MADRID, 1 Feb. (EUROPA PRESS) -

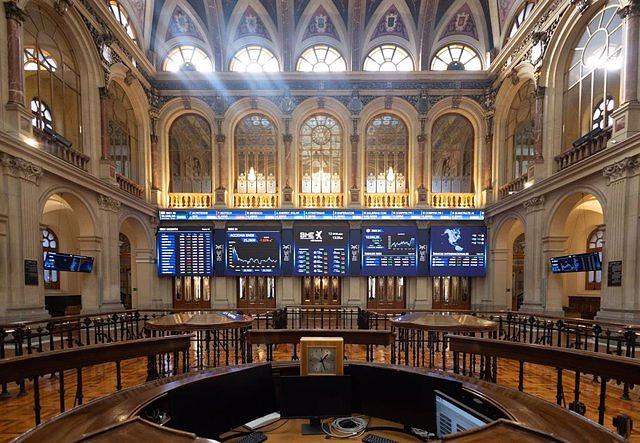

The Ibex 35 closed this Thursday with a decrease of 0.63%, which brought it to 10,014.0 points, in a day marked by the Fed's monetary policy decision on Wednesday and the publication of results. from Banco Sabadell.

Yesterday, after the European markets closed, the United States Federal Reserve decided to maintain interest rates in a target range of between 5.25% and 5.50% for the fourth consecutive meeting. The president of the central bank, Jerome Powell, announced that the price of money is already at its peak in this monetary cycle, so in 2024 rates will end up lowering.

Today, the Bank of England's Monetary Policy Committee has decided to maintain the reference interest rate for its operations at 5.25%, the highest level since 2008 and unchanged for the fourth consecutive meeting, as announced by the institution.

In the business field, Sabadell reported this Thursday that it obtained a record net profit of 1,332 million euros in 2023, which is equivalent to an increase of 55% compared to the previous year. The entity has also announced a share repurchase plan of 340 million euros and the payment of a complementary dividend of 0.03 euros per share.

The resignation of Indra's financial director and the entry into the capital of Opdenergy by GCE BidCo have also been announced.

In the macroeconomic field, Eurostat reported this Thursday that the inflation rate in the euro zone stood at 2.8% year-on-year in January, one tenth below the 2.9% rise in prices at the close of 2023.

Likewise, this Thursday the Public Treasury has placed 6,569.6 million euros, in the middle band of its objectives, in a bond issue with which it has begun the auctions for the month of February, lowering the interest offered to investors in the reference to 10 years and raising that of obligations linked to inflation.

In this context, only four stocks have ended positively: Repsol (0.91%), Sacyr (0.46%), Santander (0.12%) and ACS (0.05%). On the opposite side, the biggest falls have been those of Colonial (-4.74%), Ferrovial (-3.16%), Sabadell (-2.86%), Bankinter (-2.03%), Merlin (- 1.84%) and Acciona Energía (-1.58%).

The rest of the European indices have also closed lower, highlighting the 0.89% decrease in Paris. Behind, Frankfurt ended the session with losses of 0.26%; Milan, 0.18%; and London, 0.11%.

In the raw materials market, a barrel of Brent registered a rise of 1.06%, up to $81.40, while West Texas Intermediate (WTI) reached $76.70, up 1.12%.

In the debt market, the yield on the Spanish bond with a 10-year maturity fell to 3.072%, while the risk premium against German debt stood at 92.7 basis points.

In the foreign exchange market, the euro appreciated 0.42% against the dollar, until trading at an exchange rate of 1.0863 'greenbacks' for each unit of the community currency.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets COMUNICADO: Energy Transitions Commission (ETC) Urges Government and Industry Collaboration to Overcome Perceptions of Offshore Wind

COMUNICADO: Energy Transitions Commission (ETC) Urges Government and Industry Collaboration to Overcome Perceptions of Offshore Wind UGT and CCOO demand the regeneration of democracy, better salaries and a reduction in working hours

UGT and CCOO demand the regeneration of democracy, better salaries and a reduction in working hours Alcaraz gives up his reign in Madrid against Rublev

Alcaraz gives up his reign in Madrid against Rublev Petro announces that Colombia will break diplomatic relations with Israel

Petro announces that Colombia will break diplomatic relations with Israel How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Ivace and promotes a less invasive device for the early detection of prostate cancer

Ivace and promotes a less invasive device for the early detection of prostate cancer Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives

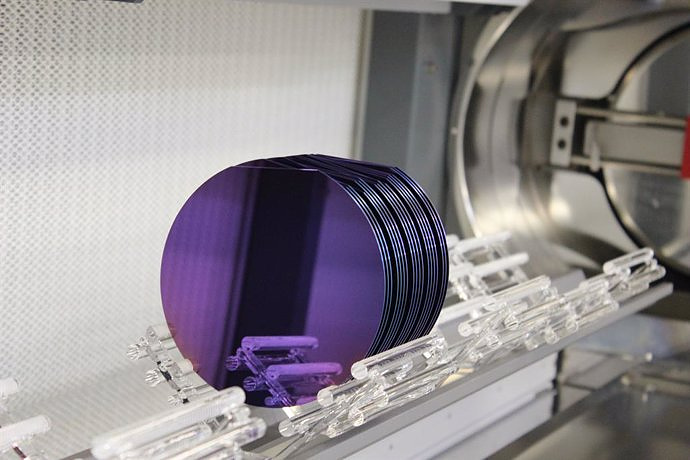

Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics

UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time

A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness