MADRID, 19 Mar. (EUROPA PRESS) -

Taxpayers will be able to access their tax data from this Tuesday starting at 12:00 p.m. for the presentation of the 2023 Income and Assets declaration, as appears in the organization's calendar.

The 2023 Income and Wealth Campaign will start on April 3 with the presentation of returns online, but from this Tuesday, for the first time, taxpayers will be able to access the Tax Agency's website and mobile application. your tax details two weeks before it starts.

According to the published calendar, the Campaign will start just after Easter, on April 3, and will extend until July 1, 2024, one day longer than is usual, since June 30 falls this year on Sunday.

From May 7 to July 1, 2024, the Tax Agency will be able to prepare the taxpayer's declaration by telephone - the appointment request will be available from April 29 to June 28 -.

It will be between June 3 and July 1, 2024 when the Tax Agency will be able to prepare taxpayers' declarations in person at its offices - with an appointment request from May 29 to June 28 -.

Among the novelties to take into account for this campaign, it is worth highlighting that all self-employed workers will be required to file their Income Tax Return next year, regardless of their income.

Also recently, the Government has established the obligation to present the Personal Income Tax (IRPF) declaration through electronic means, "as long as the Tax Administration ensures personalized attention to taxpayers who require assistance to complete it." by such means."

This clarification from the Treasury comes after a ruling by the Supreme Court this year, which revealed a "regulatory insufficiency" for the establishment of electronic means as the only channel for submitting the personal income tax return.

All measures aimed at reforms that help achieve more sustainable energy consumption are also extended until December 31, 2024, whether in private homes or in neighboring blocks. These aid will allow those who promote these actions on their properties to deduct 20%, 40% or 60% of personal income tax.

Furthermore, in terms of housing, it stands out that owners who reduce the rental price in new lease contracts in stressed areas that are signed as of January 1, 2024 will have a 90% deduction in personal income tax on the net income.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Borrell points out that several EU countries may recognize the State of Palestine in May

Borrell points out that several EU countries may recognize the State of Palestine in May The CNMV prohibits the funds that sold shares to Apollo in its takeover bid from purchasing more Applus securities

The CNMV prohibits the funds that sold shares to Apollo in its takeover bid from purchasing more Applus securities STATEMENT: SUNRATE partners with YeePay to empower Chinese companies to navigate global expansion

STATEMENT: SUNRATE partners with YeePay to empower Chinese companies to navigate global expansion Nadal is still alive and exciting in Madrid

Nadal is still alive and exciting in Madrid How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

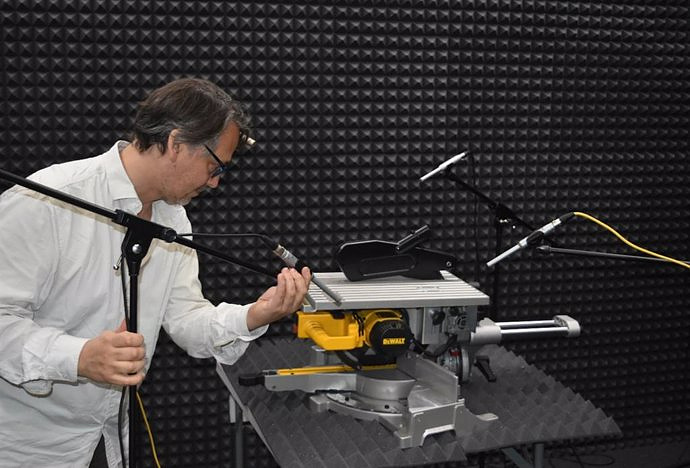

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on They create a bank of machinery sounds to prevent breakdowns through artificial intelligence

They create a bank of machinery sounds to prevent breakdowns through artificial intelligence UPV students build a prototype of a wooden house to move to Equatorial Guinea

UPV students build a prototype of a wooden house to move to Equatorial Guinea The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives

The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives ALI, virtual assistant from Alicante, internationally recognized by the OECD

ALI, virtual assistant from Alicante, internationally recognized by the OECD A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness