MADRID, 22 Feb. (EUROPA PRESS) -

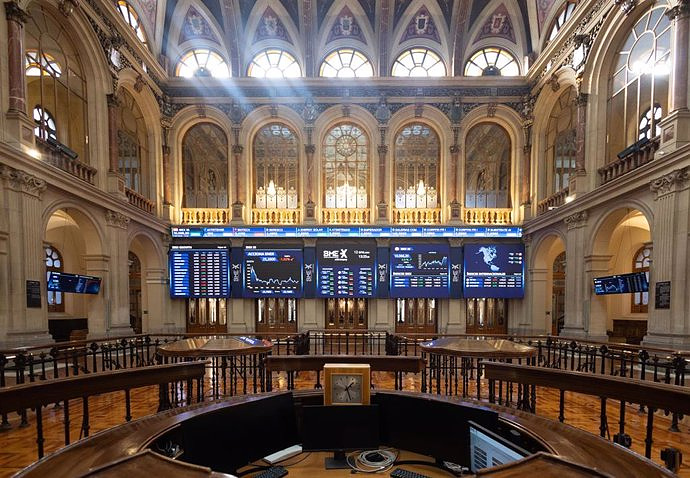

The Ibex 35 moderated the advances of the opening - when it went for 10,200 points - to 0.45% at midday, until it stood at 10,155.7 points, with Repsol as the protagonist by scoring 4.5% after presenting results in a day full of macroeconomic and business references, such as the publication of the minutes of the last meeting of the European Central Bank (ECB).

The Spanish selective has started the session digesting the minutes of the last meeting of the Federal Reserve (Fed) of the United States, known yesterday with the market already closed, and from which it is extracted that the members of the Federal Open Market Committee (FOMC ) were cautious about the risk that the disinflation process would stagnate if interest rates were lowered prematurely, which would be a greater risk than keeping them unchanged.

This morning it was learned that the rate of deterioration in the activity of the private sector in the eurozone has slowed in February to its lowest level in the last eight months as a consequence of the recovery observed in the services sector, according to the advance of the index Purchasing Managers' Composite (PMI) for the Eurozone of S

Specifically, in the month of February, the eurozone composite PMI stood at 48.9 points, compared to 47.9 in January, still signaling a contraction in business activity, but at the slowest pace in eight months; In the case of the services sector, the PMI for February stood at 50 points, a reading equivalent to stagnation, compared to the fall in January, with 48.4 points, thus marking its highest level in seven months, while the Manufacturing PMI has worsened again, with a data of 46.1 points, compared to 46.6 last month.

This afternoon, with the opening on Wall Street, the macroeconomic references of the PMI of the United States in February will be known.

In the Spanish business field, Telefónica has reported before the opening of the Madrid selective to the National Securities Market Commission (CNMV) that it recorded accounting losses of 892 million euros in 2023, after the provision of Telefónica's restructuring plan Spain and the deterioration of goodwill in its United Kingdom subsidiary.

Repsol, for its part, obtained a net result of 3,168 million euros in 2023, which represents a drop of 25.5% compared to the 4,251 million euros earned in the previous year, reported the company, which launches this Thursday also a new strategic plan for the period 2024-2027.

In addition, Iberdrola obtained a net profit of 4,803 million euros in 2023, which represents an increase of 10.7% compared to the previous year and thus shattering its record profits of 4,339 million euros from a year ago.

Thus, in the middle section of this Thursday's trading, the biggest increase within the Ibex 35 was recorded by Repsol (4.5%), followed by Telefónica (2.63%), Banco Sabadell (2.5%) and Grifols (2.4%), while on the decline side Enagás (-1.56%), Ibedrola (-0.96%) and Naturgy (-0.43%) stood out.

The main European stock markets were decisively opting for increases at midday: London added 0.17%; Paris 0.8%; Milan 1.15% and Frankfurt 1.3%.

At the same time, the price of a barrel of Brent quality oil, a reference for the Old Continent, rose by 0.23%, to 83.22 euros, while that of Texas stood at 78.1 euros, a 0.26% more.

In the foreign exchange market, the price of the euro appreciated 0.27% against the dollar, to 1.0848 'greenbacks', while in the debt market the interest required on the ten-year Spanish bond fell slightly up to 3.346%, with the risk premium (the differential with the German bond) at 90.6 points.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Abascal (Vox) criticizes that Sánchez is "victimizing" himself and calls for elections after his possible resignation

Abascal (Vox) criticizes that Sánchez is "victimizing" himself and calls for elections after his possible resignation Carlos Alcaraz reaches the round of 16 in Madrid without breaking a sweat

Carlos Alcaraz reaches the round of 16 in Madrid without breaking a sweat Some 5,000 people demonstrate in front of Congress for democracy, hours before Sánchez's decision

Some 5,000 people demonstrate in front of Congress for democracy, hours before Sánchez's decision STATEMENT: Intelligent systems used in the construction of the deepest underwater tunnel in China

STATEMENT: Intelligent systems used in the construction of the deepest underwater tunnel in China How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on UPV students build a prototype of a wooden house to move to Equatorial Guinea

UPV students build a prototype of a wooden house to move to Equatorial Guinea The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives

The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives ALI, virtual assistant from Alicante, internationally recognized by the OECD

ALI, virtual assistant from Alicante, internationally recognized by the OECD Retrópolis brings the golden age of video games and computing to the UPV

Retrópolis brings the golden age of video games and computing to the UPV A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness