MADRID, 20 Feb. (EUROPA PRESS) -

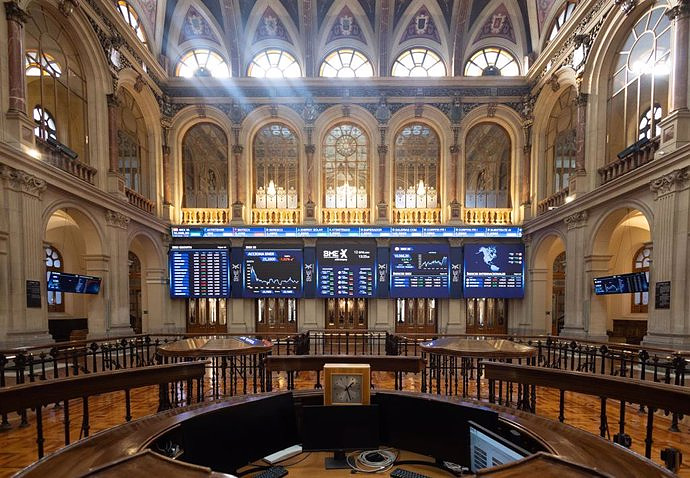

The Ibex 35 posted the best result on the European continent this Tuesday with an increase of 0.94%, which allowed it to recover the level of 10,000 points two weeks later - specifically, it closed at 10,038.2 integers -, thanks to the advances of Meliá Hoteles (10.95%) and other large capitalization values, such as Banco Santander, Iberdrola and Inditex.

In a day devoid of macroeconomic references and in which the news has come from the business sphere, the Spanish selective started with slight advances, got some air at midday and ended up boosting itself with the return to activity on Wall Street - yesterday remained closed for a holiday - although the New York indices were in favor of declines at closing time in Europe.

In the Spanish market, this day the bearish firm Gotham City Research has once again gained prominence, which has launched a new report raising new questions about the relationship between the pharmaceutical company Grifols and Scranton, a 'family office' in which the Grifols family participates.

After being pleased that his previous complaints have motivated changes in the corporate governance of Grifols, which have resulted in the separation of family members from the management of the blood products company, Gotham focuses his new battery of questions on the role of Scranton in the firm's operations.

The listed Spanish company has issued a statement in which it alleges that it has already answered "each of their malicious and misleading questions" from Gotham. Thus, the Catalan company, which lost more than 7% in the session, has recovered ground and closed with a drop of 0.36%.

In the rest of the business field, yesterday it was known with the market already closed that the Moon GC investment vehicle

For its part, Enagás has informed the market this morning that it obtained a net profit of 342.5 million euros in 2023, which represents a drop of 8.8% compared to the 375.8 million euros of the previous year. , although it allows the group to smash the annual objective that had been established in a range of 310-320 million euros.

For its part, Banco Santander will begin this Tuesday to execute the share repurchase program for an amount of 1,459 million euros announced yesterday by the entity after obtaining the relevant regulatory authorization.

Along similar lines, the CEO of CaixaBank, Gonzalo Gortázar, has indicated this day the entity's intention to execute a third share buyback program in 2024, which is pending approval by the supervisor.

Given this situation, Meliá has been the listed company that has advanced the most of the entire selective, with an increase of 10.95%; Behind them, values such as Enagás ( 2.58%), Redeia ( 1.82%), Banco Santander ( 1.67%), Caixabank ( 1.54%), Aena ( 1.34%), Bankinter ( 1 .2%), Telefónica (1.13%), Inditex (1.08%) and Iberdrola (0.97%).

On the opposite side, ArcelorMittal has led the group of almost a dozen stocks that have closed in losses by losing 1.83%, while behind them Acerinox (-1.55%) has stood out; Repsol (-1.16%); Solaria (-0.98%) and Indra (-0.38%).

The evolution has been uneven in the rest of Europe: Milan has added 0.08% and Paris 0.34%, while London has subtracted 0.12% and Frankfurt 0.14%.

On the other hand, the European Commission has announced that it approves the merger of Orange and MásMóvil but does so subject to the companies complying with the concessions agreed with the Romanian competitor Digi to avoid competition problems in the European economic area.

In other markets, the Central Bank of China has reduced the five-year reference rate, used mainly in mortgages, by 25 points, taking it below 4%, which has motivated slight increases in the early morning on the part of the Hong Kong stock markets. Kong and Shanghai.

In this sense, Banca March experts have pointed out that this measure has failed to encourage financial markets and that investors "expect more from the Chinese authorities, who remain reluctant to take forceful measures regarding consumption."

In the raw materials market, a barrel of Brent fell 1.45%, to $82.35, while West Texas Intermediate (WTI) stood at $78.6, 0.76% less.

For its part, the yield on the Spanish bond maturing in 10 years closed at 3.277% after subtracting basis points, while the risk premium (the differential with the German bond) stood at 90 points.

In the foreign exchange market, the euro appreciated 0.35% against the dollar, until trading at an exchange rate of 1.0816 'greenbacks' for each unit of the community currency.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Marc Márquez returns to pole in Jerez

Marc Márquez returns to pole in Jerez The CIS carries out a quick survey on Sánchez's letter to measure the reaction of citizens

The CIS carries out a quick survey on Sánchez's letter to measure the reaction of citizens 12M.- Puigdemont to Sánchez and Illa: "This is not about the future of the PSOE! What have you believed?"

12M.- Puigdemont to Sánchez and Illa: "This is not about the future of the PSOE! What have you believed?" Díaz proclaims that "the Government is not going to bow down" and asks not to be "on the defensive and locked in" against the right

Díaz proclaims that "the Government is not going to bow down" and asks not to be "on the defensive and locked in" against the right How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on UPV students build a prototype of a wooden house to move to Equatorial Guinea

UPV students build a prototype of a wooden house to move to Equatorial Guinea The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives

The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives ALI, virtual assistant from Alicante, internationally recognized by the OECD

ALI, virtual assistant from Alicante, internationally recognized by the OECD Retrópolis brings the golden age of video games and computing to the UPV

Retrópolis brings the golden age of video games and computing to the UPV A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness