Calls for structural reforms and promoting market integration to raise the potential growth of the euro zone

MADRID, 29 Ene. (EUROPA PRESS) -

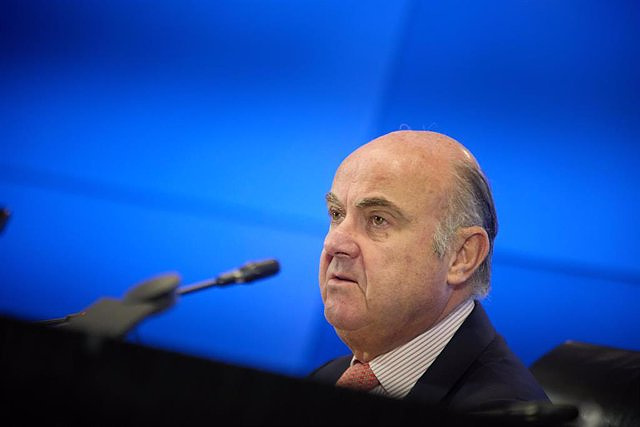

The vice president of the European Central Bank (ECB), Luis de Guindos, assumes the possibility that the euro zone economy has entered a technical recession in the fourth quarter of 2023, by chaining two consecutive quarters of decline, although he has stressed that, In any case, it will not be a deep recession, pending the preliminary data that Eurostat will publish this Tuesday.

"There may be a technical recession," acknowledged the former Spanish Minister of Economy in an interview on RNE, where he downplayed the difference between a tenth of a fall or stagnation, stressing that "we have not entered a deep recession."

"What I would tell you is that the recession is not going to be deep and that the labor market is holding up," added Guindos, recalling the ongoing disinflation process, which has slowed the rise in prices to less than 3%, while The labor market continues to perform well.

"According to our projections, the slowdown in inflation and the disinflationary process will continue without having generated a deep recession, because that can be ruled out, and with a good performance of the labor market," summarized Guindos, for whom, with all its shadows, "there are also lights in the evolution of the European economy".

The community statistics office, Eurostat, plans to publish this Tuesday its first estimate of the GDP growth data of the euro zone in the fourth quarter of 2023, after between July and September the region registered a year-on-year drop of 0.1% , leaving the door open to a technical recession.

On the other hand, the vice president of the ECB has shown his concern about the risk that the weak growth of the euro zone will drag on over time, since the loss of potential growth would end up translating into a loss of influence and international weight of the eurozone.

However, for Guindos this "fundamental" problem does not depend on monetary policy, since this medium-term growth depends on economic reforms and how the markets work, including more economic integration in Europe, where the integration has not yet been completed. banking union and there is no capital market like the United Kingdom or the United States, while in the internal market national approaches still remain above integration approaches.

"That during the next five, six, seven, eight, five years, growth in Europe is even below 1% on average would show that there are structural problems," he warned.

Despite these problems and the advantages of economies like the United States, Guindos has defended the advantages that the diversity of the eurozone also has, as well as the European social contract.

"I think that ultimately, with the tweaks and productivity improvements that have to do with investment, that have to do with digitalization, that have to do with the green economy, I believe that from a social point of view, political, the market, the European model is superior," he added.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets The CNMV once again suspends Applus's listing

The CNMV once again suspends Applus's listing Línea Directa earns 10.1 million euros in the first quarter, compared to losses of 5.3 million

Línea Directa earns 10.1 million euros in the first quarter, compared to losses of 5.3 million Unicaja triples its profit in the first quarter, up to 111 million euros

Unicaja triples its profit in the first quarter, up to 111 million euros BBVA earns 2,200 million in the first quarter, 19.1% more

BBVA earns 2,200 million in the first quarter, 19.1% more How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on UPV students build a prototype of a wooden house to move to Equatorial Guinea

UPV students build a prototype of a wooden house to move to Equatorial Guinea The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives

The UA opens the call for the Impulso 2024 Awards for the best innovative business initiatives ALI, virtual assistant from Alicante, internationally recognized by the OECD

ALI, virtual assistant from Alicante, internationally recognized by the OECD Retrópolis brings the golden age of video games and computing to the UPV

Retrópolis brings the golden age of video games and computing to the UPV A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness