MADRID, 24 Ene. (EUROPA PRESS) -

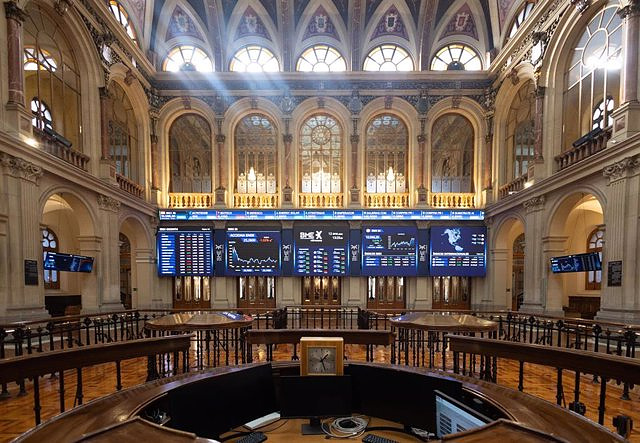

The Ibex 35 closed this Wednesday with an increase of 1.16%, reaching 9,974 points, waiting for the monetary policy meeting of the European Central Bank (ECB) to take place tomorrow, from which investors expect a new pause in interest rates - they would remain at 4.5% - and, above all, clues about when there would be cuts in interest rates.

The Spanish selective, in a week in which it acts like a pendulum (on Monday it gained 1%, yesterday it fell that same amount and today it repeats the data in a positive sign), has opted this Wednesday since the opening for a growing upward trend driven by the vast majority of its values - only five of them have closed negative - and after the market received a battery of macroeconomic data.

Regarding the ECB's decision, Bank of America experts have indicated that they do not expect changes in monetary policy or communication, but "they do expect the ECB to be more reluctant to the cuts anticipated" by the market. Likewise, the business results season in Spain picks up speed tomorrow thanks to Bankinter.

In the 'macro' section, the PMI composite index, prepared by S

For its part, the same indicator, but referring to the activity of the United States in January, has widened its difference in expansive territory thanks to the improvement of the services sector and, especially the improvement of the manufacturing sector, which has gone from a contraction zone to expansive.

In other geographies, the People's Bank of China (PBPC) has decided to lower this morning by 50 basis points the cash reserve ratio required of the country's entities with the objective of "consolidating and improving the positive trend of economic recovery." The reduction in the reserve ratio will come into force on February 5 and will mean an injection of liquidity to the market of 1 trillion yuan (129.28 billion euros), as announced by the governor of the Chinese central bank, Pan Gongsheng, in a Press conference. This has motivated a rise of 3.56% on the part of the Hong Kong Hang Seng.

In the business sphere, this morning it was known that Apollo has signed contracts to acquire 21.85% of Applus, raising the takeover price to 10.65 euros per share; In addition, this Wednesday the new edition of the International Tourism Fair (Fitur) started, which will be held from this Wednesday, January 24, until Sunday, January 28, at Ifema Madrid, and will have a large presence of travel agencies. travel, tour operators and employers.

In this context, Grifols has presided over the gains of the Ibex 35 with an increase of 5.63%, followed by IAG ( 3.4%), Colonial ( 2.91%), Mapfre ( 2.69%), Solaria ( 2 .55%), ArcelorMittal (2.03%), Bankinter (2.03%), Fluidra (1.98%) and Inditex (1.75%).

On the opposite side, only five values have closed trading with losses: Acerinox (-1.63%), affected by the 'ex-dividend' effect, Naturgy (-0.54%), Acciona Energía (-0.49% ), Telefónica (-0.18%) and Enagás (-0.07%).

The dynamism of the Madrid stock market has been shared by the rest of the main European capitals: London has risen 0.56%; Milan 0.87%; Paris 0.92% and Frankfurt 1.58%.

At closing time in the Old Continent, in the raw materials market, a barrel of Brent stood at $80.62, 1.35% higher, while West Texas Intermediate (WTI) advanced 1.86 %, up to $75.73.

The yield on the Spanish bond maturing in 10 years closed at 3.255% after subtracting one basis point, while the risk premium (the differential with the German bond) stood at 91.5 points.

In the foreign exchange market, awaiting the decision of the 'guardian of the euro', the euro appreciated 0.4% against the dollar, reaching an exchange rate of 1.0897 'greenbacks' for each unit of the community currency.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets The CNMV once again suspends Applus's listing

The CNMV once again suspends Applus's listing Línea Directa earns 10.1 million euros in the first quarter, compared to losses of 5.3 million

Línea Directa earns 10.1 million euros in the first quarter, compared to losses of 5.3 million Unicaja triples its profit in the first quarter, up to 111 million euros

Unicaja triples its profit in the first quarter, up to 111 million euros BBVA earns 2,200 million in the first quarter, 19.1% more

BBVA earns 2,200 million in the first quarter, 19.1% more How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on UPV students build a prototype of a wooden house to move to Equatorial Guinea

UPV students build a prototype of a wooden house to move to Equatorial Guinea The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives

The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives ALI, virtual assistant from Alicante, internationally recognized by the OECD

ALI, virtual assistant from Alicante, internationally recognized by the OECD Retrópolis brings the golden age of video games and computing to the UPV

Retrópolis brings the golden age of video games and computing to the UPV A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness