The statement of income in the course reminds us of the imminence of the levy to the source. What you need to know.

The entry into force of the withholding at the source on January 1, 2019 will bring changes to the payment of the tax. An evolution that generates a good number of received ideas, and concerned taxpayers. The key thing to know.

You know your sampling rate 2019 to the end of your next electronic filing.

True. The administration will communicate once your income tax return completed online. You drop off a printed paper ? You will then need to wait until you receive your notice of tax, during the summer.

Your support is essential. Subscribe for $ 1 support UsHas to know. Your sampling rate will then be updated each year, in September, in order to take account of any changes in your situation.

January 1, 2019, if you are taxable, the amount of your income will go down.

True. The principle of collection at the source is to withhold the tax directly on your income, as to their payment. The salaries and pensions that will be paid from 2019 will be net of tax (you will receive your income after deduction of the fraction of the contribution due).

ALSO READ >> tax : beware of the bug !

Example for a single person whose net monthly wage is 2,000 euros : from January 2019, if its sampling rate is 7 %, his salary will drop from 140 euros per month and will thus be increased to 1,860 euros.

Has to know. In practice, you have nothing to do. Based on the rates calculated and submitted by the tax administration to your payer (employer, pension fund, employment centre ...), the administrator will make the withholding for the account of the tax authorities.

In the year 2019 you will pay the tax once on your income 2018 and 2019.

False. in Order to avoid double taxation in 2019 , a "year in white" was introduced, with the consequence to clear the tax due on your usual income (wages, pensions...) of 2018. On the other hand, your non-recurring income (premium retirement, wage premium are not anticipated in the contract of employment...), as well as any capital gains on securities and real estate will be taxed at the end of the year.

READ ALSO >> 2018, the year trap for the PERP

Has to know. Of specific mechanisms will be put in place to ensure that taxpayers do not inflate artificially their income by 2018 (typically three years, the period of tax examination shall be exceptionally increased to four, and will expire, therefore, on December 31, 2022).

A nanny keeps your children at home ? The tax benefit related to salaries and contributions paid in 2018 is deleted.

False. reductions and tax credits related to the employment of an employee at home, in the work of energy-saving, child custody, or donations to associations made in the course of the year 2018 will be returned to you in September 2019.

Has to know. Since the first quarter of 2019, you will receive an advance of 30 % of the amount of the tax credit to which you may have received in 2017 under the services to the person and custody of a child under the age of 6 years. The balance will be paid in September 2019.

You earn a lot less than your spouse) ? You can ask to have the rates of levy are different. True. In case of disparity of income within your relationship, whether you are married or pacsé, you can opt for two-rate individual. In practice, this will be to reduce the rate applicable to the lowest income and to increase the higher.

Has to know. To benefit from differentiated rates as of January 2019, you must request them, either now, in your statement on-line this summer, on receipt of your notice of assessment, if you complete a paper return. The schedule remains the same for those who wish to adopt a rate "non-custom".

Your tax situation will now no longer any secret for your employer.

False. You will not disclose any information to your employer. It is the tax administration which is in charge of all the steps.

If you wish, you can object to the transmission of your sampling rate. You will then for a rate said to be "non-custom", established on the basis only of the income paid by your employer.

READ ALSO >> Collection of the tax at the source : "It's going to be the bazaar"

in The end, however, if this leads to a puncture less than necessary, due, for example, the collection of land revenue or financial, you will pay the difference directly to the tax authorities.

Has to know. Your sampling rate, the protection of professional secrecy. Any disclosure will be punished.

After 2019, in case of a decrease or hausis income, you may be able to adjust the amount of your tax almost in real time.

True. In the event of a substantial change in the foreseeable amount of your tax, to the upward as well as downward, you will be able to request a discount of your rates of levy at any time in the course of the year. You simply go to your personal space on the site impots.gouv.fr in order to perform a simulation to calculate the amount of tax payable based on your new income, and to seek a change in the rate of levy in consequence.

You are a self-employed professional, you are receiving property income : your income will escape the tax at source.

False. However, here, the tax on the income that can not be directly collected at the source as for the employees and for retirees, it will be collected by the tax authority on the bank account of your liking. The choice, in the form of monthly instalments of one-twelfth of the amount due, or one-fourth quarterly, (15 February, 15 may, 15 August and 15 November).

as a particular employer (household, during home, child care, gardening...), you will need to apply the levy to the source.

Read our complete file

Collection of tax at source

Lower income : - take the lead with the tax deduction at source : 9 million households will affect advances, tax credits, tax Reductions and credits : some taxpayers will receive an advance on the 15th of JanuaryFalse. If you go through the simplified systems of the Cesu or Pajemploi, don't panic ! These agencies will do the work for you. Like today, they provide you with the amount of the net salary to be paid to your employee, and will debit your account for the amount of social contributions and tax at source.

Has to know. A second system should be in place by 2019, in order to simplify your life even more. With this new system, once it releases the number of hours and the net pay at the centre (Cesu), or Pajemploi, it will take care of everything for you : calculation of the levies, and sending the pay slip and payment of the salary of your employee.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets White House debunks Hamas's proposal for a five-year truce in exchange for a Palestinian state

White House debunks Hamas's proposal for a five-year truce in exchange for a Palestinian state Lula speaks with Sánchez to show him his "solidarity" and highlight his "role and leadership"

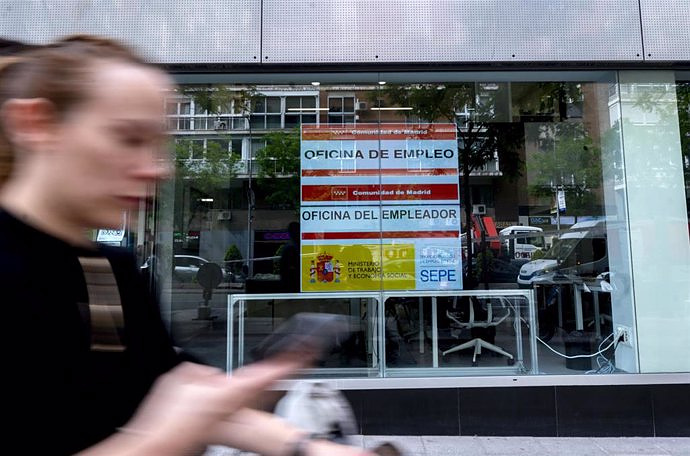

Lula speaks with Sánchez to show him his "solidarity" and highlight his "role and leadership" Unemployment rises by 117,000 people until March and 139,700 jobs are destroyed, its biggest drop since 2020

Unemployment rises by 117,000 people until March and 139,700 jobs are destroyed, its biggest drop since 2020 STATEMENT: Sottopiatto presents the most exclusive kitchenware to give as a gift on Mother's Day

STATEMENT: Sottopiatto presents the most exclusive kitchenware to give as a gift on Mother's Day How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Retrópolis brings the golden age of video games and computing to the UPV

Retrópolis brings the golden age of video games and computing to the UPV Looking for video games that value the neighborhoods of Valencia

Looking for video games that value the neighborhoods of Valencia UPV researchers improve the efficiency of air conditioning systems using a geothermal heat pump

UPV researchers improve the efficiency of air conditioning systems using a geothermal heat pump València is committed to citiverse and smart tourism to be "the reference technological hub of the Mediterranean"

València is committed to citiverse and smart tourism to be "the reference technological hub of the Mediterranean" A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness