At the 2. January 2019ShareFacebookTwitterLinkedInxingemail

The time between the years was characterised by a sideways movement. Today, a little movement in the rates, which meant for Ethereum a re-conquest of the second place came after all. What can you tell from a chart technical point of view about the coming week?

Bitcoin (BTC/USD)

The highs from the 24.12.2018 could the price of Bitcoin have not yet been returned. Since the days of the rate fluctuates between 3,600 and 3,900 US dollars. The short-term support at 3,655 thousand dollars was not sustainable under the messengers, and inventory. With the sideways movement has been achieved on the bottom of the 38.2-percent Fibonacci Retracement Level. Here is the Bitcoin, and has launched a significant counter-reaction that brought US $ 300. Currently the Bitcoin price is trading below the short term upward trend from the beginning/middle of December. This loses more and more importance. The distance to the lower edge of the cloud of the Ichimoku-Kinko-Hyo-indicator is always low and is currently just eight per cent – tendency falling. The moving averages are divided and show no clear Signal.

Bullish variant:

everything about 3.531 US Dollar is bullish in the Short term already. The 38.2-percent Fibonacci Retracement Level has been confidently defended. In the best case, the year is not tested deeply in 2018 and the area around this 3.132 up 3.303 US Dollar again, and the courses to move on. In the first step, it should go here on the short-term upward trend from the beginning/middle of December. Then again 3.929 US-Dollar outbid. This goes hand in hand with a short-term buy signal, and the moving averages would such a course increase. About 4.195 dollars for a larger buy-signal is activated, which is the goal of 4.701 US Dollar.

A breakout above 4.872 US $ goes hand in hand with the following objectives:

5.428 US Dollar5.877 US dollarsBearish variant:

The long sideways phase in a parent of the downstream market are the first warning sign. In particular, the 3.929 US dollars, covers the course and a re-Test of the cloud of the Ichimoku-Kinko-Hyo-not established the indicator is not positive. Pressure builds up and is discharged at the bottom. A break of the short-term support at 3.531 US Dollar triggers a further setback to the area of 3.132 up 3.303 US Dollar. With a significant fall of the Bitcoin is expected to have rates under 3.132 US dollars, the following course goals:

2.629 US Dollar1.920 US Dollar1.601 US Dollar1.224 US dollars Ethereum (ETH/USD)

Significantly better than Bitcoin, Ethereum is reflected and here, one can assume, as before, a stable reaction. After the Ethereum course on Christmas eve, missed the target at 167 US Dollar by two percent, 100 percent price increase, realized according to the said the setback was here for just under 30 per cent. The course of the deep was formed at 116 US dollars, and thus just above the 38.2-percent Fibonacci Retracement Level. The current upward movement looks confident and soon one can speak here of a completed bottom formation. A condition must be fulfilled for this purpose, but still. Currently Ethereum scratches at the top edge of the cloud of the Ichimoku-Kinko-Hyo-indicator. The moving averages emphasize the "Long Setup".

Bullish variant:

The "Long Setup" is fully intact and Ethereum now has the Chance to let the cloud of the Ichimoku-Kinko-Hyo-indicator. For this purpose, a daily closing price of 155 US will need dollars. With the fulfilment of the next condition: a sustainable increase of about 167 US dollars, the strong resistance area between 175 and 196 US-dollars can be tested. A significant outbreak of about 196 US Dollar solves the following course objectives:

241 U.S. Dollar338 US DollarBearish variant:

Ethereum could not rise in the short term significantly, but now the next step to the top. The Resistances 167 and 175 US dollars can not be overcome. The rate continues to fall in and out of the cloud of the Ichimoku-Kinko-Hyo-indicator. This scenario would bring significant losses and Ethereum again to the 100-US-Dollar-brand. The sliding to the averages pan of a "Long-Signal" to a "Short Signal". It is a re-Test of the range of 91 to 95 US dollars. This can stabilize the price only for the short term. A decline below the low for the year at 83 US dollars associated with the price target of US $ 60.

XRP (XRP/USD)

At the high of $ 0.47 on Christmas eve Ripple can no longer continue. The 23.6 percent Fibonacci Retracement Level was able to keep the XRP price with the course of low at 0.34 US dollars at the 27.12.2018, but since the Ripple is lagging behind the overall market and, in particular, Ethereum. The downward trend from April 2018 it will be intensively tested and currently Ripple can make a note of it. The moving averages speak for a "Long" scenario. The lower edge of the cloud of the Ichimoku-Kinko-Hyo-indicator, tested now.

Bullish variant: < / strong>

Ripple consolidates the Crossing of the downward trend from April 2018 and makes no further Deep. Permitted only one re-Test of the course of low at 0.34 US dollars would be less bullish. The next steps must be a Work off of the various Fibonacci Retracement Levels. The way is then free up to the $ 0.43. Thus the upper, then, is the cloud of the Ichimoku Kinko Hyo edge of the reach indicator. Over the course of high of 0.47 US-Dollar is the goal of the upward trend from June, 2018. This is currently at a level of 0.65 US-Dollar – and rising.

price increases above $ 0.75 is associated with significantly higher price targets:

0.89 US-Dollar1,15 U.S. Dollar1,37 US dollarsBearish variant:

The current weakness of Ripple urges caution. The course of high of Christmas eve at 0.47 US Dollar is far and underscores the weakness. Reaching the edge of the cloud of the Ichimoku-Kinko-Hyo-indicator, traders can now as a Short entry. Quickly then, the downward trend from April should come again in power and Ripple can then complete a re-Test of $ 0.31. A clear back case, of whom one was ar negates the short-term soil and enabled the goals Down:

0,24 US Dollar0,US $ 15 conclusion:also, the picture at the Top 3 Coins will remain uneven. After Bitcoin, appears Ethereum significantly stronger. The significant weakness of the Ripple has to be able to use Ethereum to slide back to second place. In any case, the following applies: strength-buy, weakness-sell. It remains to be seen how long this condition has existed and the current pressure build-up the extent to which it discharges. Not to forget: the Parent of everything Short in December 2017. Let's see whether this will change in 2019. In this sense: A successful and happy New year!

Disclaimer: The information on this page is the illustrated rate estimates do not constitute buy or sell recommendations. They are merely an assessment of the analysts.

images on the Basis of data from bittrex.com and bitfinex.com on 01. January created. USD/EUR exchange rate on the cut-off: 0,88 GBP

you have interest to learn Trading from an expert? In the trading school cryptographer various webinars for Learning the Trading craft. Just have a look!

The prices of Bitcoin, XRP, Ethereum & co. can be found here.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets White House debunks Hamas's proposal for a five-year truce in exchange for a Palestinian state

White House debunks Hamas's proposal for a five-year truce in exchange for a Palestinian state Lula speaks with Sánchez to show him his "solidarity" and highlight his "role and leadership"

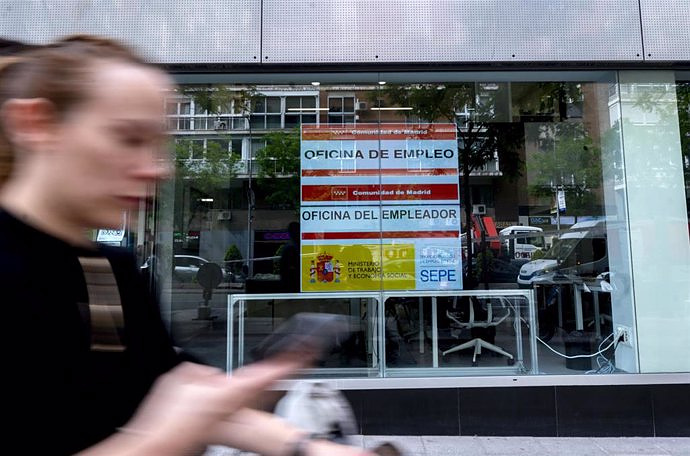

Lula speaks with Sánchez to show him his "solidarity" and highlight his "role and leadership" Unemployment rises by 117,000 people until March and 139,700 jobs are destroyed, its biggest drop since 2020

Unemployment rises by 117,000 people until March and 139,700 jobs are destroyed, its biggest drop since 2020 STATEMENT: Sottopiatto presents the most exclusive kitchenware to give as a gift on Mother's Day

STATEMENT: Sottopiatto presents the most exclusive kitchenware to give as a gift on Mother's Day How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Retrópolis brings the golden age of video games and computing to the UPV

Retrópolis brings the golden age of video games and computing to the UPV Looking for video games that value the neighborhoods of Valencia

Looking for video games that value the neighborhoods of Valencia UPV researchers improve the efficiency of air conditioning systems using a geothermal heat pump

UPV researchers improve the efficiency of air conditioning systems using a geothermal heat pump València is committed to citiverse and smart tourism to be "the reference technological hub of the Mediterranean"

València is committed to citiverse and smart tourism to be "the reference technological hub of the Mediterranean" A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness