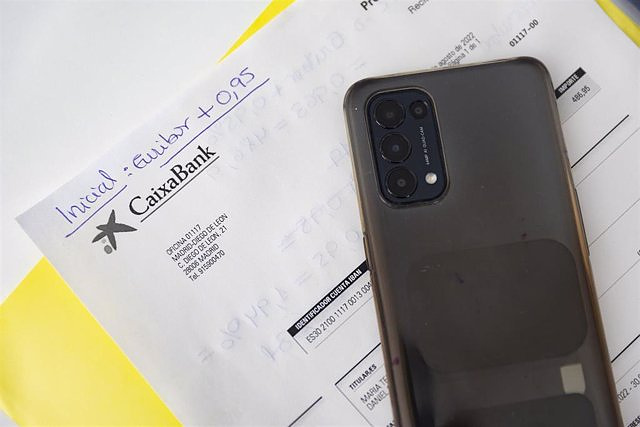

The rise in rates and the rise in the Euribor bring the average interest on loans to its highest level in seven years

MADRID, 27 Sep. (EUROPA PRESS) -

The number of mortgages established on homes fell by 18.8% last July compared to the same month in 2022, totaling 29,223 loans, with an average interest rate that continued to rise, reaching 3.24%, its figure highest since August 2016, according to data released this Wednesday by the National Institute of Statistics (INE).

With the year-on-year decrease in July, the home mortgage firm has had six months of negative rates, although the rate in July has moderated by three points compared to that registered in June (-21.9%).

The total number of home loans recorded in July (29,223) is the second lowest figure since January 2021, only surpassed by April of this year, when just over 27,000 mortgages were established.

The average amount of mortgages constituted on homes fell by 2.6% year-on-year in the seventh month of the year, to 143,412 euros, while the capital lent decreased by 20.9%, reaching almost 4,191 million euros.

Following the policy of raising interest rates carried out by the European Central Bank (ECB) to try to contain inflation and the evolution of the Euribor, the average interest rate for all mortgage loans stood at 3.52%. in July, its highest figure since November 2014, with an average term of 24 years.

In the case of homes, the average interest was 3.24%, its highest value since August 2016, with an average term of 25 years. Compared to a year earlier, the average interest rate for home loans has increased by 1.32 points. It is the fourth consecutive month in which the interest rate exceeds 3%.

42.2% of home mortgages were signed last July at a variable rate, while 57.8% were signed at a fixed rate. The average interest rate at the beginning was 2.95% for variable rate home mortgages and 3.49% for fixed rate mortgages.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Hamas views Israel's latest deal proposal in "positive spirit"

Hamas views Israel's latest deal proposal in "positive spirit" The Ibex 35 rises 0.22% mid-session driven by Aena (4.66) and Sabadell (4.57%)

The Ibex 35 rises 0.22% mid-session driven by Aena (4.66) and Sabadell (4.57%) STATEMENT: Selena Romero and Roberto Pérez winners of the 22nd Nacho Juncosa Memorial - International under-16 tennis tournament

STATEMENT: Selena Romero and Roberto Pérez winners of the 22nd Nacho Juncosa Memorial - International under-16 tennis tournament STATEMENT: DH2 Energy is the winner in the first European renewable hydrogen auction

STATEMENT: DH2 Energy is the winner in the first European renewable hydrogen auction How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on UPV students design an app that helps improve the ventilation of homes in the face of high temperatures

UPV students design an app that helps improve the ventilation of homes in the face of high temperatures Ivace and promotes a less invasive device for the early detection of prostate cancer

Ivace and promotes a less invasive device for the early detection of prostate cancer Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives

Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics

UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness