The views and opinions listed here are solely those of the authors and do not necessarily reflect the views of cointelegraph.com . Each Investment and Trading involves risk and you should be good to do research before making a decision.

The market data are taken from HitBTC exchange.

The crypto markets, signs of bottoming. Bitcoin rose in February to around 11 percent. So he has closed over the month considered for the first time since July of 2018, with a Plus.

Bitcoin is the only crypto currency that is preferred by the market participants. A number of other large Coins also make a strong impression and have recovered from their lows.

The news that Facebook is considering the introduction of a private crypto-currency, has been as positively received. The new Samsung Smartphone, the Samsung Galaxy S10 will have a crypto-Wallet for Bitcoin and Ethereum. All of these innovations will make crypto-currencies to a global audience.

The fundamental conditions in the crypto industry have improved in the past few months. Institutional actors see these developments and have begun, in the room.

We expect to see a greater involvement of institutions, as soon as the crypto currency market as a whole is a ground to confirm. Therefore, traders can open positions on the Coins, which have bottomed out or a good risk-reward ratio.

BNB/USDThe platform Binance launch pad on 25. February a sale of Fetch.AI (FET)-the tokens within 22 seconds to complete. This shows that there is a demand for the supply of Binance Launchpad.

a few weeks Ago a similar sale of a Tron-based BitTorrent-Token (BTT) in 15-18 minutes to complete. In order to speed up the launch of the Mainnet, awards Binance rewards for the Testing of the new decentralized trading platform Binance DEX. Binance Coin (BNB) has benefited from this positive reporting.

the rate Can climb higher? Let us find out.

BNB/USD Pair has increased compared to its lows from early December to almost 174 percent. After the recent Pullback, the price has had strong growth and is now only around 56 percent below its all-time high. This clearly shows a strong demand for this digital currency.

Currently, the rate is close to the critical overhead resistance of $ 12 (10,58 Euro). A breakout above this can propel the Pair towards the next target at US $ 15 (13,23 Euro) and up to 18 US dollars (15,87 EUR).

If the cops don't climb, however, about 12 US dollars (10,58 Euro) and in keeping, there could be a few days of consolidation or a small decline. While short-term traders can buy on a breakout above $ 12 (10,58 euros), can wait for the long-term comrade-in-arms on a small decline.

BSV/USDBitcoin SV (BSV) has developed this second best. 25. and 26. In February, there was a strong recovery, because the crypto currency has been listed by the payment service provider CoinGate, as well as a Turkish exchange name Vebitcoin.

The increased support was welcomed by the market participants. Can climb of the course up or the recent growth lose again?

The BSV/USD Pair is still very young. Currently, it is trying to reach the support at 65,031 US Dollar (57,208 Euro) a floor. Several Attempts to let the Pair fall have failed, because the sales decrease to the lower levels. This is a positive sign and shows that the buyer can buy the declines.

If the rate (UTC) climbs to about 71,412 US Dollar (62,821 Euro), there will probably be a rally in the direction of the 123,980 US Dollar (109,065 Euro).

If the Pair falls below the immediate support at 58,072 US $ (51,086 euros), a decline to the Low at 38,528 US $ (33,893 Euro).

LTC/USDLitecoin (LTC) Foundation has partnered with the Premier Kickboxing League Glory together in order to make LTC the official crypto currency for the various events and the Online marketing platform of Glory. In order for Litecoin to reach the large fan base of the League.

The LTC/USD Pair has remained relatively stable, after it had reached three weeks ago, the overhead resistance of 47,2460 US Dollar (41,5623 Euro). This shows that the bulls, after the rally from the lows of profits to book immediately, but still waiting.

If the price can break out over 47,2460 US Dollar (41,5623 Euro) and to hold, this indicates a probable ground. The 20-day EMA is flattened, and the RSI is now close to the middle. This shows that the bulls have the short term upper hand.

a Trader can purchase at a closing (UTC) on 47,2460 US Dollar (41,5623 Euro) and the Stop-Loss initially at 29 US dollars (26 Euro). The Stop-Loss Limit can be raised in the course of the next few days at US $ 40 (35 Euro). The goals that you should keep the top of the eye, at 69 US dollars (61 euros), and about 94 US-$ (83 euros).

If the digital currency is not about 47,2460 US Dollar (41,5623 Euro), you can fall back on US $ 40 (35 Euro) and including 29 US dollars (26 Euro) to decrease.

XRP/USDRipple (XRP) was on 25. February listed on the trading platform Coinbase Pro. 28. February, announced Coinbase support for the digital currency on its private trading platform and its mobile Apps.

the Nasdaq is also planning the Listing of a separate Index that follows the price of Ripple post. The Thai securities and exchange Commission has begun Ripple in the list of tokens, which are suitable for the Initial Coin Offerings.

