The IDAE publishes a guide to explain the measure, which can be combined with Moves III

MADRID, 14 Dic. (EUROPA PRESS) -

The Government has clarified that the 15% personal income tax deduction can be applied to the purchase of electric vehicles purchased in installments as long as they are for private use, more than 25% of the price is paid before the end of 2024 and the payment is completed. the car before 2026, while it can be combined with the aid from the Moves III Plan, extended until July 2024.

This has been detailed by the Institute for Energy Diversification and Saving (IDAE) in a guide to which Europa Press has had access, which includes the main doubts in this regard and details that consumers who buy an electric vehicle or build A charging infrastructure for private use before 2025 will be able to simultaneously benefit from a 15% deduction in personal income tax and Moves III aid.

In this sense, to benefit from the tax incentive approved at the end of June, the taxpayer will have to submit their tax return with the corresponding amount, while the aid received for both vehicles and charging stations will be considered "capital gains."

Furthermore, the IDAE emphasizes that the deduction only applies in the case of a new vehicle or infrastructure for private use, so in the case of using it in an economic activity, at the time of its acquisition or later, the right to the deduction.

Likewise, if the amount of the aid received is known when making the declaration, this will be subtracted from the total cost of the vehicle or the charging infrastructure. The maximum base of the deduction is 20,000 euros in the case of a vehicle and 4,000 euros in charging points if its cost is higher, while if it is lower, its normal cost will be applied to the deduction.

Specifically, in a vehicle the amounts subsidized by public aid will be deducted from the base of the deduction, while in a charging infrastructure the subsidized amounts cannot be part of the deduction.

IDAE has recalled the vehicles that can benefit from the 15% deduction in personal income tax are the following: M1 passenger cars, L6e light quadricycles, L7e heavy quadricycles and L3e, L4e, L5e motorcycles, which have more than 50 cm3 or a speed greater than 50 km/h.

Likewise, in category M passenger cars, the models are required to appear in the IDAE vehicle base and to belong to one of the following types of electrified vehicles: pure electric vehicles (BEV), extended range electric vehicles (EREV), plug-in hybrid vehicles (PHEV), fuel cell electric vehicles (FCV) and fuel cell hybrid electric vehicles (FCHV).

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Borrell points out that several EU countries may recognize the State of Palestine in May

Borrell points out that several EU countries may recognize the State of Palestine in May The CNMV prohibits the funds that sold shares to Apollo in its takeover bid from purchasing more Applus securities

The CNMV prohibits the funds that sold shares to Apollo in its takeover bid from purchasing more Applus securities STATEMENT: SUNRATE partners with YeePay to empower Chinese companies to navigate global expansion

STATEMENT: SUNRATE partners with YeePay to empower Chinese companies to navigate global expansion Nadal is still alive and exciting in Madrid

Nadal is still alive and exciting in Madrid How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

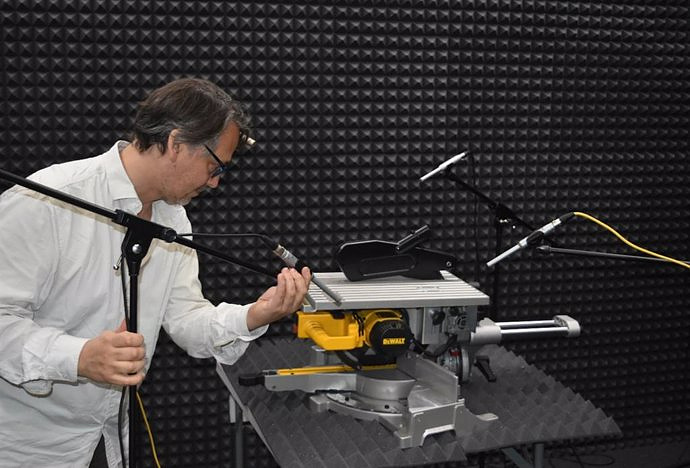

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on They create a bank of machinery sounds to prevent breakdowns through artificial intelligence

They create a bank of machinery sounds to prevent breakdowns through artificial intelligence UPV students build a prototype of a wooden house to move to Equatorial Guinea

UPV students build a prototype of a wooden house to move to Equatorial Guinea The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives

The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives ALI, virtual assistant from Alicante, internationally recognized by the OECD

ALI, virtual assistant from Alicante, internationally recognized by the OECD A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness