(Information sent by the signatory company)

A divorce and COVID-19 made it impossible for him to pay the loans requested

Benidorm, April 17, 2024.- Repara tu Deuda, a leading law firm in Spain in the Second Chance Law, has managed to cancel a debt that amounted to 175,000 euros in Benidorm (Alicante, Valencian Community) by applying the Second Chance Law . SEE JUDGMENTThe lawyers of Repara tu Deuda explain their story: "their state of insolvency arose as a result of applying for loans to purchase a home and the relevant furniture together with their ex-partner. Initially, they were paying the installments without too much difficulty, But after the divorce he found it necessary to request new financing to pay the installments and cover his most essential expenses. The debtor's intention was to pay the installments little by little when the economic situation stabilized, however, due to COVID. -19, everything got worse, which made it impossible to pay the outstanding loans. Now, thanks to Repara tu Deuda Abogados and the Second Chance Law, the bankrupt can start again without debt after ruling by the Commercial Court No. 2 of Alicante (Valencian Community) the Benefit of Exoneration of Unsatisfied Liabilities (BEPI) if applicable, leaving you free of all your debts. Repair Your Debt Lawyers began its activity as a firm specialized in this legislation in September 2015. From its beginnings to the present, it has managed to exceed the figure of 200 million euros exonerated to its clients who come from the different autonomous communities of Spain. The firm of lawyers represents in court more than 23,000 people who have put their financial history in their hands to cancel all their debts. Some of those who have resorted to this mechanism have done so after having heard the testimony of other exonerated persons who have already verified the satisfactory effects of availing themselves of this mechanism. The profile of people who resort to this tool is very diverse: small businessmen who set up a business or made investments in it with negative results, people in complicated work or health circumstances, individuals who have been victims of some type of deception, etc. The firm can also analyze contracts signed with banks and financial entities. In this sense, the objective is to check if there are abusive clauses for the cancellation of credit cards, revolving cards, mini-credits, loans and mortgages and to be able to claim from Cofidis, Moneyman, WiZink, Carrefour, Vivus, Banco Santander, CaixaBank, BBVA, Banco Sabadell, myKredit, Kviku, etc.

Contact Contact name: David Guerrero Contact description: Press Officer Contact telephone number: 655956735

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Borrell points out that several EU countries may recognize the State of Palestine in May

Borrell points out that several EU countries may recognize the State of Palestine in May The CNMV prohibits the funds that sold shares to Apollo in its takeover bid from purchasing more Applus securities

The CNMV prohibits the funds that sold shares to Apollo in its takeover bid from purchasing more Applus securities STATEMENT: SUNRATE partners with YeePay to empower Chinese companies to navigate global expansion

STATEMENT: SUNRATE partners with YeePay to empower Chinese companies to navigate global expansion Nadal is still alive and exciting in Madrid

Nadal is still alive and exciting in Madrid How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

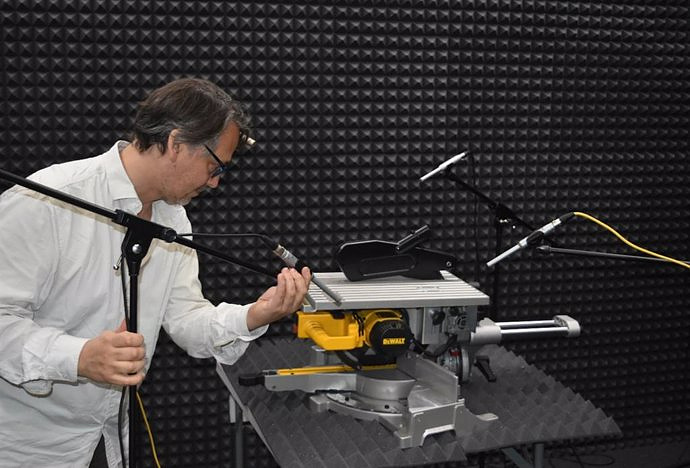

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on They create a bank of machinery sounds to prevent breakdowns through artificial intelligence

They create a bank of machinery sounds to prevent breakdowns through artificial intelligence UPV students build a prototype of a wooden house to move to Equatorial Guinea

UPV students build a prototype of a wooden house to move to Equatorial Guinea The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives

The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives ALI, virtual assistant from Alicante, internationally recognized by the OECD

ALI, virtual assistant from Alicante, internationally recognized by the OECD A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness