MADRID, 31 Ene. (EUROPA PRESS) -

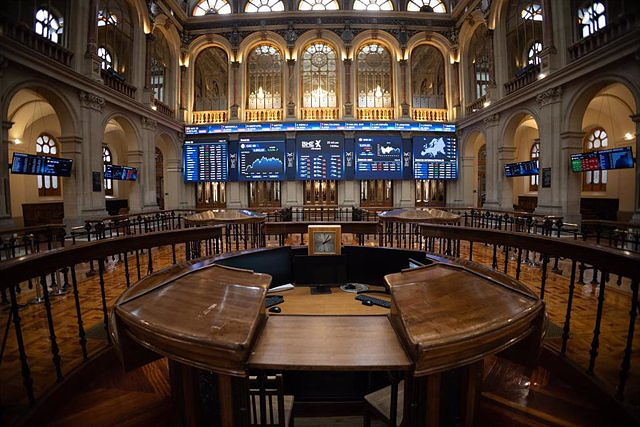

The Ibex 35 has closed the first month of 2024 with a fall of 0.24% but has managed to maintain the symbolic level of 10,000 points, a level that it lost in mid-January and that it has managed to recover in the last two sessions of the month.

The index remains attentive to the business results season - the market has already received important accounts from entities such as BBVA and Santander - and to the monetary policy decision of the United States Federal Reserve (Fed), which will be announced this afternoon with the European market already closed.

The main indicator of the Spanish market started 2024 maintaining the bullish tone of the end of 2023, a year in which the Ibex revalued by 22.76% (only half of those advances were achieved in November and December) due to the prospect of premature cuts and intense interest rates, however, in the middle of the month that prediction began to falter and on January 19 the Ibex signed its worst week (-2.3%) since August and lost 10,000 points for the first time since November .

Then it was the turn of the central banks, with the European Central Bank (ECB) at the helm, which kept interest rates at 4.5% for the third consecutive meeting, while its president, Christine Lagarde, tried to cool expectations about rate cuts and said that the decision will be conditioned by upcoming data, although he had previously indicated at the Davos forum that the path of cuts could begin in June.

On the Fed's side, Banca March experts have predicted that, as the market expects, interest rates will remain unchanged at 5.25-5.5%, although they have asked to focus "on the nuances of [President Jerome Powell's] speech and whether there are any language changes in the press release."

Linked to this, they have argued that the markets "remain optimistic" with the idea of rate cuts starting with the March or May meeting, something that seems "unlikely given the stabilization in the rate of reduction of inflation, a market labor market that remains very tight and an economy that does not lose steam.

All in all, the Spanish indicator has managed to undo the bearish tone of the second half of January thanks to the comeback of the last two sessions of the month and which has been carried out by BBVA and Banco Santander after both entities have signed record results.

Specifically, BBVA informed the market yesterday that it registered a record attributable net profit of 8,019 million euros between January and December 2023, 22% more in current euros compared to the previous year, while Banco Santander announced this Wednesday that it gained 11,076 million euros in 2023, which is equivalent to an increase of 15.3% compared to the previous year.

Likewise, the market has learned this month of an important battery of macroeconomic data: the eurozone avoided recession in the last quarter of 2023, but the weakness of activity in the region was confirmed due to the deterioration of activity in Germany, which contracted 0.3% -on the other hand, in that country today it was known that the CPI for January stopped at 2.9%, the best figure since June 2021-. In contrast, economic activity in France stagnated and Italy grew by 0.2% and Spain by 0.6% in that period.

Going into detail about Spain, this week the National Institute of Statistics (INE) has reported that the Gross Domestic Product (GDP) grew by 2.5% in 2023, one tenth more than expected. For its part, the Consumer Price Index (CPI) rose three tenths in interannual rate in January, up to 3.4%.

In the United States, the Fed's decision will pivot on the latest known data: US PCE inflation stood at 2.6% year-on-year in the month of December, identical to that of November, while the underlying index closed the last month of 2023 with an increase of 2.9%, three tenths less than the previous month.

Regarding the US labor market, this week the JOLTS job vacancy report for the month of December was released, which has risen when a decline was expected, reflecting a labor market that is still accelerated, although today it was heading in the right direction. contrary to the ADP private employment report in January by registering 107,000 jobs, which represents a slowdown compared to the 158,000 new jobs registered in the month of December and a significant decrease compared to what the market expected.

In this situation, the most notable advances of the Ibex 35 in January have been led by Indra (17.64%), Banco Sabadell (8.36%), Ferrovial (7.24%), Logista (7.19%), Fluidra (6.74%), Telefónica (6.68%), Rovi (6.4%), Caixabank (6.12%) and BBVA (5.47%).

On the other hand, the worst evolution in the month was led by Grifols (-34.36%), followed by Solaria (-26.41%), Colonial (-14.58%), Acciona Energía (-14.17% ), Acciona (-9.79%) and ACS (-8.89%).

Grifols has seen its stock greatly affected by the report by the analysis firm Gotham City Research in which the Catalan company was accused of concealing its accounts. Despite this, at the end of January, after the pharmaceutical company announced that it would take legal measures against Gotham, its stock has managed to recover and move away from the most pronounced minimum, for which it gave up more than 40% of its capitalization.

The other European benchmark cities, unlike Madrid, have managed to end January with progress: London has added 0.34%; Frankfurt 0.91%; Milan 1.29% and Paris 1.51%.

In the raw materials markets, which are still pending the geopolitical conflicts in the Middle East and the Red Sea, Brent crude oil, the benchmark in Europe, recorded a monthly advance of more than 6% this afternoon, to $81.8 a barrel. , while Texas WTI rose another 6%, to $76.2 per barrel.

Regarding currencies, this January the euro registered a depreciation of 1.7% compared to the 'greenback', to 1.0852 dollars, while the Spanish long-term bond closed at 3.082% after adding one tenth in January, with the risk premium (the spread with the German bond) at 92 points.

The troy ounce of gold, despite falling half a point in January, comfortably maintains the level of $2,000, while bitcoin added 2.25% monthly, to $43,300, after the US stock market regulator [SEC] approve this month exchange-traded funds (ETFs) backed by this cryptocurrency.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets COMUNICADO: Energy Transitions Commission (ETC) Urges Government and Industry Collaboration to Overcome Perceptions of Offshore Wind

COMUNICADO: Energy Transitions Commission (ETC) Urges Government and Industry Collaboration to Overcome Perceptions of Offshore Wind UGT and CCOO demand the regeneration of democracy, better salaries and a reduction in working hours

UGT and CCOO demand the regeneration of democracy, better salaries and a reduction in working hours Alcaraz gives up his reign in Madrid against Rublev

Alcaraz gives up his reign in Madrid against Rublev Petro announces that Colombia will break diplomatic relations with Israel

Petro announces that Colombia will break diplomatic relations with Israel How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Ivace and promotes a less invasive device for the early detection of prostate cancer

Ivace and promotes a less invasive device for the early detection of prostate cancer Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives

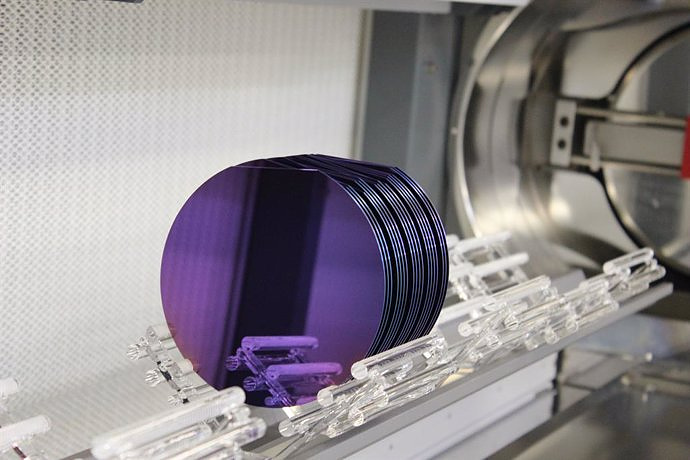

Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics

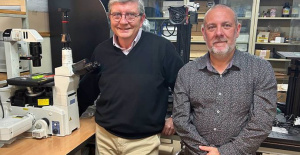

UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time

A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness