Vitas Vasiliauskas has about the advantages and disadvantages of digital Central Bank currencies (CBDCs) will be. The member of the Council of the European Central Bank difference between different application models. A financial institutions tailored solution appears to him, for the Moment, the most practical.

By Anton LivshitsOn 29. May 2019BTC$8.703,00 0.08%part Facebook Twitter LinkedIn xing mail

Convinced Bitcoin-Disciples like to refer to the advantages that are enrolled for a decentralized currency. Ironically, Central banks think, however, a diametrically opposite model of crypto-currencies: Central Bank Digital Currency (CBDC). This would be a digital currency that is brought from a Central Bank into circulation and regulated. Vitas Vasiliauskas, in his capacity of member of the Council of the ECB and the Executive Board of the Lithuanian Central Bank, has thought at a conference about the future viability of such a currency concept.

In his speech, is different Vasiliauskas Essentially between two application possibilities: accessible variant, as well as a specially designed to large investors and financial institutions tailored model. Ultimately, the ECB governing Council member to the second variant is preferable.

Digital Central Bank currencies to facilitate paymentsFor Vasiliauskas, a Substantially on institutions limited CBDC increases the efficiency of the General payment and the settlement of securities transactions. A novel technical solution would reduce also liquidity risks. The ECB governing Council member outlined how such a concept could be implemented in practice:

CBDC for Everyone: hardly any of the benefits?Some argue that it could run on a Distributed Ledger. In this case, you would replace [the CBDCs] the reserves of the Central Bank by a digital Token with restricted access or amend. A Token is a bearer object, i.e., the transmitter would be transferred during the transaction without an intermediary, the value to the recipient. This is something completely different than the current System, in which the Central Bank accounts loaded and relieved, without having to transfer actual values.

the idea Of CBDCs for the General public to introduce, takes Vasiliauskas, however, distance. This could help to improve the success of national monetary policies. They promise to increase the financial stability. However, a number of other cashless payment systems has established itself in recent years. The ECB governing Council member rated the introduction of freely available CBDCs therefore, in comparison, is hardly profitable.

The statements made Vasiliauskas clear that CBDCs to stay, at least for Lithuania to continue in the future. The financial expert, calls only for more data. Central banks of other countries, however, already today digital services. Including Sweden and the Ukraine. Such products are in comparison to Bitcoin & co., remains to be seen.

Blockchain- & Fintech Jobs : looking for a new challenge? In our job Board your current job ads from the Blockchain- & Fintech companies.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

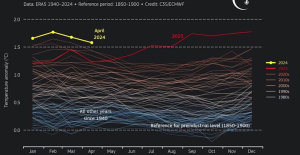

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets April 2024 was the hottest on global records

April 2024 was the hottest on global records Tezanos charges against the PP for its "dirty war" against the CIS and says that the JEC does not adhere to the principle of legality

Tezanos charges against the PP for its "dirty war" against the CIS and says that the JEC does not adhere to the principle of legality Illa promises to appoint Parlon Minister of the Interior and Trapero Director General of Mossos

Illa promises to appoint Parlon Minister of the Interior and Trapero Director General of Mossos Unions are mobilizing today to achieve labor and salary improvements in the Tax Agency

Unions are mobilizing today to achieve labor and salary improvements in the Tax Agency How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on They develop devices for the precise diagnosis of cancer patients

They develop devices for the precise diagnosis of cancer patients UMH researchers are working on a high-quality apricot crop that requires less irrigation water

UMH researchers are working on a high-quality apricot crop that requires less irrigation water The UPV develops an application to improve the quality of life of patients with glioblastoma

The UPV develops an application to improve the quality of life of patients with glioblastoma A sensor system obtains the fingerprint of essential oils and detects if they have been adulterated

A sensor system obtains the fingerprint of essential oils and detects if they have been adulterated A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness