The president of BBVA affirms that "it does not make much sense" to put brakes, like the tax, on banking activity

MADRID, 15 Abr. (EUROPA PRESS) -

The president of CaixaBank, José Ignacio Goirigolzarri, has spoken out again about the extraordinary tax on the sector, which the Government would be studying the possibility of making permanent, at a time when interest rates are falling.

"This was a tax that was created a couple of years ago, which was said to be for a limited period of time because there were extraordinary benefits that fell from the sky as a result of the rise in interest rates and it is curious that just when interest rates are lowering, it becomes permanent," he stated during his speech at the 'Wake Up Spain 2024' forum.

Goirigolzarri has admitted, however, that if the tax appears in the Official State Gazette, it will be complied with, although he wanted to point out that last year his entity paid 2.6 billion euros in taxes, with an effective rate of 35%.

For his part, the president of BBVA, Carlos Torres, who preceded Goirigolzarri, has insisted on a message that the sector has been sending since the approval of this tax and that is that Spain "needs" investment, a situation in which the banks they play "a key role."

"We are a neuralgic sector, we are at the center of economic activity and above all we help mobilize savings towards productive investment, which is the beginning of the growth cycle. This productive investment, as I say, improves productivity," he explained.

Therefore, he has maintained that banking is essential and that "it does not make much sense" to put brakes on this activity, as is the case with the tax, which applies a rate of 4.8% on interest margin and net commissions and which has been appealed before the National Court by both the affected entities and the banking associations AEB and CECA.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Nadal is still alive and exciting in Madrid

Nadal is still alive and exciting in Madrid The Treasury injected another 500 million into the SEPI in March to purchase Telefónica shares

The Treasury injected another 500 million into the SEPI in March to purchase Telefónica shares The complaints from ERC and PP against Sánchez's interview do not reach the JEC in time, which did not consider suspending it

The complaints from ERC and PP against Sánchez's interview do not reach the JEC in time, which did not consider suspending it Occupancy in Spain for the May long weekend exceeds 80%, with Andalusia and the Canary Islands as preferred destinations

Occupancy in Spain for the May long weekend exceeds 80%, with Andalusia and the Canary Islands as preferred destinations How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

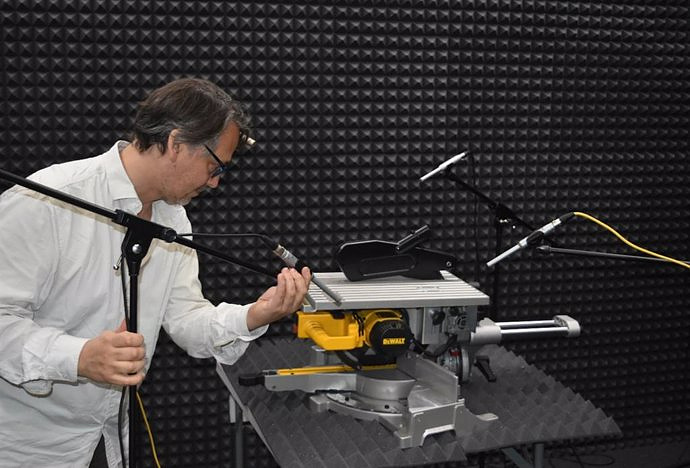

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on They create a bank of machinery sounds to prevent breakdowns through artificial intelligence

They create a bank of machinery sounds to prevent breakdowns through artificial intelligence UPV students build a prototype of a wooden house to move to Equatorial Guinea

UPV students build a prototype of a wooden house to move to Equatorial Guinea The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives

The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives ALI, virtual assistant from Alicante, internationally recognized by the OECD

ALI, virtual assistant from Alicante, internationally recognized by the OECD A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness