MADRID, 28 Ene. (EUROPA PRESS) -

Mortgage renegotiations increased by 166% between January and November 2023, compared to the same period in 2022, adding 4,327 million euros in the volume of new mortgage operations, according to data published by the Bank of Spain and collected by the Spanish Mortgage Association in its newsletter corresponding to the third quarter.

The association points out that within the sluggishness that the mortgage market is experiencing, the "growing increase" in loan renegotiations stands out. Thus, on the one hand, the activity of new loans constituted on homes has experienced a drop of 20%, while renegotiations have "almost tripled."

In this way, in the first eleven months of 2023, renegotiations represent 8.5% of new operations, compared to the 3% they represented in the previous two years. This proportion has risen in November, when renegotiations were 11%.

In fact, in the eleventh month alone, 558 million euros were recorded in renegotiations, 34.7% more than in October and 52.0% more than in the same month of 2022.

"This phenomenon would be supported by the general rise in interest rates, which has favored the conversion of the mortgage modality, from variable to fixed, supported in turn by the measures established in Royal Decree-Law 19/2022 , which reduce or even cancel the compensation costs associated with this type of modification of the contractual conditions," explains the AHE.

Among other data, the bulletin highlights the evolution of mortgages by interest rate, whether fixed, variable or mixed. In this sense, the AHE highlights the growing trend that has been maintained, since mid-2022, in the contracting of mixed mortgages, those where a fixed rate is offered for a period of more than one year and less than ten years, and subsequently a rate variable.

In particular, the AHE highlights the increase registered in originations that establish an initial fixed rate between five and ten years, which have gone in just a year and a half from representing 4% of operations to recording a share of 17%.

Thus, this category, together with the one that includes an initial fixed rate for up to five years, concentrated more than 40% of new hires until November 2023.

For its part, the other modality that brings together a "substantive" volume of operations are fixed mortgages, which account for 43% of new loans for home acquisition. However, the AHE indicates that this modality has reduced its share "considerably" since June 2022, when the official interest rates of the European Central Bank (ECB) were still at reduced levels, since this modality accounted for 67%. of new originations.

Finally, the association explains that the monetary normalization process has given continuity to the dynamics that were already occurring in variable loans, that is, "those in which the rate remains fixed for a maximum of one year, with only 16 % subscribed under this modality" in November 2023.

However, he highlights that this category, very popular in the Spanish mortgage market before the real estate crisis, "continues to have a relevant weight in the portfolio of around 55% of the outstanding balance."

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets US Police storm Columbia University and arrest more than a hundred pro-Palestinian protesters

US Police storm Columbia University and arrest more than a hundred pro-Palestinian protesters The PP incorporates the former general secretary of Ciudadanos Adrián Vázquez in its list for the European elections

The PP incorporates the former general secretary of Ciudadanos Adrián Vázquez in its list for the European elections Gamarra (PP) accuses Sánchez of "an exercise in democratic degeneration" to "avoid being controlled by counterpowers"

Gamarra (PP) accuses Sánchez of "an exercise in democratic degeneration" to "avoid being controlled by counterpowers" The May 1 demonstration for full employment begins in Madrid

The May 1 demonstration for full employment begins in Madrid How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Ivace and promotes a less invasive device for the early detection of prostate cancer

Ivace and promotes a less invasive device for the early detection of prostate cancer Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives

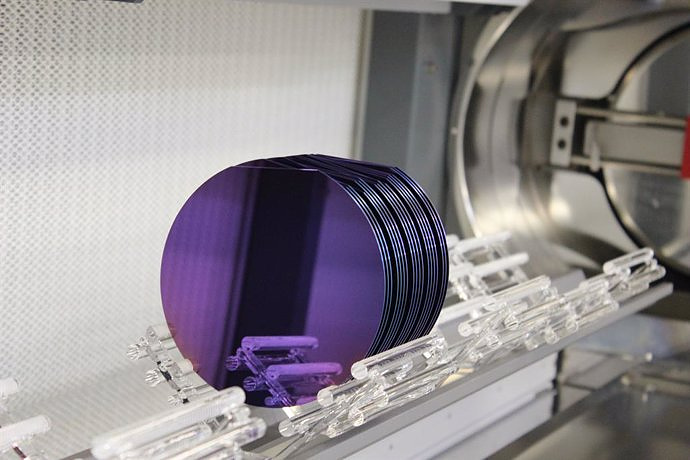

Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics

UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time

A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness