MADRID, 16 Ago. (EUROPA PRESS) -

Business delinquencies in Spain increased three points in the first quarter of the year compared to the previous quarter, its biggest quarterly rise in 12 years, according to the Cepyme Synthetic Indicator of Business Delinquencies (ISME), created in 2010 to measure the evolution of delinquencies through the average payment period.

This increase is the result of both the increase in invoices with late payment and the extension of payment periods, as explained by Cepyme.

Thus, commercial debt with late payment reached 73.3% of the total in the first quarter, 3.6 points more than in the previous quarter, reaching 348,992 million euros, 42% more than in the same period from the previous year.

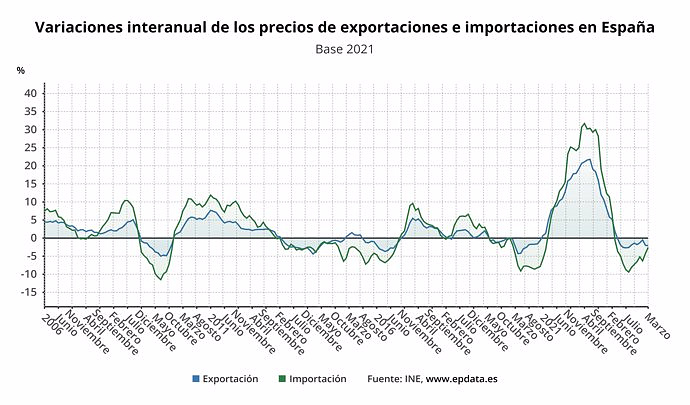

"The slowdown in the recovery of the Spanish economy and the adverse impact of inflation on business accounts continue to negatively affect the evolution of business delinquencies," says Cepyme in its Observatory on delinquencies, prepared in collaboration with Cesce and Informa.

For its part, the average payment period rose in the first quarter to an average of 83.9 days, compared to 81.4 days in the previous quarter and 82.6 days in the first quarter of 2021.

Cepyme stresses that this increase is largely due to the slowdown in the economy, affected by the escalation of prices and the consequences of the conflict in Ukraine, which is having "negative effects on the economic recovery and directly reducing the liquidity of companies ".

"Companies are not transmitting all of their cost increases to the end customer and this translates into a shrinking cash flow, which affects the ability to pay suppliers. In fact, a growing number of companies recognize this problem and is negotiating with its suppliers an extension of the payment terms", affirms the employers' association of SMEs.

The business organization's forecasts for the coming months are negative, since it estimates that the tensions in energy prices will continue at least until next spring and the general rises in costs will imply "additional pressure on business margins", which will increase the risk of non-payment or delay in meeting obligations.

All of this, he recalls, in a context of uncertainty, in which the decision of the central banks to curb inflation will translate into higher financing costs and tougher conditions, which will complicate the possibility of accessing external financing to face treasury gaps.

According to Cepyme, the delay in the payment of invoices especially affects smaller companies, which have greater difficulties in accessing credit and which suffer more especially from delinquency as their customer base is more concentrated.

Thus, micro-enterprises recorded the largest year-on-year increase in their average payment period (PMP) in the first quarter, 7.9 days more, standing at 87.6 days, becoming the companies that take the longest to pay.

Small companies increased their average payment period by 0.6 days in the first quarter, to 83.5 days, while medium-sized companies cut it by the same proportion, from 84.7 to 84.1 days.

By branch of activity, construction and real estate development, together with the textile sector, remain the activities with the greatest delays in payment, reaching 98.4 and 90.4 days on average, respectively.

It also highlights the evolution of the average payment period of the agri-food industry, which in the first quarter rose 8.2 days in year-on-year terms, to 80.7 days, due to the breakdown of several global supply chains.

In contrast, the food distribution and wood and furniture sectors have been the activities with the least delays in their payments in the first quarter of this year, with average periods of 65 and 77.4 days, respectively.

During the first quarter, Murcia was the autonomous community with the longest average payment period, a total of 96 days, almost three more than in the previous quarter but 0.5 days less than a year earlier.

The autonomous communities that registered the greatest interannual increase in business delinquencies were Aragón (7.2 days), Castilla y León (6.6 days) and Canarias (4.6 days).

On the contrary, the communities that have registered a greater year-on-year drop in their average payment periods have been Cantabria (-23.3 days), Extremadura (-6.8 days) and the Basque Country (-3.8 days).

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Nadal is still alive and exciting in Madrid

Nadal is still alive and exciting in Madrid The Treasury injected another 500 million into the SEPI in March to purchase Telefónica shares

The Treasury injected another 500 million into the SEPI in March to purchase Telefónica shares The complaints from ERC and PP against Sánchez's interview do not reach the JEC in time, which did not consider suspending it

The complaints from ERC and PP against Sánchez's interview do not reach the JEC in time, which did not consider suspending it Occupancy in Spain for the May long weekend exceeds 80%, with Andalusia and the Canary Islands as preferred destinations

Occupancy in Spain for the May long weekend exceeds 80%, with Andalusia and the Canary Islands as preferred destinations How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on They create a bank of machinery sounds to prevent breakdowns through artificial intelligence

They create a bank of machinery sounds to prevent breakdowns through artificial intelligence UPV students build a prototype of a wooden house to move to Equatorial Guinea

UPV students build a prototype of a wooden house to move to Equatorial Guinea The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives

The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives ALI, virtual assistant from Alicante, internationally recognized by the OECD

ALI, virtual assistant from Alicante, internationally recognized by the OECD A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness