create tremendous value for shareholders," said Andrew K. Silvernail.

For his part, Miles Roberts sees the combination with IP as an attractive opportunity to create a truly international leader in sustainable packaging solutions that is well positioned in attractive and growing markets across Europe and North America.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Sentences of up to 7 years for four police officers for illegal detention and injuries to a young man in Barcelona

Sentences of up to 7 years for four police officers for illegal detention and injuries to a young man in Barcelona They investigate in Jaén the death of a six-year-old boy whose mother shows signs of self-harm

They investigate in Jaén the death of a six-year-old boy whose mother shows signs of self-harm The judge orders Rubiales to appear in court once a month and ask for permission if he travels abroad

The judge orders Rubiales to appear in court once a month and ask for permission if he travels abroad Scotland's First Minister resigns after the breakdown of the Government coalition

Scotland's First Minister resigns after the breakdown of the Government coalition How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

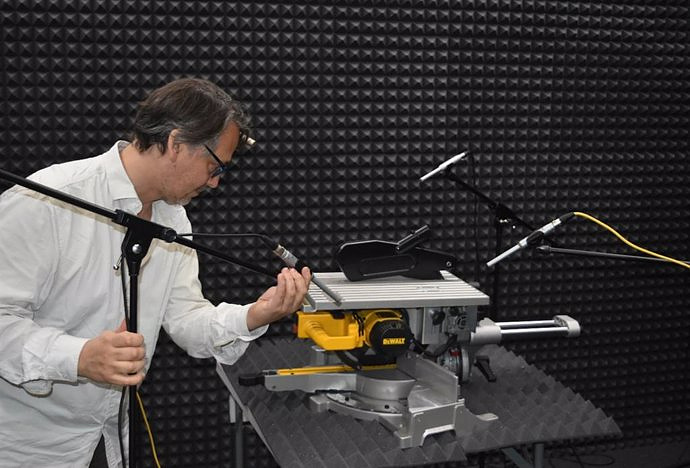

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on They create a bank of machinery sounds to prevent breakdowns through artificial intelligence

They create a bank of machinery sounds to prevent breakdowns through artificial intelligence UPV students build a prototype of a wooden house to move to Equatorial Guinea

UPV students build a prototype of a wooden house to move to Equatorial Guinea The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives

The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives ALI, virtual assistant from Alicante, internationally recognized by the OECD

ALI, virtual assistant from Alicante, internationally recognized by the OECD A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness