MADRID, 9 Feb. (EUROPA PRESS) -

The Ibex 35 closed this week with a fall of 1.64%, after ending Friday's session with a slight decrease of 0.09% and standing at 9,896.6 points, after investors have digested an important battery of business results and a short list of macroeconomic references while discussions continue, with somewhat less optimism, about the first interest rate cuts by central banks.

On the other hand, in the global scope of stock markets, the performance of the US S index stood out this day.

Back to the Spanish stock market and its weekly performance, XTB executive, Joaquín Robles, explained to Europa Press that its negative behavior is explained by the evolution of the companies most vulnerable to high interest rates.

Investors are beginning to consider that the rate cuts will begin later than expected, according to Robles, which is causing an adjustment in valuations and bringing the Ibex 35 close to annual lows and erasing the increases achieved during the month of December.

Thus, on a business level, companies such as Grifols, Solaria, Acciona Renovables and Colonial have been aggravated by high interest rates, which have already lost more than 20% this year, while the rest of the energy companies are also acting as a brake. on the indicator.

Robles himself has recalled that this situation cannot be extrapolated in view of what is happening on Wall Street, which continues to achieve new historical highs despite the fact that economic strength may delay rate cuts: "now we see [that economic strength] as a positive factor that will help companies improve their results," he argued.

In other geographies, Robles has put the emphasis on China, whose stock markets also initially rebounded strongly due to rumors of new stimuli aimed at stabilizing the markets, but they evaporated in subsequent sessions due to the lack of transparency.

At the 'macro' level, the composite Purchasing Managers' Index (PMI) showed that the deterioration in eurozone private sector activity extended to the beginning of 2024, although the pace of decline in January was the lowest in recent years. six months.

On the other hand, retail sales in the eurozone in December fell 0.8% year-on-year and 1.1% monthly, while factory orders in Germany for the same month surprised by rising by 8.9% when a decrease of 0.1% was expected; Likewise, in the German country it was known this day that the CPI stood at 2.9% year-on-year in January, which represents eight tenths less than the figure of 3.7% registered in December 2023 and the lowest year-on-year increase. of prices since June 2021,

For its part, the PMI indicator for the United States in January has reflected that it continued to advance in the expansion zone, although less than expected since the improvement in the manufacturing sector was lackluster by a services sector that fell below forecasts - although Also, in both cases, they remain on expansive ground.

At the national level, it has been known that Spain's General Industrial Production Index (IPI) fell an average of 0.8% in 2023, thus breaking the streak of positive rates of the last two years, while the number of new Commercial companies increased by 9.1% in 2023 compared to the previous year, reaching a total of 108,091 companies, the highest number since 2007, when more than 142,000 companies were formed.

Given this situation, the Ibex 35 values with the best weekly performance have been Acerinox (8.56%), Rovi (7.55%), Unicaja (4.46%), Ferrovial (3.73%), Fluidra (3 .66%) and ArcelorMittal (3.07%).

On the other hand, the worst weekly evolution has been led by Acciona Energía (-8.87%), Acciona (-6.47%), Colonial (-5.36%), Banco Santander (-5.25%) and Banco Sabadell (-5.04%), while stocks such as Endesa, Solario, Cellnex, Redeia and Naturgy have recorded losses of more than 4%.

Robles has framed the fall of Banco Santander after the 'Financial Times' published that Iran was able to avoid sanctions using accounts from the Cantabrian entity, while Acerinox led the increases in the Spanish selective after announcing the purchase of the North American manufacturer Haynes International for nearly 800 million dollars.

Likewise, in the business field, the CNMV maintains Talgo's listing suspended pending the company providing more information about the possible takeover bid (OPA) by a Hungarian group for 100% of the company.

In the rest of the reference European stock markets, only London, with a decrease of 0.52%, has joined Madrid in the falls, while Frankfurt has signed a draw (0.05%) and Paris and Milan have managed to advance with increases, respectively, of 0.73% and 1.43%.

The barrel of Brent was around 82 dollars, 6% more than a week ago, while the West Texas Intermediate was at 76.7 dollars, 6.2% more than at the close of last week. week.

In the debt market, the yield on the Spanish bond with a 10-year maturity has closed at 3.363% after adding two tenths in the week. In this way, the risk premium against German debt was 98.5 points.

In the currency market, the euro remained practically stable during the week against the dollar, trading at an exchange rate of 1.078 'greenbacks' for each unit of the community currency.

On the other hand, bitcoin exceeded $47,000 this afternoon, 10.6% more in the week, driven by inflows of money into exchange-traded funds (ETFs), which already exceed $8,000 million, according to Robles.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Real Madrid saves a draw in Munich and will appeal again to the Bernabéu

Real Madrid saves a draw in Munich and will appeal again to the Bernabéu The Congress of Argentina approves the omnibus law that allows the privatization of some public companies

The Congress of Argentina approves the omnibus law that allows the privatization of some public companies Marjane Satrapi, Princess of Asturias Award: "I am angry with Borrell, if I had him in front of me I would slap him"

Marjane Satrapi, Princess of Asturias Award: "I am angry with Borrell, if I had him in front of me I would slap him" Judge fines Trump $9,000 for contempt of court and considers sending him to prison during trial

Judge fines Trump $9,000 for contempt of court and considers sending him to prison during trial How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives

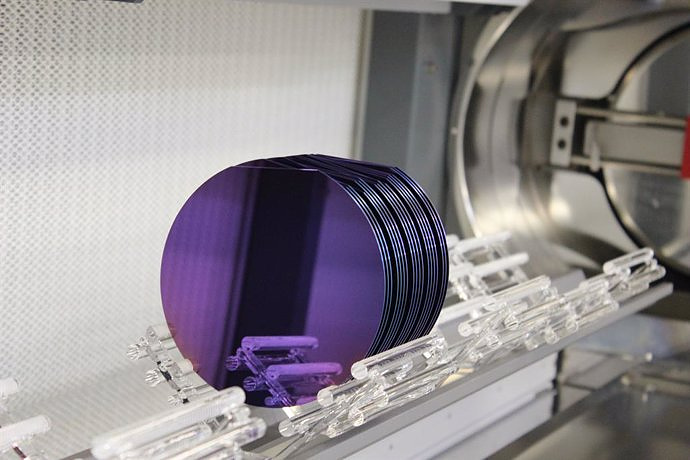

Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics

UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time

A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time They create a bank of machinery sounds to prevent breakdowns through artificial intelligence

They create a bank of machinery sounds to prevent breakdowns through artificial intelligence A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness