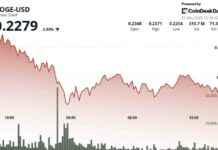

The leverage flush went down as crypto prices took a nosedive due to renewed trade war fears, with BTC sliding 3% from its near record highs. This all went down on May 23, 2025, around 4:40 p.m., sending shockwaves through the crypto trading community. People who were banking on a solid bitcoin rally were in for a rude awakening when Donald Trump’s latest tariff threats hit the headlines.

What Happened in the Crypto World

In the past four hours leading up to the plunge, over $300 million worth of leveraged derivatives positions were liquidated across centralized exchanges, as reported by CoinGlass data. The majority of these liquidations were from long positions, where traders bet on higher prices. BTC longs took the biggest hit, accounting for $107 million, followed by Ethereum’s ether with close to $87 million. Other tokens like Solana’s SOL, Dogecoin, and SUI also saw significant liquidations ranging between $10 million and $18 million each. It was a rough day for many traders who were hoping for a different outcome.

The Trade War Fears

The sell-off was triggered by Trump’s proposal of a 50% tariff on imports from the European Union starting next month, along with a 25% tariff on iPhones manufactured outside the U.S. This reignited fears of an escalating trade war, causing BTC and major altcoins like Ether, XRP, and Cardano to drop 3% to 4%. Smaller-cap tokens like Uniswap and SUI experienced even bigger losses, falling 5% to 7% over the past 24 hours. It was a rollercoaster ride for many traders, including the well-known James Wynn, who found himself in hot water after opening a $1.1 billion BTC long bet with 40x leverage on the Hyperliquid exchange. With $7.5 million of unrealized losses and the threat of liquidation looming if BTC dropped to $102,000, things were looking grim for Wynn.

The Unusual Market Trends

Surprisingly, the long liquidations came at a time when there was a shift towards short positions in BTC derivatives, despite record prices, as reported by CoinDesk. Not really sure why this matters, but it seems like the market was in a bit of a frenzy with traders trying to navigate the uncertainty brought on by the trade war fears. Krisztian Sandor, a U.S. markets reporter focusing on stablecoins and tokenization, highlighted the chaos that ensued in the crypto market as a result of the leverage flush. It was a wild ride for everyone involved, with fortunes made and lost in a matter of hours.

In conclusion, the crypto market proved once again that it is volatile and unpredictable, with traders having to constantly adapt to changing circumstances in order to stay afloat. Whether it’s trade war fears, regulatory concerns, or market manipulation, there’s always something lurking around the corner to shake things up. But hey, that’s the thrill of the game, right?