Some people believed that Ripple, Coinbase had to offer a certain incentive or money to be listed. But the company has denied this. Although JPM was a frequent topic of conversation was the recently announced Stablecoin of JPMorgan Chase in the short term, no threat to the XRP from Ripple, as from a study of Binance.

Das XRP/USD Pair remains in a descending channel. It tried to climb, currently up, after it had received support at 0,27795 US Dollar (0,2445 Euro). However, there are in the vicinity of the 20-week EMA some sellers.

A rise above this level could take the course on the resistance line of the descending channel near $ 0.40 (0.35 Euro). A breakout and closing (UTC) on the channel would signal a trend reversal.

If the cops can't, however, break out over the 20-week EMA, will try the bears again to come under 0,27795 US Dollar (0,2445 Euro). A decline below the support zone between 0,24508 US Dollar (0,2156 Euro) and 0,27795 US Dollar (0,2445 Euro), continuing the downward trend again.

DASH/USDDash was in Venezuela a popular transaction medium and continues to grow. The Fast-Food chain Church's Chicken Venezuela accepted the Coin in 10 of their 13 branches. In collaboration with Dash also continues to launch promotions to bring more people to use the crypto currency.

The Brazilian crypto-stock exchange CoinBene has integrated a Dash, and the Coin is thus given the opportunity of his presence in the country to expand.

The DASH/USD Pair has been trying for some weeks to form a bottom. The rate is currently stuck in a range between 56,214 US Dollar (49,452 Euro) and 103,261 US $ (90,839 Euro). The 20-week EMA is also located directly above the range. Therefore, a breakout above the 20-weeks is expected to grow at EMA purchaser, the can catapult the course in the direction of $ 175 (154 Euro) and to 224 US $ (198 Euro).

If the price does not break out, however, the resistance of the range, it will consolidate for a few more weeks.

The Trend is negative, when the bears leave the rate below the support of 56,214 US Dollar (49,452 Euro) to decrease. We were able to find at the current level is not a reliable trading constellation.

The market data are taken from HitBTC exchange. The Charts for the analysis come from trading view.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets White House debunks Hamas's proposal for a five-year truce in exchange for a Palestinian state

White House debunks Hamas's proposal for a five-year truce in exchange for a Palestinian state Lula speaks with Sánchez to show him his "solidarity" and highlight his "role and leadership"

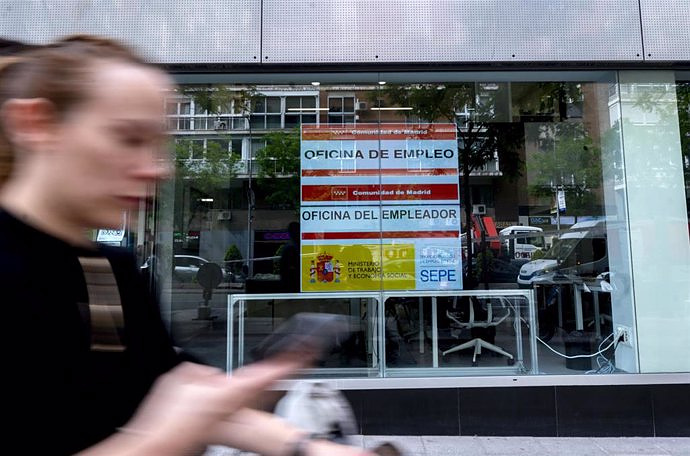

Lula speaks with Sánchez to show him his "solidarity" and highlight his "role and leadership" Unemployment rises by 117,000 people until March and 139,700 jobs are destroyed, its biggest drop since 2020

Unemployment rises by 117,000 people until March and 139,700 jobs are destroyed, its biggest drop since 2020 STATEMENT: Sottopiatto presents the most exclusive kitchenware to give as a gift on Mother's Day

STATEMENT: Sottopiatto presents the most exclusive kitchenware to give as a gift on Mother's Day How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Retrópolis brings the golden age of video games and computing to the UPV

Retrópolis brings the golden age of video games and computing to the UPV Looking for video games that value the neighborhoods of Valencia

Looking for video games that value the neighborhoods of Valencia UPV researchers improve the efficiency of air conditioning systems using a geothermal heat pump

UPV researchers improve the efficiency of air conditioning systems using a geothermal heat pump València is committed to citiverse and smart tourism to be "the reference technological hub of the Mediterranean"

València is committed to citiverse and smart tourism to be "the reference technological hub of the Mediterranean" A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness