Alright, so there’s this new meme coin making waves in the crypto world called Pepeto. It’s not just your average meme coin looking to make a quick buck; it’s got a whole backstory and a comeback story that’s got people talking. Pepeto is mixing together lore and technology, bringing in ties to Pepe’s mysterious past and a bold resurgence that’s got everyone intrigued.

The scoop on Pepeto: A tale of betrayal, redemption, and the rise of the frog deity

Rumors have been swirling around Pepeto, also known as the “God of Frogs,” within the meme coin community. Word on the street is that one of the original founders of Pepe, who was thought to have vanished into thin air, was actually forced out before the coin hit it big. Allegedly betrayed by the current CEO of Pepe and left out in the cold right as things were heating up, this founder is said to have made a grand return under the new banner of Pepeto. Unlike its predecessor, Pepeto is not just about riding the hype train but about making a lasting impact. It’s not just a meme; it’s a statement. A reset. A reclaiming of the froggy throne. Pepeto isn’t just taking on Pepe; it’s aiming to rule the entire frog-themed memecoin realm.

But wait, there’s more to Pepeto than just a captivating story. The project is packed with real-world applications, from PepetoSwap, a decentralized platform for easy and secure token exchanges, to the upcoming Pepeto Exchange, which promises to provide a transparent and safe trading environment built from scratch. With a solid roadmap and a focus on trader safety, functionality, and education, Pepeto is setting a new standard for memecoins in a landscape that’s evolving rapidly.

In a time where memecoins need to bring more than just hype to the table, Pepeto is stepping up to the challenge. It’s not just about flashy promises anymore; it’s about delivering real value, and that’s exactly what Pepeto aims to do.

From $10k to over $1m? Pepeto’s price potential has investors buzzing

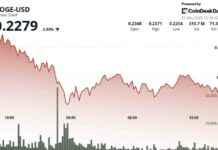

Let’s talk numbers for a minute. If you were to invest $10,000 in Pepeto today at the current price of $0.00000013 per token, you’d end up with around 76.9 million Pepeto tokens. If Pepeto were to reach just the current price of Pepe at $0.00001308, your holdings would be valued at a little over $1,006,000. That’s a 100x return on your investment, folks. And here’s the kicker – Pepeto and Pepe have the exact same max supply of 420 trillion tokens, sparking even more speculation, especially as Pepeto’s team hints at a Tier 1 exchange listing on the horizon.

But there’s more to Pepeto than meets the eye. The name itself, P E P E T O, reveals the project’s core values: Precision, Energy, Power, and Efficiency, elements that were allegedly missing from the original Pepe concept. The final letters, T and O, stand for Technology and Optimization, reflecting the cutting-edge infrastructure that Pepeto is putting in place through tools like PepetoSwap and the future Pepeto Exchange. It’s this blend of narrative, technology, and timing that sets Pepeto apart from the rest. It’s not just another meme coin; it’s a movement with real potential.

How to get your hands on PEPETO tokens

Getting started with PEPETO is a breeze:

• Set Up a Wallet – Pick a wallet like MetaMask or Trust Wallet that works with Ethereum.

• Fund the Wallet – Add ETH, USDT, or BNB to your wallet.

• Join the Presale – Head over to pepeto.io and snag your PEPETO tokens.

• Stake Tokens – Start earning rewards through Pepeto’s staking system.

About PEPETO

PEPETO brings together the viral energy of memecoins with practical utility. With features like a zero-fee exchange, a cross-chain bridge, and high-yield staking rewards, it’s shaping up to be one of the most promising projects to watch in 2025.

So there you have it, folks. Pepeto isn’t just another run-of-the-mill meme coin; it’s a force to be reckoned with in the ever-evolving world of cryptocurrency. Keep your eyes peeled for what’s next from the Pepeto team – the froggy revolution is just getting started.