According to a report by Sopra Steria

MADRID, 5 Abr. (EUROPA PRESS) -

55% of Spanish banking clients would open an account with technology companies such as Amazon, Microsoft, Apple, if they offered financial products, according to the study 'Digital Maturity of the Spanish Banking Sector 2023', carried out by Sopra Steria in collaboration with Ipsos.

This report, based on surveys of 2,000 traditional and digital banking users in Spain, measures customers' opinions on the products and services offered by their entities. In it, the firm points out that technology companies are perceived as "less expensive" by 48% of banking clients, "more secure" by 36% and with "more personalized" services also by 36%.

When asked if they would be willing to have an account with the main players in the trade of goods or services online (Amazon, Alibaba, Uber, etc.) if they offered attractive financial products, 42% of Spaniards responded affirmatively, while the European percentage was significantly lower, at 34%.

Additionally, 39% would open an account with high-tech hardware and software providers, such as Apple or Microsoft, or with email and search engine providers, such as Google. Only 29% would use a social network in these same terms.

On the other hand, Sopra Steria points out that the majority of Spanish clients - 76%, compared to 80% in Europe - continue to trust their bank, although "they are not completely satisfied" with the interactions with their entity in important moments in their lives, a perception that is "more pronounced" than that of the average European.

Specifically, the firm explains that 58% of people believe that their bank "is not interested in making them earn money", compared to 51% in Europe, while 43% of Spaniards think that they are not treated as someone who amount, compared to 27% in Europe who think the same.

Thus, the study indicates that 29% of Spanish clients wanted to change banks in 2023, a figure higher than the European average, which is 27%. The cost of the services is the main argument for carrying out this action, followed by the quality of the advice, the ability to respond to requests and the variety of the offer.

The report also points out that the impact of rising interest rates appears to be "much more significant" in Spain than in other European countries, since 71% of clients - which in Europe is 58% - say that this situation could limit your investments.

On the other hand, it indicates that Spanish clients who have been victims of a hacking attempt (25%) have increased by four points, although the figure is still behind the European average (27%).

However, in this edition, users are "less positive" about the effectiveness of their bank's response in the event of a hack. 42% indicate that, in the face of these attacks, appropriate measures were not taken or they were not effective.

Sopra Steria reports that the report was prepared based on a survey carried out in Spain among 2,000 people, representative of the population aged 18 and over, who have a bank account in a traditional or online bank.

The results are compared with those for Europe, which refers to representative samples surveyed in nine countries: France, Germany, Spain, the United Kingdom, Italy, Sweden, Belgium, the Netherlands and Luxembourg.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Prominent American writer Paul Auster dies at 77 from lung cancer

Prominent American writer Paul Auster dies at 77 from lung cancer RELEASE: Rendeavor Expands High-Speed Internet Access to Local Communities Around Tatu, Kenya

RELEASE: Rendeavor Expands High-Speed Internet Access to Local Communities Around Tatu, Kenya Real Madrid saves a draw in Munich and will appeal again to the Bernabéu

Real Madrid saves a draw in Munich and will appeal again to the Bernabéu The Congress of Argentina approves the omnibus law that allows the privatization of some public companies

The Congress of Argentina approves the omnibus law that allows the privatization of some public companies How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives

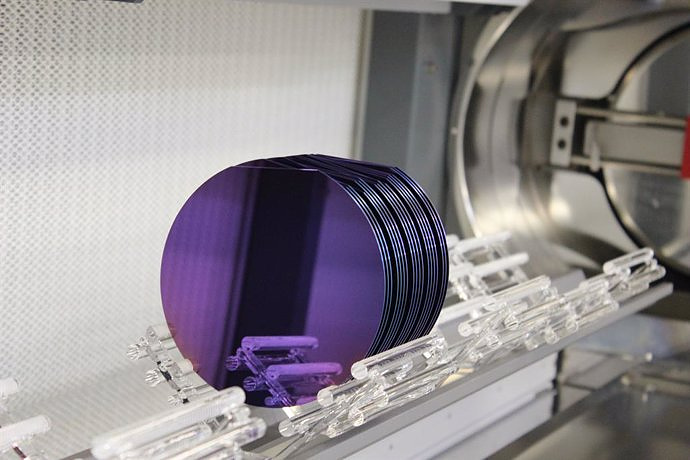

Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics

UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time

A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time They create a bank of machinery sounds to prevent breakdowns through artificial intelligence

They create a bank of machinery sounds to prevent breakdowns through artificial intelligence A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness