It advances 6% in the month of June and 3.53% only in the last week

The Ibex 35, the main indicator of the Spanish Stock Market, has closed the first half of the year with a revaluation of 16.57%, reaching 9,593 integers, for which reason it has returned to the maximum of February 2020, a few weeks before the that the confinement due to coronavirus was decreed and the markets sank.

The 6% increase in the month of June, the second highest after January (9.78%), has returned to the national selective the good tone with which it began the year and which was only interrupted in March by the turbulence that the bankruptcy of US financial institutions and the absorption in Switzerland of Credit Suisse by UBS generated in the markets.

The increases in interest rates undertaken this month by the main central banks to curb inflation have not stopped the rises in the stock markets on both sides of the Atlantic either.

In this sense, the European Central Bank (ECB) has raised rates this month to 4%, the Bank of England (BoE) to 5% and the United States Federal Reserve (Fed) left them unchanged at 5- 5.25%, although its members have anticipated that there are more increases ahead.

XTB expert Joaquín Robles has pointed out that investors continue to bet on the strength of the economy despite the prospects for further rate hikes, more persistent inflation than expected, the progressive slowdown of the economy and geopolitical risks.

FULL OF SESSIONS IN GREEN DURING THE WEEK

The Spanish Stock Market has concluded the last week of June with an appreciation of 3.53%, after reaping a full five positive sessions, registering a rise of 0.87% in the session this Friday, without worrying about the message from the central bankers at the forum in Sintra (Portugal), where they reported that monetary policy still has a long way to go.

Robles (XTB) has pointed out that two other increases of at least 25 basis points are discounted in Europe, and in the US the one in July is taken for granted.

Important macroeconomic references have also been released during the week: inflation in the euro area in June has moderated to 5.5%, although core inflation has risen by one tenth, to 5.4%; while the unemployment rate stood at 6.5% in May, record lows.

In Spain, inflation fell to 1.9% in June, the lowest since April 2021, and it was the first major economy in the common market to fall below the 2% target, while core inflation stood at 5.9%.

For its part, French inflation stood at 5.4% and German inflation at 6.4%.

On the other side of the Atlantic, PCE inflation, one of the Fed's reference measures when evaluating its monetary policy, fell to 3.8% in May and core inflation to 4.6%, which meant that Wall Street indices marked provisional increases of around 2% for the week.

AT THE DOORS OF THE 9,600 POINTS

The Ibex 35 has traded for a good part of the session this Friday above 9,600 integers, but it has lost strength in the final stretch of the negotiation and has closed with a rise of 0.87%, to the aforementioned 9,593 points.

The focus of the session has been on Applus, since the National Securities Market Commission (CNMV) suspended the trading of Applus shares before the opening in a precautionary manner and with immediate effect, pending the release of relevant information about the company.

At around 12:15 p.m., the US fund Apollo launched a takeover bid for 100% of Applus at a price of 9.5 euros per share in cash, yielding a total amount of 1,226.2 million euros. Right after, the CNMV announced that it was lifting the suspension of the value, which closed the session with a rise of 5.85%, the third best result in the continuous market.

Within the Ibex 35, Grifols has led the increases this Friday with a rise of 1.87%, followed by Merlín Properties with 1.69% and Indra with 1.67%. In contrast, Acerinox led the small group of five stocks that closed the session with losses, losing 1.5%, while Acciona Energía dropped 1.03%.

The main European stock markets have closed with increases: London has added 0.8%; Milan 1.08%; Paris 1.19% and Frankfurt 1.26%.

In the raw materials market, Brent crude, a benchmark in Europe, rose 0.7%, to $75 a barrel, while Texas oil, WTI Intermediate, appreciated 1.1%, at $70.95 a barrel. For its part, the euro appreciated 0.45% compared to the "green ticket", to 1.0915 dollars.

In the debt market, interest on long-term Spanish debt has closed at 3.377%, while the risk premium (the differential with the German bond, considered the benchmark) remained at 98.9 points.

Looking ahead to next week, investors' attention will focus on the publication of macroeconomic data: the PMI manufacturing indicators will be released on Monday, which are expected to remain in contractionary territory, and will be published throughout the week. the minutes of the last monetary policy meeting, which together with the statements by central bankers on the outlook for economic rates and growth could alter the course of the stock markets pending the start of the business results season.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets US Police storm Columbia University and arrest more than a hundred pro-Palestinian protesters

US Police storm Columbia University and arrest more than a hundred pro-Palestinian protesters The PP incorporates the former general secretary of Ciudadanos Adrián Vázquez in its list for the European elections

The PP incorporates the former general secretary of Ciudadanos Adrián Vázquez in its list for the European elections Gamarra (PP) accuses Sánchez of "an exercise in democratic degeneration" to "avoid being controlled by counterpowers"

Gamarra (PP) accuses Sánchez of "an exercise in democratic degeneration" to "avoid being controlled by counterpowers" The May 1 demonstration for full employment begins in Madrid

The May 1 demonstration for full employment begins in Madrid How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Ivace and promotes a less invasive device for the early detection of prostate cancer

Ivace and promotes a less invasive device for the early detection of prostate cancer Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives

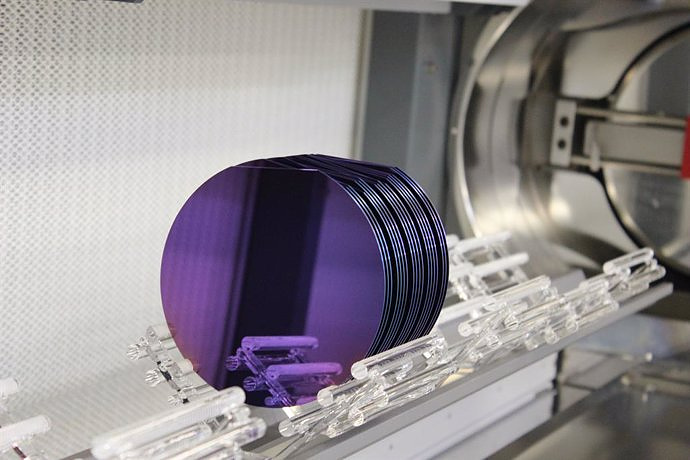

Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics

UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time

A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness