MADRID, 13 Feb. (EUROPA PRESS) -

The Ibex 35 closed this Tuesday with a fall of 0.59%, reaching 9,925.4 points, in a day marked by inflation in the United States in January, which fell three tenths, to 3.1%, while the underlying has remained unchanged at 3.9%.

Both data have been worse than expected by the market, since the consensus forecast a cut of five tenths for general inflation and another two for core inflation.

The Spanish selective traded without major variations compared to yesterday's close until the data from the United States was known, at which time the index, just like its European and American counterparts - whose indices lost 1% at closing time in Europe -, he opted by decision for the losses due to the derivatives that this macroeconomic reference may have on monetary policy.

The manager Federated Hermes has indicated in an afternoon statement that these inflationary data "will further lengthen the calendar for the first rate cut."

On the other hand, the Public Treasury has placed 2,036.27 million euros in three- and nine-month bills this Tuesday, in the middle band of its objectives, and has done so at higher rates in both references and with a demand that has tripled what was finally awarded.

Regarding the international panorama, pessimism among homebuilders in Germany reached a level never seen before at the start of 2024, according to the latest survey carried out by the Munich Institute for Economic Research (Ifo).

For its part, the increase in salaries in the United Kingdom during the final quarter of 2023 moderated to 6.2% annually, excluding bonuses, compared to the annual increase of 6.7% between the months of September and November, although the The observed increase exceeded the market consensus expectation of 6%, which reinforces the Bank of England's position of waiting before undertaking its first rate cut after the recent cycle of increases.

In this context, marked by this fear of higher interest rates for a longer period of time, financial institutions have lavished themselves on the small group of eight securities that have closed with advances: Banco Sabadell has added 3.06%; Caixabank 2.68% and Bankinter 1.33%.

On the other hand, on the decline side, Solaria Energía (-4.51%), ArcelorMittal (-4.32%), Cellnex (-3.33%), Acciona Energía (-2.89%) have been especially penalized. ), Colonial (-2.59%), Mélia Hotels (-2.59%) and Grifols (-2.53%).

The rest of the European markets have also seen declines after the US benchmark: London has lost 0.81%; Paris 0.84%; Frankfurt 0.94% and Milan 1.03%,

These declines have occurred in a context in which the Nikkei, the benchmark index for the Japanese markets, closed this Tuesday's session with a rise of 2.89%, to its best level since January 1980, boosted by the rebound in technology and the weakness of the yen.

At closing time in the Old Continent, a barrel of Brent was trading at $82.78, up 0.95%, while West Texas Intermediate (WTI) reached $77.88, up 1.25%. further.

In the debt market, the yield on the Spanish bond with a 10-year maturity has closed at 3.333% after adding almost two basis points. In this way, the risk premium against German debt was 94 points.

For its part, the euro weakened by 0.5% against the dollar, trading at an exchange rate of 1.0717 'greenbacks' for each unit of the community currency.

The prospect of high rates has affected other assets such as the troy ounce of gold, which lost more than 1% of its value and dropped below $2,000 for the first time since mid-December, and bitcoin, which It recorded a 2.7% correction that made it lose the level of $50,000 that it reached yesterday for the first time since December 2021.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets COMUNICADO: Energy Transitions Commission (ETC) Urges Government and Industry Collaboration to Overcome Perceptions of Offshore Wind

COMUNICADO: Energy Transitions Commission (ETC) Urges Government and Industry Collaboration to Overcome Perceptions of Offshore Wind UGT and CCOO demand the regeneration of democracy, better salaries and a reduction in working hours

UGT and CCOO demand the regeneration of democracy, better salaries and a reduction in working hours Alcaraz gives up his reign in Madrid against Rublev

Alcaraz gives up his reign in Madrid against Rublev Petro announces that Colombia will break diplomatic relations with Israel

Petro announces that Colombia will break diplomatic relations with Israel How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Ivace and promotes a less invasive device for the early detection of prostate cancer

Ivace and promotes a less invasive device for the early detection of prostate cancer Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives

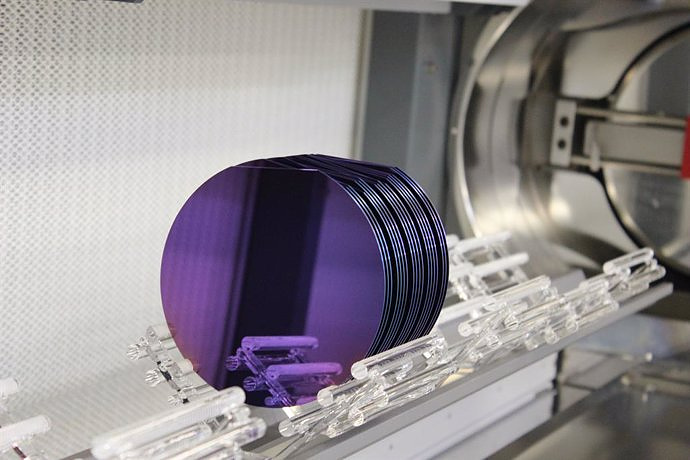

Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics

UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time

A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness