Sales in Spain and Portugal rose 12.5%, to 1,541 million

Coca-Cola Europacific Partners (CCEP) obtained an accounting net profit of 854 million euros during the first half of this year, which represents an increase of 26.5% compared to the same period of the previous year, as reported by the multinational, which has announced its proposal to acquire, together with Aboitz Equity Ventures, the Philippine bottler (CCBPI) from The Coca-Cola Company for 1,800 million dollars (1,640 million euros).

Specifically, in comparable terms, the company's net profit increased by 14% between January and June, up to 847 million euros, while book income amounted to 8,977 million euros, 8.4% higher than that achieved in the first semester of 2022.

Book operating profit for the first six months of this year was 1,170 million euros, 21% more, while on a comparable basis it stood at 1,165 million euros, 10.8% more.

"We are very proud to have closed a great first half, in which we have achieved strong sales and net profit growth and have generated a robust 'cash flow'. Our evolution reflects great execution in the market and strong relationships with our customers, all of which has resulted in strong volume growth in all the markets in which we operate," said Damian Gammel, CEO of Coca-Cola Europacific Partners.

In this way, the multinational's sales in Spain and Portugal rose 12.5%, reaching 1,541 million euros, driven by the recovery of consumption outside the home in the first quarter, in the face of Covid restrictions. .

Regarding the different beverages in the portfolio, Coca-Cola, Coca-Cola Zero and Aquarius have performed well in the first half of the year, while Monster's volumes have experienced double-digit growth, both in the second quarter and in the first semester of the year.

The bottler has specified that the increase in revenues/unit cases in the first half of the year has been driven by the prices applied in the first quarter, together with the successful 'mix' of channels and containers, very positive due to the growth of the segment consumption outside the home.

GROWS WITH THE PURCHASE OF THE FILIPINO BOTTLER

On the other hand, the multinational has reported that it has sent a non-binding letter of intent to acquire the Philippine bottler along with Aboitz Equity Ventures, a company that has "attractive profitability" and "growth prospects".

"We are delighted to announce the acquisition of Coca-Cola Beverages Philippines Inc, together with Aboitz Equity Ventures Inc., one of the leading conglomerates in the local market. This represents a great opportunity to purchase an established and well-run business with very good prospects. of growth and profitability", said the CEO of Coca-Cola Europacific Partners, Damian Gammel.

With this acquisition, CCEP continues to grow and support its transformation in Indonesia. "This step allows us a more diverse presence within our API business segment, which supports Indonesia's transformation and furthers our medium-term strategic objectives," Gammel stressed.

The bottler has indicated that this acquisition is in line with its objectives to drive sustainable and stronger growth through diversification and scale.

In this way, CCEP will be the majority owner with 60% of the company, while AEV will have a 40% stake. The bottler will have a governing body with five members, of which three will be appointed by CCEP and two by AEV, while the firm chaired by Sol Daurella will appoint the CEO. An operation that is still subject to a series of conditions, according to the bottler.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

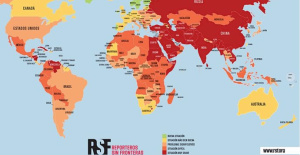

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Spain moves from 36th to 30th place in RSF's world press freedom ranking but political pressure increases

Spain moves from 36th to 30th place in RSF's world press freedom ranking but political pressure increases Spain receives 16.1 million tourists until March and registers the best first quarter in history

Spain receives 16.1 million tourists until March and registers the best first quarter in history More than 2,000 arrested during pro-Palestinian protests at US universities

More than 2,000 arrested during pro-Palestinian protests at US universities Illa advocates for a "transversal" Government and Junts rules out agreeing with the socialists

Illa advocates for a "transversal" Government and Junts rules out agreeing with the socialists How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on UPV students design an app that helps improve the ventilation of homes in the face of high temperatures

UPV students design an app that helps improve the ventilation of homes in the face of high temperatures Ivace and promotes a less invasive device for the early detection of prostate cancer

Ivace and promotes a less invasive device for the early detection of prostate cancer Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives

Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics

UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness