MADRID, 15 Sep. (EUROPA PRESS) -

The Ibex 35 concluded the week with an increase of 1.98%, allowing it to recover the level of 9,500 points - specifically, it closed at 9,549.7 points - which it lost two weeks ago after the tenth consecutive rise in the interest rates of the European Central Bank (ECB), which yesterday raised rates by a quarter of a point, to 4.5%.

According to XTB expert, Dario García, the stock indices rose betting on the more short-term effect, for which the terminal rate would be 4.25% (between 4.5% of the refinancing rate and 4% of the deposit rate), after interpreting the words of the president of the ECB, Christine Lagarde, that this increase would be the last increase of the current cycle, even despite revising the growth of the European economy downwards and revising the raises inflation expectations.

Inflationary data from the United States in August also stood out this week, on which the Federal Reserve (Fed) will pivot in its meeting scheduled for next week.

The year-on-year inflation rate in the United States accelerated its rise to 3.7% in August from 3.2% the previous month, representing a new rebound for the second consecutive month, although the underlying inflation rate, which excludes The impact of the volatility of food and energy prices reached 4.3%, four tenths less than in July.

Likewise, investment confidence (ZEW index) in Germany in September has improved more than expected, although in the eurozone it has worsened more than analysts anticipated; In both cases they have remained in negative territory.

In this context, of the Ibex 35, the stock with the best weekly performance has been Grifols (8.9%) after the European Parliament has approved a law on compensation for plasma donations, García pointed out. After Grifols, the biggest increases have been for Rovi (6.6%); Solaria (6.6%); Indra (4.66%) and, with less upward momentum, BBVA (3.44%); Banco Santander (2.45%); Repsol (2.42%) and Telefónica (2.37%).

Inditex has recorded an advance of 2.55% after informing the market that it registered a record in its net profit of 2,513 million euros during the first half of its 2023-2024 fiscal year.

On the other hand, the components with the worst performance in the week have been Aena (-2.53%); Logista (-1.58%) and IAG (-1.11%).

The rest of the European indices have also advanced positions in the week: Frankfurt has added 0.94%; Paris 1.91%; Milan 2.35% And London 2.74%. For their part, the New York indices barely rose during the week, provisionally, half a percentage point during the week.

In the raw materials market, Brent crude oil maintains its upward streak due to OPEC cuts and the push from Asia (this morning it was announced that China's industrial production accelerated its growth in August to 4.5% in rate). year-on-year, the second largest increase of the year), so the reference crude oil in the Old Continent rose 3.5% in the week and has approached $95 a barrel, the highest since November.

For its part, the barrel of Texas (WTI) also rose 3.5% in the week and was close to $91 a barrel, returning to levels not seen since June 2022, when the energy crisis derived from the war in Ukraine impacted the markets.

In the debt market, the yield on the Spanish bond with a 10-year maturity closed at 3.738% after appreciating almost one tenth in the week. The risk premium (the differential with the German bond) remained at 106.7 points.

In the currency market, the euro lost 0.2% in the week against the dollar, reaching 1,068 'greenbacks', the lowest since mid-March. THE IBEX INCREASES 0.01% THIS FRIDAY IN THE 'QUADRUPLE WITCHING HOUR'

The Ibex started this Friday's session maintaining the vigorous tone of the day before after the ECB's rate hike and has reached the level of 9,600 points, which returned the index to the highs of six weeks ago; However, the index has lost steam and the 'quadruple witching hour' has plunged it into a state of volatility in the last stretch of trading.

The third 'quadruple witching hour' (in which options and futures contracts on indices and stocks expire in Europe and the United States) so far this year has caused the selective to enter losses but at the last moment, after the closing auction, has managed to escape the setbacks and end the session with an increase of one hundredth, 0.01%.

On the other hand, this Friday China published a battery of economic data that gives clues about the progress of its economy. On the one hand, the country's industrial production rose 4.5% in August, eight tenths more than in July, while retail sales rose by more than two points, up to 4.6% in the eighth month of the year. anus. For its part, the unemployment rate in August fell by one tenth, to 5.2%.

Continuing with the macro agenda, this Friday it was announced that inflation in France rose six tenths, to 4.9% in August, while that of Italy contracted by five tenths, to 5.4% in the same month. .

In this context, ArcelorMittal was the most bullish value this Friday (1.56%), ahead of Ferrovial (1.43%), ACS (1.43%), Endesa (1.12%), Rovi (1 .01%), Aena (0.89%) and Iberdrola (0.73%).

On the opposite side, Merlín has led the declines with a fall of 3.4%, while Colonial has fallen 2.88%; Banco Sabadell, 2.72%; Logista, 2.51%, and Bankinter, 2.05%.

The European stock markets, although also affected by volatility, have added in the session: Milan has advanced 0.08%; London 0.5%; Frankfurt 0.56% and Paris 0.96%.

Investors will focus next week on the monetary policy meetings of the Federal Reserve (Fed) and the Bank of England (BoE), which will take place in the middle of the week, at which time the interest rate will also be published. of China's 1-year loans, Germany's Producer Price Index and UK inflation data.

Prior to this, the market will know the inflationary data of the eurozone and, at the end of the week, the last review of the Spanish GDP for the second quarter will be carried out and macroeconomic data (both from the manufacturing and services sectors) in the eurozone will be known. , United Kingdom and United States.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets The Congress of Argentina approves the omnibus law that allows the privatization of some public companies

The Congress of Argentina approves the omnibus law that allows the privatization of some public companies Marjane Satrapi, Princess of Asturias Award: "I am angry with Borrell, if I had him in front of me I would slap him"

Marjane Satrapi, Princess of Asturias Award: "I am angry with Borrell, if I had him in front of me I would slap him" Judge fines Trump $9,000 for contempt of court and considers sending him to prison during trial

Judge fines Trump $9,000 for contempt of court and considers sending him to prison during trial Bayern and Real Madrid live the first European 'classic' at Wembley

Bayern and Real Madrid live the first European 'classic' at Wembley How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives

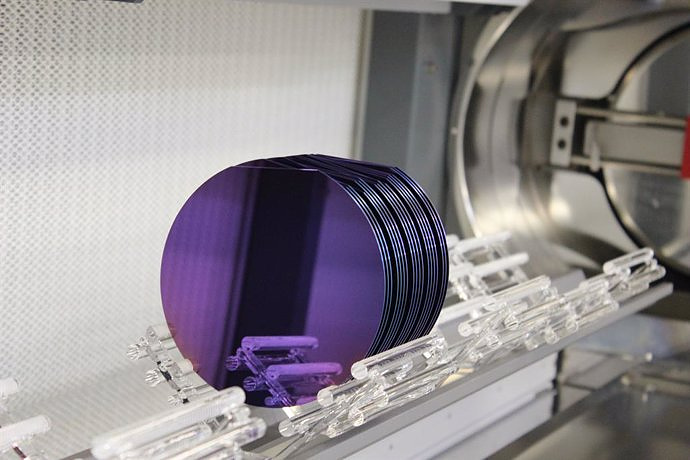

Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics

UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time

A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time They create a bank of machinery sounds to prevent breakdowns through artificial intelligence

They create a bank of machinery sounds to prevent breakdowns through artificial intelligence A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness