MADRID, 7 Jul. (EUROPA PRESS) -

BBVA Research will lower its growth forecasts for the Spanish economy next week, as anticipated by the bank's president, Carlos Torres Vila, during the business meeting organized this Thursday by CEOE and Cepyme.

Last April, BBVA Research cut its forecast for Spanish GDP growth in 2022 by 1.4 points, to 4.1%, and lowered the estimated growth for 2023 by 1.6 points, to 3.3%. mainly because of the impact of the war in Ukraine.

On July 14, BBVA Research plans to publish its new macroeconomic forecasts. "The growth forecast that we have now is 4.1%, but our study service is going to make a new forecast that will be lower than this," Torres Vila revealed.

During the business meeting, the president of BBVA reviewed the current context and recalled that the economy was recovering strongly from the coronavirus with some inflationary tensions that, at the time, were described as transitory.

Although Torres has stated that the second quarter will still show significant growth, with the recovery of the tourism sector, he has recognized that the invasion of Ukraine "disrupts" the short-term macro outlook and also has long-term repercussions.

"What is happening to us is a consequence, to a large extent, of that invasion and part of the damage that we all suffer as a society has to do with the war situation. This is a war and we have chosen to fight it, which I think is what correct", explained Torres, who pointed out that the tensions that this situation has caused in energy and supply chains have also added to the confinements in China.

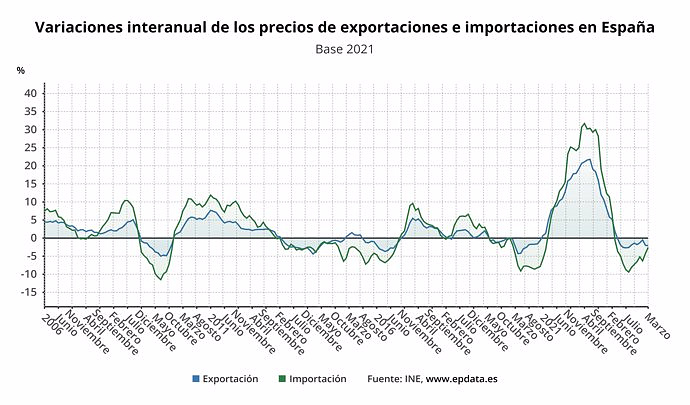

In this scenario, inflation is rising sharply and, although BBVA expects it to "mode down a little", the forecasts continue to rise each month. "The latest forecast of the Studies Service is an inflation of 7%, but with increasingly upward biases. This has the repercussion of impoverishing society," she pointed out.

Torres then referred to the response that central banks are giving to this situation, raising interest rates, which are "a clear tool" to anchor inflation expectations and moderate demand given the price situation.

Although the manager believes that raising rates "is what needs to be done", it will cause lower growth and will make the forecasts for the Spanish and European economy "worse than a few months ago". In this line, it has advanced that BBVA Research will lower its growth forecasts for the Spanish economy in its next revision.

During his speech, the BBVA chairman defended that decarbonisation should not be seen as a cost, but rather as "a great opportunity" that requires a high volume of investment that will only come if it makes economic sense.

"The good news is that we already have a lot of business case and we have to make it take advantage of it. We have a great immediate opportunity to make investments that help us decarbonize those that make economic sense and, those that do not make economic sense, they will have if we all do the right thing so that the incentives are correct and that investment makes economic sense", he maintained.

In this sense, the president of BBVA has pointed out that if Europe were decarbonized, it would be in a better position to respond to the war due to the invasion of Ukraine by Russia. "I think that Russia's actions would have been very different if we were decarbonized. Short-term tensions do not have to leave behind the drive for decarbonization, which is so necessary to ensure not only the stability of the planet, but can help us in decisions of strategic autonomy", he pointed out.

The role that the public sector must play in decarbonisation, in the opinion of Torres Vila, is to establish the main objectives and ensure that the incentives are adequate, ensuring the formation of prices and eliminating subsidies for emission technologies that still exist. "I know that it is difficult from the political point of view for us to add a price premium to energy, but if we don't, we won't have the right investment," she assured.

The BBVA chairman recalled that, despite having closed 52% of the branches in Spain and having cut the workforce by 25% since 2015, the clientele has increased by 22%, which reflects, in his opinion, that BBVA can provide better service with fewer offices and employees.

"This efficiency is compatible with a higher quality of service. Remote customer service has also increased, we have almost 4 million customers who have remote service, more than 3,000 remote managers", he highlighted.

Last year BBVA added 9 million customers throughout the group, compared to 3 million in 2015. As Torres pointed out, all the growth in that period has occurred thanks to the digital channel. "Digitization has meant a radical change in the business model that is giving us very clear increases in market share in all markets. Digitization does not stop here, the world continues its transition at an accelerated pace and that affects all sectors", he explained.

During the opening of the meeting, the president of the CEOE, Antonio Garamendi, highlighted the response of the financial sector to the coronavirus pandemic and the support for families and businesses with financing and moratoriums. Likewise, he has highlighted that banking "is key" for the economy to work.

"It is the basis for our country to be a country that achieves the objectives that we all seek and if there is one thing we can be calm about today in Spain, it is because we have a robust financial system, which is what is going to give us the guarantee. Therefore, and it is a message for those who want to hear it, let's take care and treat the financial sector well, because we need it," Garamendi warned.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Nadal is still alive and exciting in Madrid

Nadal is still alive and exciting in Madrid The Treasury injected another 500 million into the SEPI in March to purchase Telefónica shares

The Treasury injected another 500 million into the SEPI in March to purchase Telefónica shares The complaints from ERC and PP against Sánchez's interview do not reach the JEC in time, which did not consider suspending it

The complaints from ERC and PP against Sánchez's interview do not reach the JEC in time, which did not consider suspending it Occupancy in Spain for the May long weekend exceeds 80%, with Andalusia and the Canary Islands as preferred destinations

Occupancy in Spain for the May long weekend exceeds 80%, with Andalusia and the Canary Islands as preferred destinations How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on They create a bank of machinery sounds to prevent breakdowns through artificial intelligence

They create a bank of machinery sounds to prevent breakdowns through artificial intelligence UPV students build a prototype of a wooden house to move to Equatorial Guinea

UPV students build a prototype of a wooden house to move to Equatorial Guinea The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives

The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives ALI, virtual assistant from Alicante, internationally recognized by the OECD

ALI, virtual assistant from Alicante, internationally recognized by the OECD A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness