The developer has not paid 57 million of the principal of a debt and warns of "significant pressure" on its cash position

MADRID, 10 Oct. (EUROPA PRESS) -

Country Garden Holding, which was the largest real estate developer in China, acknowledged this Tuesday in a statement sent to the Hong Kong Stock Exchange the non-payment of the principal of "a certain debt" in the amount of 470 million Hong Kong dollars (57 million euros) and has warned that it expects not to be able to meet all its debt payment obligations abroad ('offshore') as scheduled or within the corresponding grace period.

The company has warned that potential non-payment of amounts due, including but not limited to payment obligations on US dollar bonds issued by Country Garden, may result in creditors demanding "accelerated performance of their relevant debt obligations." or adopt coercive measures".

In this sense, the promoter has assured that it will actively promote offshore debt management measures and, under the premise of respecting the existing legal status and the legal payment order of all creditors, will formulate general solutions in a fair and equitable manner. to achieve a long-term sustainable capital structure.

As such, Country Garden has retained China International Capital Corporation Hong Kong Securities and Hualian Norge (China) as financial advisors, as well as Sidley Austin Law Firm as legal advisors to help evaluate the capital structure and liquidity status of the group and formulate an overall plan that offers a solution as soon as possible.

"The company sincerely requests that creditors allow time for it to objectively evaluate the current challenges it faces and work with its advisors to formulate the best pragmatic and feasible solutions for all stakeholders," the document states.

The Chinese real estate developer has highlighted the liquidity pressure that its activities are experiencing, and continues to try to optimize the existing debt structure to ensure that the interests of all investors are safeguarded to the greatest extent possible.

"In an extremely difficult financial environment, the group has insisted on meeting its payment obligations through sales collections and existing cash resources. However, it currently faces severe challenges in sales and financing, and the funds available on its books continue to decline," he acknowledged.

In this regard, it has warned that, although it has used different options, such as the disposal of assets, to obtain cash flow and continue to meet its financial commitments, in the current market environment, "it is still difficult to quickly replenish sufficient cash flow. to improve liquidity in the short term", with the result that the group's cash position "remains under significant pressure".

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Prominent American writer Paul Auster dies at 77 from lung cancer

Prominent American writer Paul Auster dies at 77 from lung cancer RELEASE: Rendeavor Expands High-Speed Internet Access to Local Communities Around Tatu, Kenya

RELEASE: Rendeavor Expands High-Speed Internet Access to Local Communities Around Tatu, Kenya Real Madrid saves a draw in Munich and will appeal again to the Bernabéu

Real Madrid saves a draw in Munich and will appeal again to the Bernabéu The Congress of Argentina approves the omnibus law that allows the privatization of some public companies

The Congress of Argentina approves the omnibus law that allows the privatization of some public companies How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives

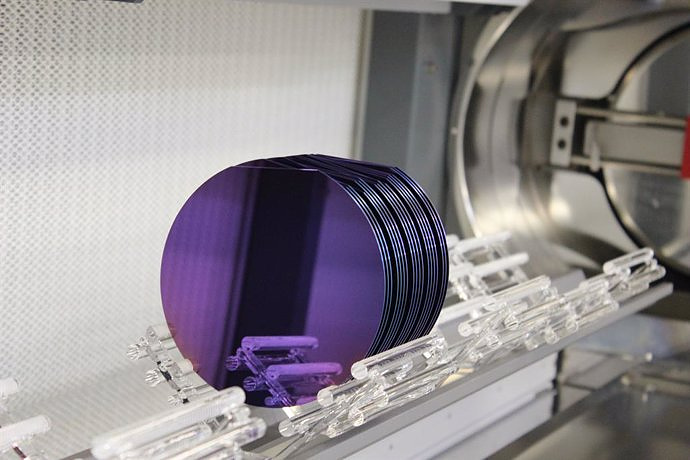

Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics

UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time

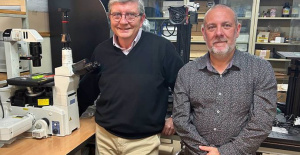

A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time They create a bank of machinery sounds to prevent breakdowns through artificial intelligence

They create a bank of machinery sounds to prevent breakdowns through artificial intelligence A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness