Only two have responded to the instructor's questions, while two others have not appeared for the summons

MADRID, 22 Ago. (EUROPA PRESS) -

Six of the ten investigated summoned this Monday at the National High Court for their alleged participation in the 'Titella case', which has the television producer José Luis Moreno as the main investigated, have accepted their right not to testify before the questions of the investigating judge and the Public Prosecutor's Office alleging that they were summoned in July and that they have not had access to the necessary documentation to prepare the interrogation with guarantees.

Legal sources consulted by Europa Press at the end of the appearance have indicated that, in this way, there have only been two defendants who have decided to respond to Judge Ismael Moreno, while the other two have not appeared for the summons.

These citations, framed in the batch of up to 77 people that the instructor faces until the end of August, are related to the alleged money laundering plot of 'Titella'. They take place after last July, a 482-page report from the Civil Guard of Catalonia and the National Police arrived at the offices of the Central Court of Instruction number 2.

In the report, the agents identified all the new defendants, whom they divide into administrators, figureheads and bank employees who actively or secondaryly collaborated with the organization.

"Evidence and indications have been obtained that would relate those under investigation to the facts that are being clarified, specifically the existence of a criminal organization that operates internationally, whose criminal activity is diversified into different specialties from fraud to and fraud to banking entities, to the falsification of bank documents such as checks and promissory notes, in addition to the subsequent laundering of the benefits obtained," the document explained.

As they indicated, this structure "divided into operational cells and clearly hierarchical" would have as alleged leaders since 2017 José Luis Moreno himself and Antonio Aguilera and Antonio Salazar, who had "defined functions."

Some 58 of the 77 new defendants appear in the report as alleged figureheads of the companies and companies that the plot would have used to profit from the aforementioned credits and bank concessions. "They were in charge of appearing at the bank, presenting the accounting and financial documentation that Aguilera and Salazar had prepared together with the rest of their collaborators in order to request financing for their companies," the report states.

"The contracted products were very diverse, from lines of credit to bank loans and ICO loans, through factoring, confirming, discount lines, promissory notes, credit policies, leasing, renting and any other that was beneficial to them," the agents detailed.

Of the rest of the new accused, the official letter distinguished the bank employees who, on the one hand, had "real knowledge that those investigated as leaders of the organization" were the ones who directed the companies and managed the financing "despite not appearing in the administrative bodies of the companies or appear in them as partners or attorneys-in-fact". Even so, they agreed to "provide them with all the information and carry out with them the banking operations that they requested", either due to "negligence or lack of diligence in their functions".

On the other hand, the judicial police pointed to another link: that of the bank employees who "actively and directly participated in these operations, receiving remuneration from the organization for their work, both in money and in kind, such as mobile phones of high-end, televisions, cars or stays in hotels".

That was the case, presumably, of the manager of a Banco Popular office in Valladolid who received a Roomba vacuum cleaner or that of the manager of a Liberbank branch, who would have received a flat-screen television, electrical appliances, tickets for the VIP box of a football match, an apartment in Benidorm or a ham.

Lastly, and without mentioning names, the official letter sent to the instructor also distinguished a last step: that of bank employees who have appeared during the investigation "collaborating with those investigated or referenced by them in some of the monitored conversations."

The investigations around Titella began in 2018 and the operation hatched in June 2021 with the arrest of the ventriloquist and that of dozens of people in different cities for an alleged fraud perpetrated through a corporate network.

The investigators divide the alleged plot into two organizations: one led by Moreno, Antonio Aguilera and Antonio Salazar, dedicated since 2017 to "fraud and fraud against banking entities and private investors", "to the falsification of bank effects such as checks and promissory notes" and to "money laundering"; and another, headed by Carlos Brambilla, an alleged drug trafficker who would have used said structure to launder money.

According to the judicial report, Moreno and Aguilera would be the "maximum responsible" and Salazar, the third in action. Each one would have a function. The producer, "as a well-known public figure, would lend his name as a business card" in order to easily get the financing they would pretend to need to launch a film project. Therefore, he "was the main recipient of the funds obtained".

That money would then pass into the hands of Aguilera and Salazar. The two would have "extensive knowledge in banking and commercial operations", so they would take care of creating the companies, "make them up", appoint administrators and present them to the banking entities as the recipients of the necessary financing for said projects. In reality, they would have no activity at all.

Through this network of "shell companies" managed by presumed figureheads, both organizations would move "large amounts of cash" which they tried to dispose of with income that they passed off as benefits from their commercial work or with cash injections for which they would have the complicity of bank employees who would take their commission in exchange for introducing this money into the legal circuit.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets US Police storm Columbia University and arrest more than a hundred pro-Palestinian protesters

US Police storm Columbia University and arrest more than a hundred pro-Palestinian protesters The PP incorporates the former general secretary of Ciudadanos Adrián Vázquez in its list for the European elections

The PP incorporates the former general secretary of Ciudadanos Adrián Vázquez in its list for the European elections Gamarra (PP) accuses Sánchez of "an exercise in democratic degeneration" to "avoid being controlled by counterpowers"

Gamarra (PP) accuses Sánchez of "an exercise in democratic degeneration" to "avoid being controlled by counterpowers" The May 1 demonstration for full employment begins in Madrid

The May 1 demonstration for full employment begins in Madrid How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

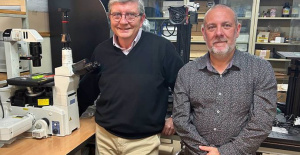

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Ivace and promotes a less invasive device for the early detection of prostate cancer

Ivace and promotes a less invasive device for the early detection of prostate cancer Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives

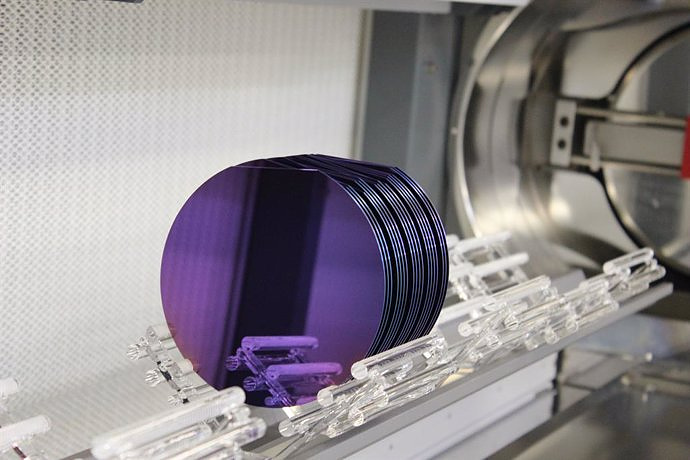

Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics

UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time

A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness