Dogecoin, the meme-coin project that caught everyone’s attention and shot up to $0.73 in 2021, is back in the limelight. People are talking about a potential rebound to $0.50, and retail investors are wondering if the lovable DOGE can make a comeback. However, there’s a new player in town that’s gaining traction among long-term investors looking for utility, innovation, and high growth potential – Ozak AI. Priced at just $0.003 in its presale phase, Ozak AI is seen as a more calculated and risk-adjusted bet with a potential 300x upside.

Dogecoin’s Journey to $0.50

Dogecoin has always been driven by a passionate community, viral social media campaigns, and celebrity endorsements, especially from Elon Musk. Despite its limited use case, Dogecoin has managed to stay relevant due to its widespread popularity and status as the original meme coin. Analysts believe that DOGE could hit $0.50 during the next crypto bull run, depending on market conditions, renewed interest from retail investors, and continued support from influential figures. However, it’s important to note that Dogecoin lacks a strong utility narrative, as it was initially created as a joke and has not seen significant development or innovation.

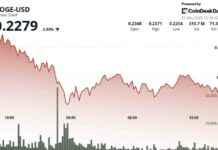

For investors buying Dogecoin at current prices (around $0.15-$0.20), a move to $0.50 would represent a 2.5x to 3x return, which is decent but not as lucrative as what emerging utility tokens like Ozak AI offer.

Why Ozak AI Might Be the Smarter Choice

Ozak AI is a cutting-edge crypto project that combines predictive artificial intelligence with decentralized infrastructure to provide real-time data insights and automation solutions for individuals and businesses. Unlike Dogecoin, Ozak AI’s value is rooted in utility and innovation, rather than hype. The Ozak AI ecosystem includes features like the Ozak Stream Network (OSN) for low-latency data flow, Prediction Agents (PAs) for forecasting trends, DePIN Technology for enhanced data security, and Ozak Data Vaults for secure data storage and retrieval.

Priced at just $0.003 in its presale phase and having raised over $1 million, Ozak AI has significant upside potential. If it reaches its projected $1 target, early investors could see a 300x return, surpassing the growth prospects of traditional coins like DOGE. Ozak AI addresses real-world problems, making it more likely to be adopted in the long term.

Dogecoin may reach $0.50 if the next bull run gains momentum, but its growth potential is limited by its lack of utility. In contrast, Ozak AI offers both advanced technology and high return on investment potential. With its presale ongoing and excitement building around its AI capabilities, Ozak AI presents a compelling option for investors looking beyond meme coins. For those seeking innovation and exponential gains, Ozak AI could be the wiser choice as we head into 2025.

About Ozak AI

Ozak AI is a blockchain-based project that offers a technology platform specializing in predictive AI and advanced data analytics for financial markets. By providing real-time insights through machine learning algorithms and decentralized technologies, Ozak AI assists crypto investors and companies in making informed decisions.

Not really sure why this matters, but Ozak AI seems to be the new kid on the block, offering a more grounded and practical approach compared to the meme-driven hype of Dogecoin. Maybe it’s just me, but it feels like Ozak AI is onto something big, and investors might want to take notice.

For more information, you can visit Ozak AI’s website, check out their Telegram channel, or follow them on Twitter. Remember, this is a paid post, so take everything with a grain of salt and do your research before diving in. After all, in the world of crypto, anything can happen.