On Monday, the U.S. stocks didn’t really know what to do as investors were all over the place with Moody’s Ratings stripping the U.S. of its last triple-A credit grade and lawmakers pushing through a tax bill that’s supposed to make the federal deficits even larger. The S&P 500, trying to keep up its five-day winning streak, kind of went up a bit, while the Nasdaq Composite managed to rise by a tiny 0.01%. The Dow Jones Industrial Average was the winner of the day, rising by 0.3% thanks to UnitedHealth Group shares making a comeback.

Moody’s made the big announcement late on Friday, downgrading U.S. debt to AA1 because of those “persistent, large fiscal deficits” and the rising interest costs. Meanwhile, the House Budget Committee was busy giving the green light to President Trump’s tax-and-spending plan, which would extend the cuts and increase spending, ultimately leading to even bigger deficit predictions. The 10-year Treasury yield had a bit of a moment, spiking up to 4.56%, the highest it’s been in over a month, before settling back down to 4.46%. The 30-year Treasurys also saw some action, touching 5% before calming down around 4.95%. The dollar index was not having a good day, dropping by 0.7%, while gold decided to make a move, jumping up by 1.5% to $3,235 an ounce.

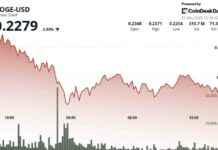

Tech stocks were all over the place, just like everything else. Tesla took a little dip, losing 2% after that big 17% rally last week. Apple also slipped by 1.5%, and Nvidia, Alphabet, and Meta were all in the red. On the other hand, Microsoft and Amazon were like, “We’re good,” and edged a bit higher. Oh, and Bitcoin was doing its thing, surging up to $105,400, which made shares of Strategy go up by 3%. But Palantir, AMD, and Super Micro Computer weren’t feeling it and each fell over 2%.

JPMorgan CEO Jamie Dimon was like, “Hey, we haven’t even seen the full impact of those tariffs yet,” while the Fed officials were like, “No changes to interest rates for now, folks.” The global markets were a mixed bag – European stocks decided to go up a bit, while Asia was like, “Nah, we’re going down.” The European Union was like, “Our growth outlook is not looking so great,” and Diageo was like, “We might take a $150 million hit from those tariffs.” So yeah, that’s how the day went for the stocks – a little crazy, a little uncertain, and a whole lot of drama.