MADRID, 19 Jul. (EUROPA PRESS) -

The recovery of consumption outside the home drove a 10% increase in spending on snacks and non-alcoholic beverages in the first quarter of the year in Spain, according to barometer data presented by Kantar after analyzing the state of the sector in eight countries (Spain, UK, France, Portugal, mainland China, Thailand, Brazil and Mexico).

Specifically, for the snacks and non-alcoholic beverages sector, the first quarter of the year was the fourth in a row to present a positive trend (27% compared to the same period in 2021), doing so at a much higher rate than consumption within the home.

This recovery was partly thanks to the good performance obtained by the sector in Brazil and in Europe, where the figures achieved by the United Kingdom, France and Spain stand out.

In Spain, spending outside the home on snacks and non-alcoholic beverages increased by 32% in this period compared to the same period of the previous year, while consumption within the home was 2%. Together, this contributed to a combined increase of 10% in these categories for inside and outside the home.

"These results show the good rate of recovery achieved by OOH in general and the snacks and non-alcoholic beverages sector in particular since the beginning of the year, both in Spain and outside our borders. Although the figures recorded between January and March 2020 -just before confinement- we are very close, which indicates the good health of these categories", assured the expert in Horeca and Foodservice at Kantar, Worldpanel division, Cristina García.

Thus, while the value of this segment in Spain obtained 42% in the first quarter of 2020, this figure was 35% this year.

Regarding the effect that the general rise in prices could have had on the evolution of the sector at the beginning of the year, Kantar confirms that this increase did not have much repercussion on consumption outside the home. "Despite the fact that thrips increased by an average of 22% in Spain and prices per unit by 10%, the growth continued to be very remarkable, a circumstance that was also replicated in the rest of the countries studied. However, the highest Inflation peak occurred in the second quarter, so we at Kantar will closely follow developments," Garcia said.

According to the data managed by Kantar, cafeterias, bars and restaurants led the recovery of the sector globally, and quick service restaurants (QSR) and the impulse channel benefited from the new scenario experienced by consumption outside the home as consequence of the pandemic.

Comparing drinks and snacks, consumption outside the home recovered faster in the non-alcoholic beverage segment, where it presented a global increase of 34%, complementing the good performance obtained within the home, where the segment reached a growth of 2%.

However, snack categories were more resilient than beverages, experiencing less of a decline in OOH value and managing to grow at home.

As far as consumption preferences are concerned, these vary from one country to another. In Spain, there is a greater preference for cookies, which account for 37% of OOH spending, compared to salty snacks or ice cream, which account for 27% and 24% of spending, respectively.

Regarding the value outside the home of salty snacks in particular, which reached 17% in the first quarter of 2022 in Spain, it has not yet fully recovered from the pre-pandemic, whose figure was 23%, which had an impact on higher consumption of the category within households.

In this way, the total recovery of the value of salty snacks depended on the modern channel (hypermarkets, supermarkets and 'discount') and convenience stores.

Likewise, at a general level, the recovery of OOH will be strongly linked to impulse consumption, a habit that has been maintained after the pandemic, with the emotion factor acquiring greater importance, through the incorporation of novel and spicy flavors in the products.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets US Police storm Columbia University and arrest more than a hundred pro-Palestinian protesters

US Police storm Columbia University and arrest more than a hundred pro-Palestinian protesters The PP incorporates the former general secretary of Ciudadanos Adrián Vázquez in its list for the European elections

The PP incorporates the former general secretary of Ciudadanos Adrián Vázquez in its list for the European elections Gamarra (PP) accuses Sánchez of "an exercise in democratic degeneration" to "avoid being controlled by counterpowers"

Gamarra (PP) accuses Sánchez of "an exercise in democratic degeneration" to "avoid being controlled by counterpowers" The May 1 demonstration for full employment begins in Madrid

The May 1 demonstration for full employment begins in Madrid How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Ivace and promotes a less invasive device for the early detection of prostate cancer

Ivace and promotes a less invasive device for the early detection of prostate cancer Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives

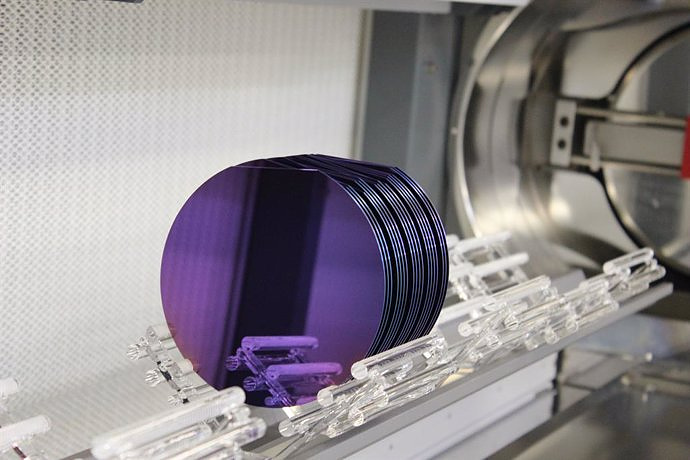

Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics

UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time

A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness