MADRID, 19 Sep. (EUROPA PRESS) -

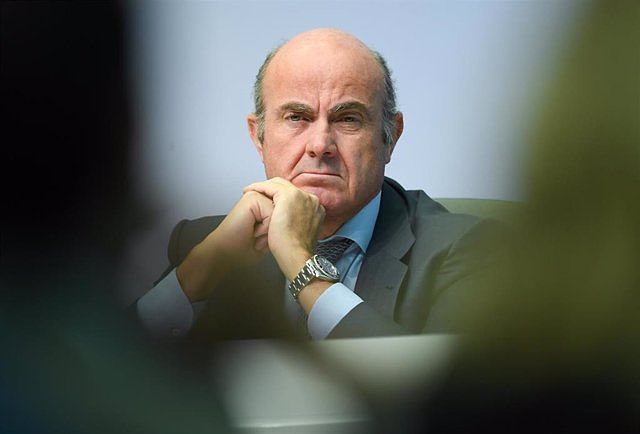

The Vice President of the European Central Bank (ECB), Luis de Guindos, insisted on Monday that the fiscal policy of European governments should not be expansionary due to the effect it would have on inflation, counteracting the efforts being made by the monetary authority by raising interest rates.

"The margin of economic policy is not what we had during the time of the pandemic. On the one hand, we find higher inflation, which conditions the direction of monetary policy. Fiscal policy cannot be the one that It was at that time, the famous 'whatever it takes' for fiscal policy", Guindos stressed during his speech at an event organized by Banco Sabadell.

"We also find ourselves in a situation of enormous uncertainty with the slowdown in economic growth. And therefore [about] the business sector, we believe that there will be specific segments in which solvency may be affected in the euro zone ", has added the vice president of the ECB.

In this sense, the former Spanish minister has indicated that governments can carry out a certain expansion from fiscal policy, but believes that the measures must be selective and focused on the vulnerable segments of the population that are suffering from inflation and the 'shock ' energetic.

In addition to the effects on inflation, Guindos considers that another large pan-European package of expansionary fiscal policy is not possible, since the ratios of debt to gross domestic product (GDP) have increased by 20 percentage points compared to ago two years.

"There is also a very significant deterioration in public deficits that cannot continue forever. That is why I am referring to the selectivity [of fiscal policy], it can be via taxes or via public spending, but always selective," Guindos added.

Asked about the tax on bank profits that the Spanish government has raised, Guindos has avoided speaking out because the Executive has not asked for the opinion of the ECB and, in any case, the body would have to examine the proposal in detail.

In any case, Guindos has recalled that the general approach of the ECB is that this type of tax measures do not affect the cost of financing, or the granting of credit or the solvency of the sector.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets The Prosecutor's Office requests 63 years in prison for Rato and a fine of more than 42 million euros

The Prosecutor's Office requests 63 years in prison for Rato and a fine of more than 42 million euros Marlaska puts more radars, surveillance on highways and motorists, and controls in the face of the increase in accidents

Marlaska puts more radars, surveillance on highways and motorists, and controls in the face of the increase in accidents Pedro Rocha, elected new president of the RFEF

Pedro Rocha, elected new president of the RFEF The PSC would win the elections with 40-47 seats and ERC is ahead of Junts, according to the CEO

The PSC would win the elections with 40-47 seats and ERC is ahead of Junts, according to the CEO How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives

The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives ALI, virtual assistant from Alicante, internationally recognized by the OECD

ALI, virtual assistant from Alicante, internationally recognized by the OECD Retrópolis brings the golden age of video games and computing to the UPV

Retrópolis brings the golden age of video games and computing to the UPV Looking for video games that value the neighborhoods of Valencia

Looking for video games that value the neighborhoods of Valencia A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness