After rebounding in the new short term reduced, Bitcoin (BTC) cost published a 15% profit over three times as it climbed in $32,400 to $37,200.

This has been an impressive movement since BTC cost was trading in an range for months and whatever the motives behind the surge, an individual would anticipate big dealers and arbitrage desks to follow the fad.

Interestingly, this isn't the case as lots of the very best traders started brief positions as BTC started its 15 percent movement.

Take note of how both top cryptocurrencies have a tendency to trade at tandem the majority of the time although investors might be rotating from BTC into Ether owing to its function in decentralized fund, volatile price appreciation, along with the charm of Eth2 staking.

According to the identical source, there has been a 135% increase in cryptocurrency social networking action within the last 3 months.

In accordance with CryptoQuant, the outflow suggests an"OTC bargain from institutional investors" that are potentially accumulating BTC into chilly pockets.

These bullish signals comparison with all the exchange-provided dealers' long-to-short internet positioning. This index is calculated by assessing the customer's consolidated position immediately, ceaseless and futures contracts also it offers a clearer perspective of whether professional dealers are leaning bullish or bearish.

Bearing this in mind, there are occasional disagreements from the ways between various exchanges, so audiences should track fluctuations rather than complete figures.

Over the previous 3 days, leading dealers at each market examined have improved their shorts. Though big dealers, market makers, and arbitrage desks can hold positions in their chilly pockets or Grayscale GBTC funds, the long-to-short ratio proves that there's a lack of assurance on if BTC will push $38,000 and chase the $40,000 amount in the brief term.

In addition, the current outperformance by Ether might have been fueled by leading traders decreasing BTC exposure. This makes much more sense considering that the forthcoming CME ETH record is on Feb. 8. It is just natural that there are a spike in appetite among institutional shareholders.

Leading traders may also have transferred their BTC off trade in search of greater return chances, so assuming they've entered brief rankings is a hasty decision.

If these high dealers did input BTC brief positions, there could be indications on derivatives markets. To disprove this concept, Friday's $1 billion choices comeback still favors bulls, who in the moment have lots of incentives to push the purchase price over $40,000.

Every single investment and trading movement involves danger. You need to run your own research after making a determination.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets White House debunks Hamas's proposal for a five-year truce in exchange for a Palestinian state

White House debunks Hamas's proposal for a five-year truce in exchange for a Palestinian state Lula speaks with Sánchez to show him his "solidarity" and highlight his "role and leadership"

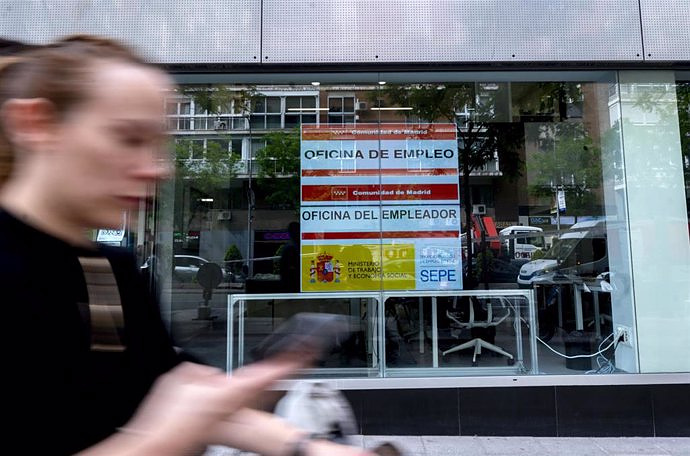

Lula speaks with Sánchez to show him his "solidarity" and highlight his "role and leadership" Unemployment rises by 117,000 people until March and 139,700 jobs are destroyed, its biggest drop since 2020

Unemployment rises by 117,000 people until March and 139,700 jobs are destroyed, its biggest drop since 2020 STATEMENT: Sottopiatto presents the most exclusive kitchenware to give as a gift on Mother's Day

STATEMENT: Sottopiatto presents the most exclusive kitchenware to give as a gift on Mother's Day How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Retrópolis brings the golden age of video games and computing to the UPV

Retrópolis brings the golden age of video games and computing to the UPV Looking for video games that value the neighborhoods of Valencia

Looking for video games that value the neighborhoods of Valencia UPV researchers improve the efficiency of air conditioning systems using a geothermal heat pump

UPV researchers improve the efficiency of air conditioning systems using a geothermal heat pump València is committed to citiverse and smart tourism to be "the reference technological hub of the Mediterranean"

València is committed to citiverse and smart tourism to be "the reference technological hub of the Mediterranean" A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness