"There is none so blind as those who won't listen"

At a recent piece of Coin Geek titled"The BTC bubble will pop shortly," the journalist Patrick Thompson writes:"the electronic money market bubble has been coming to a finish; some consider that the markets have just one pump left prior to a significant decline, but the end is near"

The end is close.

But wait, have not we heard this all before? Yes, countless times. Jesus allegedly rose from the dead after, but the guy from Nazareth has nothing on bitcoin.

You see, bitcoin isn't a bubble, it is a pin. It is the reply to this question of how we, the people, fight financial mismanagement and fiduciary neglect.

Then again, it's a bubble. I call this Bitcoin Paradox. Allow me to clarify.

In November, as an instance, Ruffer, the British-based juggernaut, announced it had spent over $700 million in bitcoin.

With over $7.8 trillion under control, the BlackRock transfer might just help elevate bitcoin into another level.

Not only because bitcoin is a monetary bubble but as it's an epistemic one.

Epistemic bubbles demand people accessing information at a significantly biased way, greedily accepting exactly what they wish to listen to, and dismissing anything distasteful, however precise the signs could be.

In brief, people of epistemic bubbles are just interested in obtaining information that reinforce existing customs. After gas problems are solved, Ethereum has the capability to revive Bitcoin. It is younger, fresher and owns enormous potential, maybe more possible than Bitcoin can ever hope to own. Some notable Satoshi devotees, or Satoshees, refuse to take this reality.

The people we surround ourselves tend to be like-minded, therefore our planet becomes filtered and appears to affirm everything we think. This, then, induces us to increase our confidence in our own beliefs every time the others around us state arrangement. ... However, it should not."

After all, we're in the middle of bitcoin mania, a profoundly emotional phenomenon. Symptoms could consist of unreasonable heights of euphoria, volatile moods (thereby representing the crypto marketplace ), hyperactivity (again, representing the crypto marketplace ) and delusions (sometimes reflecting the crypto marketplace ).

Jesus (yes, yet another Jesus mention ) talked about the risks of false prophets. Although he commented upon crypto, one supposes he'd warn against lost confidence.

If unsure, simply ask Mel Gibson.

A king, however strong, should remain aware of one simple truth -- many others are constantly vying for his chair. As George R.R. Martin composed ,"The Iron Throne will visit the guy who has the power to grab it."

This"guy" seems to be Ethereum. Obviously, a lot of Satoshee will scoff at this statement. But in contrast to popular view, ignorance isn't bliss. Competition is different. A logical bitcoiner will eliminate himself out of the bubble, at least briefly, and inspect the circumstance.

There's every chance that Ethereum and Bitcoin can co-exist at a crypto-infused Shangri-La. Then again, there is an opportunity -- a slender one, but nevertheless an opportunity -- which Ethereum will dethrone Bitcoin. Failure to take this possibility could end up being deadly. Epistemic ignorance never finishes nicely.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Felipe VI swears the flag again 40 years later at the AGM with Princess Leonor as a witness

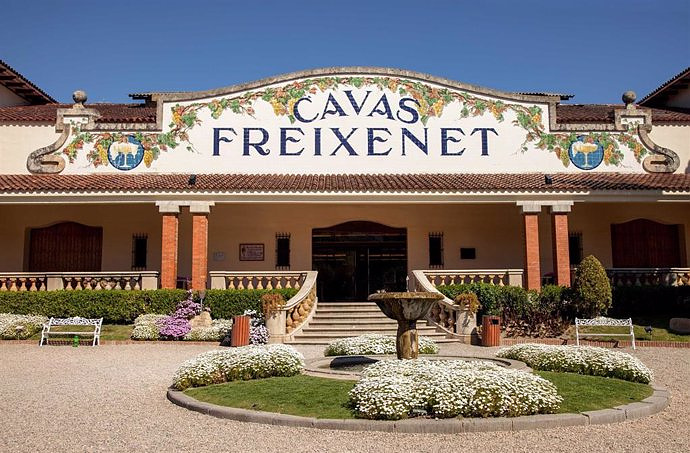

Felipe VI swears the flag again 40 years later at the AGM with Princess Leonor as a witness Freixenet and unions agree to reduce working hours by 20-50% this year due to the drought

Freixenet and unions agree to reduce working hours by 20-50% this year due to the drought STATEMENT: Nearly 400 people participate in the II Family Support Conference at UIC Barcelona

STATEMENT: Nearly 400 people participate in the II Family Support Conference at UIC Barcelona Cerdán censures the "dirty war" of the right and calls for a debate around "democratic regeneration"

Cerdán censures the "dirty war" of the right and calls for a debate around "democratic regeneration" How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on A sensor system obtains the fingerprint of essential oils and detects if they have been adulterated

A sensor system obtains the fingerprint of essential oils and detects if they have been adulterated Faraday UPV presents the 'Origin' rocket to exceed 10 km of flight: "It is the beginning of the journey to space"

Faraday UPV presents the 'Origin' rocket to exceed 10 km of flight: "It is the beginning of the journey to space" The Generalitat calls for aid worth 4 million to promote innovation projects in municipalities

The Generalitat calls for aid worth 4 million to promote innovation projects in municipalities UPV students design an app that helps improve the ventilation of homes in the face of high temperatures

UPV students design an app that helps improve the ventilation of homes in the face of high temperatures A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness