(Information sent by the signatory company)

The fund offers an estimated APR return of 3% for the period of 15 months. With this new launch, the company continues to adapt to the new market context

Madrid, April 18, 2024.- Allianz launches the Allianz Target 3% 2025 EUR CLASS fund on the market and continues to expand its savings and investment offer. This diversified fixed income fund, with a preset profitability objective, is another example of the company's constant adaptation to market conditions and customer needs. The new fund, accessible from a minimum investment of €1,000, It offers an estimated APR return of 3%, for a period of 15 months. Allianz Target 3% 2025 EUR CLASS can be contracted through the unit linked Allianz FondoVida product of Allianz Seguros or through the securities agency Allianz Soluciones de Inversión, until the end of June. A complete savings and investment offer With this launch, the company continues to complete its offering of savings and investment products and expands its range of Wealth Management products. The company makes available to its clients various financial products capable of responding to diverse needs of savers: Allianz Capital, Unit Linked, insurance plans pensions, investment funds or Allianz Perspektive (guaranteed long-term savings product with the guarantee of Allianz Leben, the largest Life company in Germany). Allianz has the securities agency Allianz Investment Solutions, focused on financial advice, estate planning and other financial services, since 2020 it has managed six investment funds (Allianz Cartera Dinámica, Allianz Bolsa Española, Allianz Cartera Moderada, Allianz Cartera Decidida, Allianz Conservador Dinático and Cartera Bonos 2026), four of which were rated 5 stars in the Morningstar Rating in its first three years of activity (March 2023). At the beginning of April, Allianz Investment Solutions put six new investment funds on the market, which add to its portfolio to complete its offer. On the other hand, Allianz launched, in February of this year, the Allianz Target Maturity Euro Bond fund III, a fixed income fund with attractive returns accessible from an investment of €1,000.About Allianz SegurosAllianz Seguros is the main subsidiary of the Allianz Group in Spain and one of the leading companies in the Spanish insurance sector. To offer the best results for its more than 3 million customers, the company is committed to physical proximity (through its Branches and Delegations with nearly 2,000 employees and its network of more than 10,000 mediators), and technological proximity (through tools such as its application for smartphones and tablets, its eClient area of the corporate website, and its more than 500,000 SMS sent annually to its clients). It has one of the most complete and innovative ranges of products on the market and is based on the comprehensive security concept. For this reason, the products and services offered by the company range from the personal and family to the business sphere, offering everything from Life, Car, Home, Accident, or Health insurance, through Multi-risk for companies and businesses, to the most personalized insurance solutions. complex.

Contact Contact name: Sonia Rodríguez Contact description: Allianz Contact phone: 638 93 00 08

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Prominent American writer Paul Auster dies at 77 from lung cancer

Prominent American writer Paul Auster dies at 77 from lung cancer RELEASE: Rendeavor Expands High-Speed Internet Access to Local Communities Around Tatu, Kenya

RELEASE: Rendeavor Expands High-Speed Internet Access to Local Communities Around Tatu, Kenya Real Madrid saves a draw in Munich and will appeal again to the Bernabéu

Real Madrid saves a draw in Munich and will appeal again to the Bernabéu The Congress of Argentina approves the omnibus law that allows the privatization of some public companies

The Congress of Argentina approves the omnibus law that allows the privatization of some public companies How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives

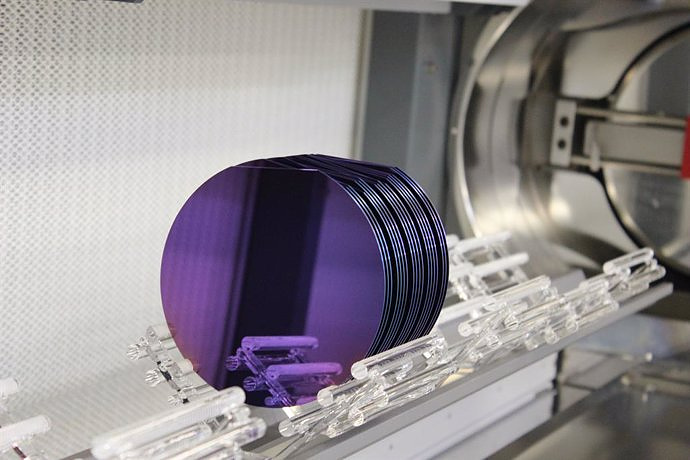

Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics

UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time

A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time They create a bank of machinery sounds to prevent breakdowns through artificial intelligence

They create a bank of machinery sounds to prevent breakdowns through artificial intelligence A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness