MADRID, 5 Mar. (EUROPA PRESS) -

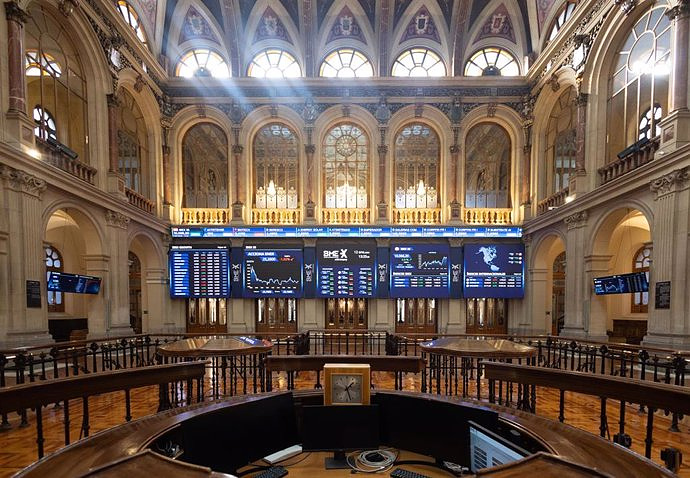

The Ibex 35 closed this Tuesday with a rise of 0.47%, which took it to 10,117.7 points - a level it lost a week ago, in a day in which investors continued to pay attention to Grifols, that it has not yet submitted its accounts audited by KPMG; of Cellnex's new strategic plan, which will pay at least 3,000 million in dividends between 2026 and 2030; and Ercros, which has received a takeover bid from Bondalti.

The Spanish team started the session with doubts and in the morning decided on relegations; However, at midday a consistent upward trend began that was only interrupted by the end of the negotiation.

In the Spanish macroeconomic field, the Public Treasury has placed 5,117.73 million euros in short-term debt this Tuesday, in the expected medium range, and has done so by offering higher returns for 6-month bills and for 12 months.

Within the macroeconomic agenda, at the international level, the publication of the PMI indices stands out, which show that the deterioration in the activity of companies in the eurozone showed signs of stabilization in the month of February, although the indicator remains on the ground. recessive -below 50 points-.

For its part, the activity of Spain's private sector accelerated in February to its highest levels since May 2023, thanks to the boost in the services sector, as well as the recovery in manufacturing, as reflected by the PMI index, whose composite data rose to 53. .9 points from 51.5 the previous month.

In the United States, the same reference has shown that activity improved more than expected in February - reaching 52.5 points - thanks to the performance of both the services and manufacturing sectors, as both have exceeded expectations.

On the other hand, the National People's Congress is being held in China, where the Government has announced a forecast increase in GDP for 2024 of 5%, which implies that Beijing maintains a growth objective similar to that set for last year, when Finally, the Chinese economy registered an expansion of 5.2%, accelerating compared to the 3% growth in 2022.

In this context, the biggest increases within the Ibex 35 have been recorded by Acciona Energía (3.54%), Solaria (3.17%), Cellnex (2.97%), Mapfre (2.63%), Redeia ( 2.06%) and Naturgy (2.05%). On the other hand, Grifols has been - once again - the 'red lantern' with a fall of 3.81%, followed by IAG (-1.92%), ArcelorMittal (-1.79%), Indra (-1 .51%), Sacyr (-1.2%) and Inditex (-1.09%).

Within this compendium of values, it is worth noting that Cellnex has announced that it expects to pay at least 3,000 million euros in dividends between 2026 and 2030, as reported within the framework of its Capital Markets Day, where it has highlighted that it expects Shareholders can receive a minimum dividend of 500 million euros per year from 2026.

Grifols is strongly maintaining its bearish streak - so far this year it has lost half of its market capitalization - while awaiting the accounts audited by KPMG and with the transfer of bearish funds taking short positions in its capital.

On the other hand, the Portuguese group Bondalti, owned by the José de Mello group, has launched a voluntary takeover bid for Ercros at 3.6 euros per share, which means valuing Ercros at 329.2 million euros.

The price offered by Bondalti implies a premium of 40.6% over the price at which Ercros shares closed yesterday (2.56 euros) and 51.3% over the weighted average trading price of the last month, as explained the Portuguese group in the request that it has sent to the National Securities Market Commission (CNMV) for the takeover bid to be authorized.

In this way, Ecros, which is listed on the continuous market, concluded trading this Tuesday with a revaluation of 33.59%, at 3.42 euros per share, which placed it close to the price offered by Bondalti in its takeover bid. .

The main stock markets concluded trading with mixed results: London added 0.08% and Milan 0.71%, while Frankfurt lost 0.1% and Paris 0.3%.

In the raw materials market, the price of a barrel of Brent quality oil, a reference for the Old Continent, fell 0.37% at closing time in Europe, to $82.5, while that of Texas It stood at $78.5, 0.3% less.

In the foreign exchange market, the price of the euro against the dollar remained unchanged at 1.086 'greenbacks', while in the debt market the interest required on the ten-year Spanish bond closed at 3.176% after subtracting eight basis points, with the risk premium (the differential with the German bond) at 85.5 punots.

The price of bitcoin continues its climb, which has helped it establish a new intraday historical high by exceeding the threshold of $69,000 for the first time, thus shattering its previous record from November 2021.

According to data from Coin Desk consulted by Europa Press, the reference cryptocurrency was exchanged during the session for up to $69,208.79, although it subsequently relaxed its momentum to just over $66,000.

For its part, the troy ounce of gold has reached an all-time high of $2,141 at the opening of Wall Street in a context marked by doubts about when the first interest rate cuts will arrive, geopolitical risks and massive purchases of this metal by central banks.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets The Prado will exhibit Caravaggio's 'Ecce Homo' from May 28 after a temporary loan agreement with Conalghi

The Prado will exhibit Caravaggio's 'Ecce Homo' from May 28 after a temporary loan agreement with Conalghi The judge officiates the UCO of the Civil Guard in the case against Begoña Gómez for alleged influence peddling

The judge officiates the UCO of the Civil Guard in the case against Begoña Gómez for alleged influence peddling Brussels sees no more risk for the rule of law in Poland and is preparing to close the sanctioning file

Brussels sees no more risk for the rule of law in Poland and is preparing to close the sanctioning file The PP calls to mobilize on May 26 against the amnesty, the "hoaxes" and the "suspicion of corruption" of the Government

The PP calls to mobilize on May 26 against the amnesty, the "hoaxes" and the "suspicion of corruption" of the Government How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on UMH researchers are working on a high-quality apricot crop that requires less irrigation water

UMH researchers are working on a high-quality apricot crop that requires less irrigation water The UPV develops an application to improve the quality of life of patients with glioblastoma

The UPV develops an application to improve the quality of life of patients with glioblastoma A sensor system obtains the fingerprint of essential oils and detects if they have been adulterated

A sensor system obtains the fingerprint of essential oils and detects if they have been adulterated Faraday UPV presents the 'Origin' rocket to exceed 10 km of flight: "It is the beginning of the journey to space"

Faraday UPV presents the 'Origin' rocket to exceed 10 km of flight: "It is the beginning of the journey to space" A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness