MADRID, 8 Abr. (EUROPA PRESS) -

35% of home buyers in 2024 have not needed a mortgage, 3% more year-on-year and 8% more compared to 2022, the year in which the first interest rate increase occurred, according to Fotocasa.

Specifically, of the 35% who bought without a mortgage, 17% declare that they had enough money saved for it (in 2023 they were 18%), compared to 10% (8% in 2023) who managed to carry out the purchase thanks to help provided by family members. The remaining 7% (6% in 2023) had enough with the sale of their old home.

The buyers who did have to go to the bank to complete their purpose were 66% (in February 2023 it was 68%). Of these, 54% were satisfied with the financing granted by the entity, but up to 12% also needed additional help from family members.

Given the rise in rates and high financing costs, the proportion of purchases that are closed without a mortgage has grown, as has the need to have family support for buyers who do mortgage their homes.

There is also a relevant percentage of buyers who are waiting for a rate de-escalation, which will cause "a strong demand for which the market must respond," according to the Director of Studies and spokesperson for Fotocasa, María Matos.

On the other hand, in February 2024, 35% of individuals over 18 years of age affirm that the rise in mortgages has impacted their purchase intention quite a bit or a lot. This figure is one percentage point below that recorded a year earlier, and also below that corresponding to August 2023 (in both cases 36%).

19% of buyers affirm that the rise in mortgage prices "has had a great impact on them", to the point that they were actively searching for a home or about to buy one, but they have stopped the process for this reason, although they are two points less than the 21% who stated this six months and a year earlier. In addition, there are 16% (they were 15% in February 2023) who have been greatly impacted by it, to the point that they are rethinking the process.

Among those who have purchased a home, 46% have been very or somewhat impacted by prices, and 70% of home seekers have not closed the transaction.

By age, only 25% of those over 55 declare that the rise in mortgages impacted their purchase intention, compared to 45% of people between 25 and 34 years old, whose intentions have been affected.

By territory, the reduction in the impact of the rise in mortgages on purchase intention is seen more slightly in Madrid (where it repeats the 36% of February 2023, but below the 40% of August) and Catalonia, which It remains at 33% in August, one percentage point more than the 32% in February 2023.

Somewhat more pronounced is the decrease in the impact in the Valencian Community, which remains at 32%, compared to 34% twelve months earlier and 36% in August. For its part, Andalusia is the community where the impact reduction is greatest, with 36%, four points less than in February 2023 and two than in August.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

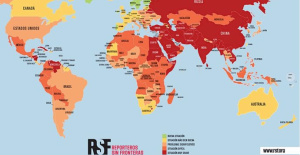

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Spain moves from 36th to 30th place in RSF's world press freedom ranking but political pressure increases

Spain moves from 36th to 30th place in RSF's world press freedom ranking but political pressure increases Spain receives 16.1 million tourists until March and registers the best first quarter in history

Spain receives 16.1 million tourists until March and registers the best first quarter in history More than 2,000 arrested during pro-Palestinian protests at US universities

More than 2,000 arrested during pro-Palestinian protests at US universities Illa advocates for a "transversal" Government and Junts rules out agreeing with the socialists

Illa advocates for a "transversal" Government and Junts rules out agreeing with the socialists How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on UPV students design an app that helps improve the ventilation of homes in the face of high temperatures

UPV students design an app that helps improve the ventilation of homes in the face of high temperatures Ivace and promotes a less invasive device for the early detection of prostate cancer

Ivace and promotes a less invasive device for the early detection of prostate cancer Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives

Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics

UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness