Before the Ether on the 13. September could rise by a whopping 19 percent, had to cope with the Ethereum course, a sharp price fall. A part of the Community, the exchange BitMEX thinks is responsible. What is behind these allegations?

On 8. September 2018 fell to the Ethereum-price under 200 US Dollar. This means that the price is low, which stood for the last Time in June 2017. 12. September 2018, the Ethereum has reached course with 166,99 dollars his previous year minimum.

Previously, there was the General market situation, the Bomb Difficulty and self-critical statements by Vitalik Buterin as possible reasons. Now BitMEX classified as a market manipulator in the number of Suspects. This is not the first manipulation allegation against the crypto stock exchange.

Fixed: Arthur Hayes, CEO of BitMEX, is not a supporter of Ethereum. In mid-August he called Ethereum as a Shitcoin, its course was soon double digits. Even more directly, he spoke in the BitMEX-own Trollbox:

In this Dialog, you can see the explosiveness in his opinion. It is not simply an attitude to Ethereum, which could be recorded even under a matter of taste. Arthur Hayes says that so-called ETH/USD Perpetual Swaps, the rate of Ethereum without the use of Ethereum can be manipulated.

Perpetual Swaps: constantly renewing futures contractsPerpetual Swaps trading instruments of BitMEX. They are reminiscent of Futures, are futures contracts, which expire never. Traders can trade with a up to 50 times leverage, without that this Position will be closed after a certain period of time. Instead, a Perpetual Swap is renewed every eight hours. The maintenance of a Perpetual Swaps is not free of charge: those Who trade with the Trend, you must pay for Maintaining his Position, who trades against the Trend, worthy of as long as money. On BitMEX Trading Perpetual may use Swaps, in principle, constant as Short Positions.

Short Positions, i.e. bets on a falling price, not be able to use for a Trader for speculative objectives. Also, a long-time investor may hedge by a Short Position the value of their actual Investments. Although this will cost you in the long-term investor, every eight hours, but he can minimize, in the case of a rate fall, when intelligently chosen Leverage, the loss of so.

Perpetual Swaps for Ethereum are good for Hedging nothingSuch Perpetual Swaps, even if they are conducted under the ETH/USD, on the Basis of the exchange rate between Ethereum and Bitcoin. Neither for Long nor for Short Position you have to purchase Ether. Trader on BitMex bets so actually only an Index. Even more importantly, Also for the design of ETH/USD exchange rate the exchange rate between Bitcoin and Ethereum, those between Ethereum and the US is one-Dollar is irrelevant. But this also means, conversely, that the Ethereum calculated value is not only dependent on the fluctuations within the Ethereum course, but also from the Bitcoin exchange rate.

This double dependence makes the Perpetual Swap ETH/USD as a Hedging Instrument, is useless. Shorting is only for speculators and other rates are falling, interested useful.

In August, it was apparent that the buying and selling rates for ETH/USD Swaps were significantly greater than the Index for Ethereum. Probably some of the Trader's Long Position after the introduction of this Perpetual Swaps opened with the idea that Ethereum is currently undervalued. Real counter-positions, built a Hedge, not saw you.

The result was a huge gap between buying and selling positions. The fees for the purchase positions exceeded 50 percent per year. The positions could not be maintained. To have any time probably whales entering the market and extremely affordable Short Position opened and the price to Fall.

How realistic is the BitMEX-Thesis?as far as the anomalies are worth noting. Also, Arthur Hayes’ Position with Ethereum is known. That the traders have used the presented mechanisms of Perpetual Swaps against Ethereum, is without a doubt a possibility. However, the influence of the Ethereum course on BitMEX to other courses is only a psychological. As a Trader on the Exchange BitMEX, and sell the so-called Quanto derivatives that are linked to the Ethereum course, no single Ether-Token buy.

such A psychological impact, one must not underestimate, especially when it coincides with a generally pessimistic market situation, various criticisms of Ethereum and a further shift in the Difficulty Bomb. BitMEX may have contributed to an overall picture, but certainly not alone in the course have influenced.

the First signs of a recovery from the Ethereum coursein the Meantime, the situation has eased to Ethereum. Since the 12th century. In September the rate has risen by about 20 percent and currently stands at over 200 dollars:

Everything again on the way up? Not so fast: The EMA200 on an hourly chart (red line) is currently a barrier, of course, is bounced off a few hours ago. The since 12. September reached a rate of profit is nice, but before one can speak of a trend reversal, it must overcome the Ethereum course the EMA200 in a sustainable way.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets UGT and CCOO demand the regeneration of democracy, better salaries and a reduction in working hours

UGT and CCOO demand the regeneration of democracy, better salaries and a reduction in working hours Alcaraz gives up his reign in Madrid against Rublev

Alcaraz gives up his reign in Madrid against Rublev Petro announces that Colombia will break diplomatic relations with Israel

Petro announces that Colombia will break diplomatic relations with Israel The Fed maintains rates and gives the ECB the initiative to reverse monetary restriction

The Fed maintains rates and gives the ECB the initiative to reverse monetary restriction How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Ivace and promotes a less invasive device for the early detection of prostate cancer

Ivace and promotes a less invasive device for the early detection of prostate cancer Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives

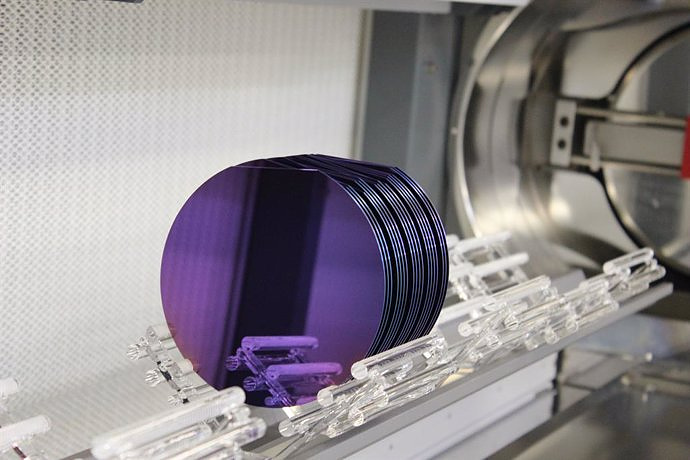

Valencia unanimously approves the ordinance to allocate spaces to test innovative initiatives UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics

UPV researchers promote a paid master's degree as a "talent factory" in integrated photonics A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time

A spin-off of the UV works on obtaining high-resolution 3D biomedical images in real time A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness