MADRID, 30 Nov. (EUROPA PRESS) -

Azora, Eiffel Investment Group and Andera Partners have led a round of nearly 100 million euros from the French company mylight150, specialized in the design and distribution of photovoltaic self-consumption solutions and intelligent energy management systems, as reported this Thursday by the firm. , which already operates in France, Spain, Switzerland and Romania.

Thus, the Spanish fund Azora has entered as an investor in the French company mylight150, which has closed this round to consolidate its leadership in France and extend its commercial offer in Spain and other European countries, as detailed in a press release.

The firm has highlighted that Elevation Capital Partners, its current investor, has also participated in the round, while Demeter Partners and its Paris Fond Vert Fund, shareholders since 2020, complete their capital exit with this transaction.

The company has explained that, after receiving an initial investment of 2 million in 2016 and an additional round of 6.5 million in 2020, it has closed this round of 'growth capital' with three venture capital firms specialized in sustainability and transition investments. energy, specifically, Eiffel Investment Group through its Eiffel Essentiel fund; Azora Capital, through its Azora European Climate Solutions Fund I, and Andera Partners, with its Andera Smart Infra I fund.

The company based in Lyon (France) has explained that it expects to invoice 100 million euros in 2023, and that it currently employs more than 260 professionals, of which 70 are in its technological development and innovation department.

In this sense, it has highlighted that it hopes to add another 100 additional people to its workforce before the end of 2024, and multiply its turnover by five before 2030.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Sentences of up to 7 years for four police officers for illegal detention and injuries to a young man in Barcelona

Sentences of up to 7 years for four police officers for illegal detention and injuries to a young man in Barcelona They investigate in Jaén the death of a six-year-old boy whose mother shows signs of self-harm

They investigate in Jaén the death of a six-year-old boy whose mother shows signs of self-harm The judge orders Rubiales to appear in court once a month and ask for permission if he travels abroad

The judge orders Rubiales to appear in court once a month and ask for permission if he travels abroad Scotland's First Minister resigns after the breakdown of the Government coalition

Scotland's First Minister resigns after the breakdown of the Government coalition How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

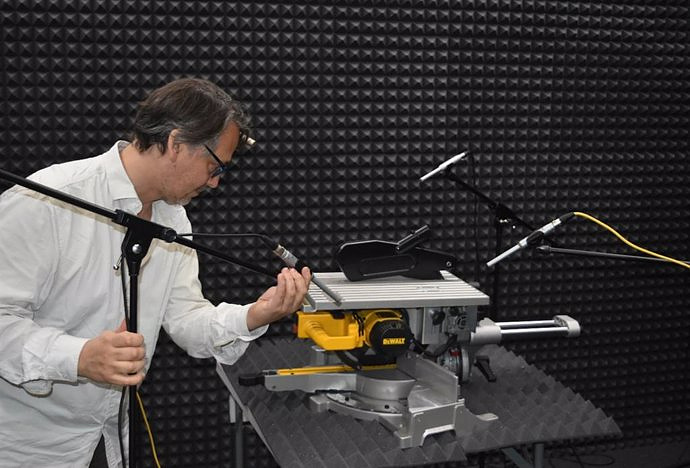

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on They create a bank of machinery sounds to prevent breakdowns through artificial intelligence

They create a bank of machinery sounds to prevent breakdowns through artificial intelligence UPV students build a prototype of a wooden house to move to Equatorial Guinea

UPV students build a prototype of a wooden house to move to Equatorial Guinea The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives

The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives ALI, virtual assistant from Alicante, internationally recognized by the OECD

ALI, virtual assistant from Alicante, internationally recognized by the OECD A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness