(Information sent by the signatory company)

- Fullerton Fund Management, in collaboration with UNDP, launches its Sustainability Management Framework for private equity climate investments

Guides private capital investors on how to align their strategy, management, transparency and governance practices to achieve their decarbonization objectives

SINGAPORE, April 17, 2024/PRNewswire/ -- Fullerton Fund Management (Fullerton) has partnered with the United Nations Development Program (UNDP) to develop a Sustainability Management Framework to guide investments private equity climate initiatives in Asia, using the UNDP SDG Impact Standards as a basis. The framework offers private equity firms a roadmap to adopt practices that can help accelerate their net-zero emissions goals.

In Asia, the environmental and business case for climate investments is compelling, with the potential market size for green businesses in Asia set to exceed $4 trillion by 2030[1]. Governments have firmly committed to decarbonizing their economies, and around $53.5 trillion in investments are needed between 2020 and 2060 to meet the already announced net zero targets[2]. There are huge investment opportunities ahead and venture capital can play a key role, alongside public spending, in filling the funding gap.

Venture capital investors are well positioned to exert greater influence on their portfolio companies on climate and sustainability issues. However, disclosure standards across the region are uneven and companies continue to fail to disclose information, particularly in emerging Asia. This presents a challenge for climate investors who want to evaluate the important environmental issues, and their implications, for their investments.

The Sustainability Management Framework guides private equity investors on how to integrate sustainability considerations and the Sustainable Development Goals (SDGs) into their strategy, management, transparency and governance practices, to achieve their decarbonization objectives. Through this framework, climate investors can conduct a critical evaluation of the various possible investment practices and decide which set of practices best fits their investment mandates and stakeholder requirements.

"As a private equity investor in Asia, we recognize that sustainability issues have considerable implications for the investment value of a company, especially for private equity, which has a long investment horizon. With the launch of this Investment Management Framework Sustainability with the support of UNDP, we are committed to integrating sustainability considerations into our private equity climate investments. And, more importantly, we look forward to sharing this framework and insights from real-world case studies with our counterparts. that can assess the relevant sustainability aspects needed to optimize decarbonization in the region," said Huck Khim Tan, Deputy Chief Investment Officer and Head of Alternatives at Fullerton Fund Management.

"The private sector has an important role to play in accelerating Asia's decarbonization, including in collaboration with and alongside the efforts of actors in the public and multilateral spheres. Recognizing this, we are delighted to collaborate with Fullerton Fund Management to develop this Sustainability Management Framework, leveraging the UNDP SDG Impact Standards for private equity funds. This framework is useful for climate investors seeking to align their internal practices and decision-making to achieve their sustainability objectives. decarbonization," explained Haoliang Xu, UN Under-Secretary-General and Associate Administrator of the United Nations Development Programme.

About Fullerton Fund Management

Fullerton Fund Management Company Ltd ("Fullerton") is an active investment company whose objective is to optimize investment results and improve the investor experience.

We help our clients, including government entities, sovereign wealth funds, pension plans, insurance companies, private wealth and retailers, in the region and beyond, achieve their investment objectives through our suite of solutions. Our experience covers equities, fixed income, multi-asset, alternatives and treasury management, in public and private markets.

As an active manager, we place special emphasis on profitability, risk management and investment knowledge. Incorporated in 2003, Fullerton is headquartered in Singapore with associated offices in Shanghai, Jakarta and Brunei. Fullerton is part of a multi-asset management group, Seviora, a holding company created by Temasek. Income Insurance, one of Singapore's leading insurers, is a minority shareholder in Fullerton.

For more information visit www.fullertonfund.com

About the United Nations Development Program ("UNDP"):

As the United Nations' lead agency for international development, UNDP works in 170 countries and territories to eradicate poverty and reduce inequality. UNDP helps countries develop policy, leadership skills, partnership and institutional capacities, as well as build resilience to achieve the Sustainable Development Goals. UNDP's work focuses on three priority areas: sustainable development, democratic governance and peacebuilding, and climate and disaster resilience. More information at undp.org or @UNDP

About the UNDP Sustainable Finance Center:

The UNDP Sustainable Finance Center (SFH) brings together UNDP financial expertise to leverage public and private capital for the Sustainable Development Goals (SDGs), supporting governments, investors and businesses in achieving climate goals. , social impact and sustainability. Their work drives systemic change toward a sustainable financial architecture that benefits people and the planet. SDG Impact is a global flagship initiative of SFH, created to accelerate private sector investment and activity for sustainability and achieving the SDGs, making it easier for companies and investors to integrate impact into their internal management practices. and decision-making, as well as directing capital towards the areas where it can make the biggest difference for people and the planet.

Learn more about its integrated services, which ensure all financing is sustainable, at sdgfinance.undp.org or follow us @UNDP_SDGFinance

Logo - https://mma.prnewswire.com/media/2388661/Fullerton_Fund_Management_Logo.jpgLogo - https://mma.prnewswire.com/media/2388643/UNDP_Logo.jpg

View original content: https://www.prnewswire.com/news-releases/fullerton-fund-management-lanza-su-marco-de-gestion-de-la-sostenibilidad-302119781.html

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Real Madrid saves a draw in Munich and will appeal again to the Bernabéu

Real Madrid saves a draw in Munich and will appeal again to the Bernabéu The Congress of Argentina approves the omnibus law that allows the privatization of some public companies

The Congress of Argentina approves the omnibus law that allows the privatization of some public companies Marjane Satrapi, Princess of Asturias Award: "I am angry with Borrell, if I had him in front of me I would slap him"

Marjane Satrapi, Princess of Asturias Award: "I am angry with Borrell, if I had him in front of me I would slap him" Judge fines Trump $9,000 for contempt of court and considers sending him to prison during trial

Judge fines Trump $9,000 for contempt of court and considers sending him to prison during trial How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives

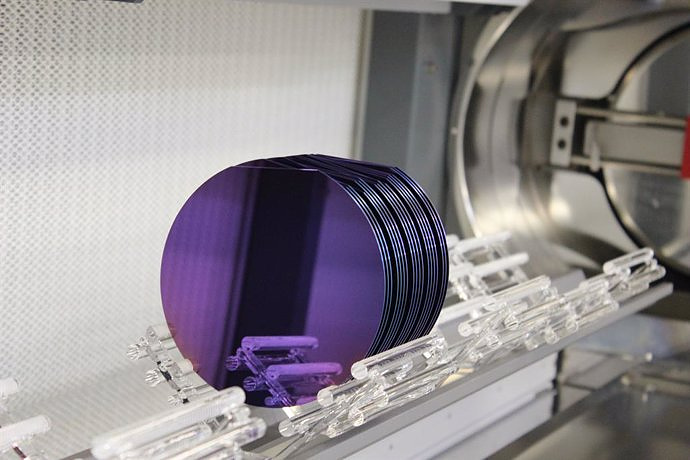

Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics

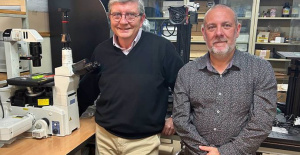

UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time

A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time They create a bank of machinery sounds to prevent breakdowns through artificial intelligence

They create a bank of machinery sounds to prevent breakdowns through artificial intelligence A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness