MADRID, 13 Oct. (EUROPA PRESS) -

The deputy governor of the Bank of Spain, Margarita Delgado, has asked European banks to be prudent and ensure provisioning levels that take into account the most adverse scenarios.

At the 'Global Managers' meeting organized by KPMG in Paris, the deputy governor reflected on the current situation of uncertainty and its possible effect on the financial system in the near future.

As he explained, in the current context and given the escalation of the energy conflict with Russia, the European Central Bank (ECB) hopes that the inflationary episode in the eurozone will be more intense and lasting than was thought before the summer, which will has led to a recent revision of its inflation forecasts significantly upwards, in line with the OECD.

Thus, the projections of the ECB experts point to an average inflation of 8.1% in 2022, to decrease to 5.5% in 2023 and 2.3% in 2024 and it is also expected that the economic activity in the euro area "slows down markedly in the coming quarters", with economic growth of 3.1% in 2022 slowing to 0.9% in 2023.

“Although a recession in the euro area is currently not expected as a baseline scenario, it is becoming more likely. Indeed, uncertainty is high and both inflation and GDP developments will largely depend on the severity of any disruption. energy supply and winter conditions, which could lead to higher energy prices and more severe production cuts," the deputy governor warned.

On the positive side, Dlegado has highlighted that the labor market "remains solid", although wage growth has remained "slow" in recent months and "remains moderate" compared to current inflation rates. "It is crucial that, going forward, both wage demands and business margins remain subdued to avoid the emergence of significant second-round effects, which would only make inflationary pressures more persistent," he stressed.

The deputy governor also referred to the process of normalizing monetary policy in the context of rising inflation, which has been reflected in the significant increase in market interest rates, such as the 12-month Euribor, the cost of corporate debt issuance or interest on new business loans, while causing a gradual increase in the average cost of outstanding debt for households and businesses.

In this scenario, the deputy governor of the Bank of Spain has acknowledged that the European banking sector currently maintains a "solid" position and improved its profitability in the first half of 2022, thanks to higher rates, and the return on equity (RoE ) remained heterogeneous across business models and countries. In addition, Delgado discounts that soon the entities will begin to remunerate the deposits, which will have an impact on the margins.

Looking ahead to 2023, the deputy governor has warned that the combination of a deterioration in the macroeconomic outlook together with more restrictive financing conditions "will put pressure on the debt service capacity of companies and households." "I believe that the labor market will be one of the key elements that define the economic environment. Its robustness could partially offset the negative consequences of the energy and inflationary shocks", she reflected.

In this context, Margarita Delgado has called for prudence and stressed the need for credit institutions to ensure that their provision levels and capital models take into account the most adverse scenarios.

"It is in a longer horizon (one or two years) when the negative impact on the ability of households and companies to meet their financial obligations is likely to arise," Delgado warned, who at the same time has shown his conviction that European banks are well prepared to deal with the new stresses and turmoil.

On the other hand, the deputy governor of the Bank of Spain has emphasized that fiscal policy has "a key role to play" in the current scenario of uncertainty, "as long as it is directed at the households and economic sectors hardest hit by the crisis, given the limited room for maneuver of public budgets".

In this sense, Delgado has affirmed that an adequate combination of policies would support economic normalization and help to address the inflationary episode, as well as the continuation of prudent approaches by those who set prices and wages.

"This is not a financial crisis, but a mixture of geopolitical, energy, commercial and, above all, humanitarian aspects, which will require firm decisions to avoid greater evils," he warned.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Khan is re-elected mayor of London and underpins Labor's victory in local elections

Khan is re-elected mayor of London and underpins Labor's victory in local elections Felipe VI swears the flag again 40 years later at the AGM with Princess Leonor as a witness

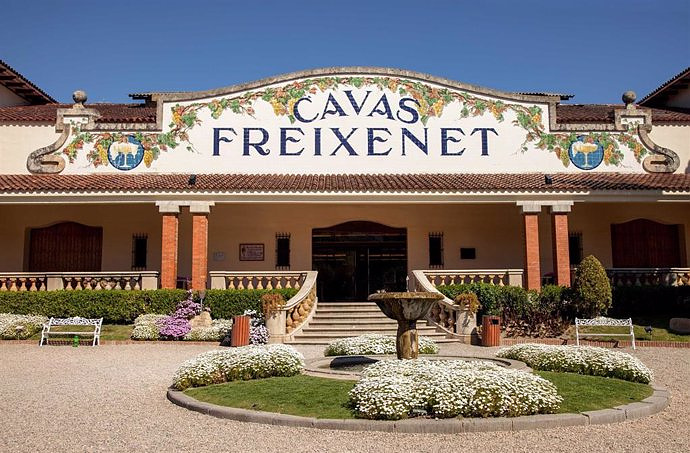

Felipe VI swears the flag again 40 years later at the AGM with Princess Leonor as a witness Freixenet and unions agree to reduce working hours by 20-50% this year due to the drought

Freixenet and unions agree to reduce working hours by 20-50% this year due to the drought STATEMENT: Nearly 400 people participate in the II Family Support Conference at UIC Barcelona

STATEMENT: Nearly 400 people participate in the II Family Support Conference at UIC Barcelona How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on A sensor system obtains the fingerprint of essential oils and detects if they have been adulterated

A sensor system obtains the fingerprint of essential oils and detects if they have been adulterated Faraday UPV presents the 'Origin' rocket to exceed 10 km of flight: "It is the beginning of the journey to space"

Faraday UPV presents the 'Origin' rocket to exceed 10 km of flight: "It is the beginning of the journey to space" The Generalitat calls for aid worth 4 million to promote innovation projects in municipalities

The Generalitat calls for aid worth 4 million to promote innovation projects in municipalities UPV students design an app that helps improve the ventilation of homes in the face of high temperatures

UPV students design an app that helps improve the ventilation of homes in the face of high temperatures A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness