MADRID, 27 Feb. (EUROPA PRESS) -

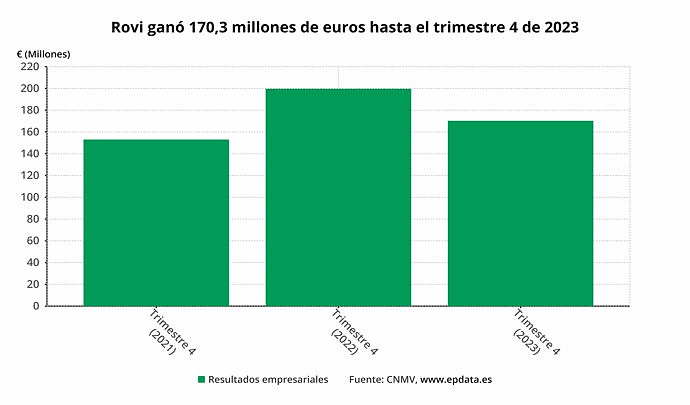

Rovi obtained a net profit of 170.3 million euros in 2023, a figure 15% lower than the profits that the company registered in 2022, which were close to 200 million euros, as reported by the pharmaceutical company to the National Commission on Tuesday. Stock Market (CNMV).

Rovi's operating income increased by 1%, to 829.5 million euros, thanks especially to the third-party manufacturing business, which grew by 1%, to 409.3 million euros, and the pharmaceutical specialties business, whose Sales also grew 1% compared to the previous year.

Sales of Rovi's heparin division decreased by 5% in 2023, to 250.6 million euros, due, according to the pharmaceutical company, to the difference between the increase in orders from partners linked to the treatment of Covid in 2022 and the lowest order volume in 2023.

The gross operating result (Ebitda) of the pharmaceutical company decreased by 12% in 2023, to 244.5 million euros, while the net operating result (Ebit) totaled 220.1 million euros, 14% less than in 2022.

"2023 is the first year of a new post-pandemic scenario, in which Covid-19 has become a seasonal disease and the vaccine is administered once a year. In this difficult context, we have been able to continue growing," he said. outstanding Juan López-Belmonte Encina, president and CEO of Rovi.

Rovi's gross margin decreased 4.5 points in 2023 due to the greater contribution to the third-party manufacturing business of income related to the activities developed to prepare the plant for the production of medicines under the agreement with Moderna, which contributes lower margins than the group's sales, and due to the lower margin from the manufacturing of the coronavirus vaccine compared to 2022.

The pharmaceutical company has also reported that it will propose to its general meeting of shareholders the payment of a dividend charged to the results of the 2023 financial year and to the results of previous years in the amount of 1.1037 euros per share.

This amount is approximately equivalent to 35% of the attributable profit for 2023, as highlighted by Rovi.

Looking ahead to 2024, Rovi expects its operating income to decrease "in the middle band of the first ten", that is, the ten between 0% and 10%, compared to those of 2023.

However, the company warns that there are certain factors that could affect these estimates "and whose realization, at this date, is difficult."

Among them, Rovi mentions the possibility of increasing vaccination rates in the Covid campaign; the incorporation of new clients due to the expansion of formulation, aseptic filling, inspection, labeling and packaging capabilities at the pharmaceutical company's facilities in Madrid; and the possible marketing authorization of Risvan by the US FDA in March 2024 to be able to market the product in the United States, "predictably with a partner."

"The potential sales to be achieved for this product in 2024 will depend on the terms of the agreement that Rovi establishes with said potential partner, which could also impact the estimates for 2024," the pharmaceutical company states.

Regarding the share buyback program launched by the company last July, Rovi has reported that, as of January 31, 2024, it had executed approximately 74.85% of the buyback program, having acquired a total of 1,808,392 own shares for a total amount of 97.3 million euros.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Prominent American writer Paul Auster dies at 77 from lung cancer

Prominent American writer Paul Auster dies at 77 from lung cancer RELEASE: Rendeavor Expands High-Speed Internet Access to Local Communities Around Tatu, Kenya

RELEASE: Rendeavor Expands High-Speed Internet Access to Local Communities Around Tatu, Kenya Real Madrid saves a draw in Munich and will appeal again to the Bernabéu

Real Madrid saves a draw in Munich and will appeal again to the Bernabéu The Congress of Argentina approves the omnibus law that allows the privatization of some public companies

The Congress of Argentina approves the omnibus law that allows the privatization of some public companies How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives

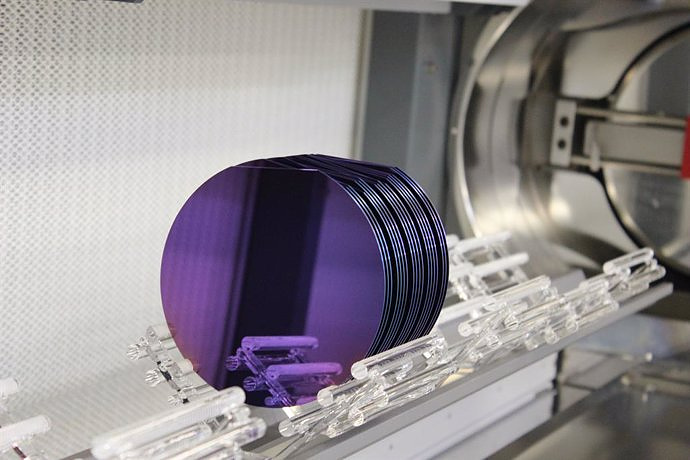

Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics

UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time

A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time They create a bank of machinery sounds to prevent breakdowns through artificial intelligence

They create a bank of machinery sounds to prevent breakdowns through artificial intelligence A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness