Sequoia Capital Managing Partner Roelof Botha found himself in a bit of a pickle recently when his personal info got mixed up in the whole Coinbase hack situation. Apparently, some sneaky hackers targeted big shots like Botha in an attempt to mess with the largest U.S. cryptocurrency exchange. The stolen goods included Botha’s digits, address, and other juicy bits linked to his Coinbase account. A top-secret source spilled the beans on the situation, but we can’t reveal their identity because, you know, it’s all hush-hush.

So, turns out these Coinbase hackers went the extra mile and greased the palms of customer service reps in India to get their grubby hands on client data. The loot they snagged included everything from names and birthdates to banking deets and more. The scammers even tried to squeeze $20 million out of Coinbase in exchange for keeping their traps shut, but the company wasn’t having any of that nonsense. Suspicious activity from some customer service peeps had actually been detected as far back as January, talk about a sneaky operation.

Now, Botha isn’t just any old Joe Schmoe, he’s part of the infamous “PayPal Mafia” crew along with big names like Peter Thiel and Elon Musk. He’s been kickin’ it at Sequoia Capital since 2003, making savvy investments in companies like YouTube and Instagram. The guy was even promoted to senior steward in 2022, talk about climbing the corporate ladder. A few unlucky Coinbase users got hit with security alerts over the weekend, warning them that their info might’ve been compromised. All this drama is shining a bright ol’ spotlight on the security concerns surrounding cryptocurrency bigwigs as the industry keeps on growing and attracting attention.

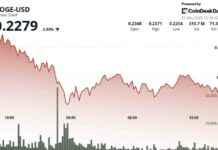

Despite all the chaos, COIN is actually up 9% today, trading at $266.4 as we speak. It seems like investors are keeping the faith in the company’s long-term potential, even with all the data security troubles. Not really sure why this matters, but hey, maybe it’s just me, but it’s interesting to see how things play out in the wild world of cryptocurrency. Who knows what’s gonna happen next, right? But for now, it looks like COIN is weathering the storm like a champ.