MADRID, 18 Abr. (EUROPA PRESS) -

Sumar's spokesperson in Congress, Íñigo Errejón, has demanded that the Government veto the possible Public Acquisition Offer (OPA) of the Emirati group Taqa in Naturgy and that there be an entry of public capital into the energy company in a similar way as with Telefónica.

The takeover bid has not yet materialized, and the Emirati group has currently indicated that it is holding talks with the shareholders of the energy company for its possible landing in its shareholding, in which Criteria Caixa, La Caixa's investment arm, stands out as the main shareholder with 26.7%.

These conversations have not pleased the minority partner of the Government, as he sees them as a "threat" to Spain's strategic interests.

"This represents a threat to the strategic interests of our country, to our sovereignty and to national security," Errejón stated in Congress this Thursday. For this reason, he has asked on behalf of his parliamentary group that the Executive "veto" and "not authorize" the operation and that, instead, there be an entry of public capital into Naturgy.

In the opinion of the leader of Más País, companies such as Naturgy or Telefónica are strategic for the interests of Spain in terms of communications, transport or energy, so they "cannot be sold to funds of dubious origin and cannot depend on the whims financial".

And not only that, but Errejón believes that "there must also be a presence of the State that guarantees national interest and security."

If Taqa finally launches an offer to take over the shares of the CVC and GIP funds in Naturgy, the Government will have to approve the operation, as happened with the emergence of the Saudi STC in the capital of Telefónica.

This is due to the well-known 'anti-takeover shield', which was introduced in the middle of the pandemic and which gives the Executive the power to authorize or reject foreign investments in strategic listed companies when the transaction involves more than 10% of the company's shares or , if they are not listed, when the investment is above 500 million euros.

The Minister of Economy, Commerce and Business, Carlos Body, has already said that the Government will analyze the operation on Naturgy when it materializes, as it has done in the case, for example, of Orange and MásMóvil or other operations.

Of course, he stressed that the Executive has a "very clear" vision regarding the need to protect the "strategic interests" of the country and, in reference to the anti-takeover shield, the Executive also has the necessary regulatory instruments.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Real Madrid saves a draw in Munich and will appeal again to the Bernabéu

Real Madrid saves a draw in Munich and will appeal again to the Bernabéu The Congress of Argentina approves the omnibus law that allows the privatization of some public companies

The Congress of Argentina approves the omnibus law that allows the privatization of some public companies Marjane Satrapi, Princess of Asturias Award: "I am angry with Borrell, if I had him in front of me I would slap him"

Marjane Satrapi, Princess of Asturias Award: "I am angry with Borrell, if I had him in front of me I would slap him" Judge fines Trump $9,000 for contempt of court and considers sending him to prison during trial

Judge fines Trump $9,000 for contempt of court and considers sending him to prison during trial How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives

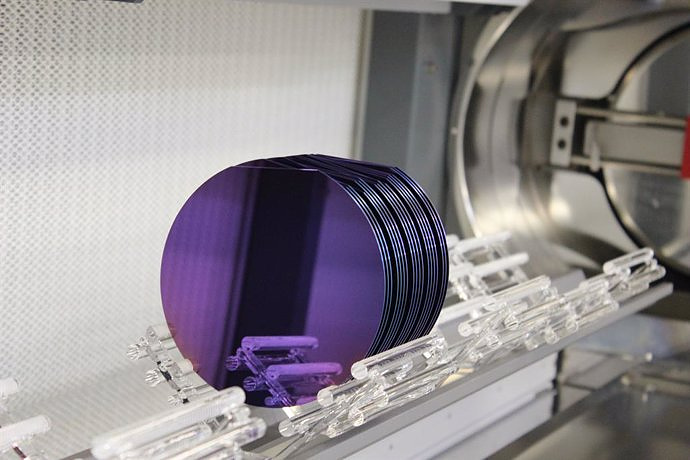

Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics

UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time

A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time They create a bank of machinery sounds to prevent breakdowns through artificial intelligence

They create a bank of machinery sounds to prevent breakdowns through artificial intelligence A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness