Ratifies the condemnation of the bank as subsidiary civil liability and says that the bank's internal control systems were "insufficient"

MADRID, 6 Dic. (EUROPA PRESS) -

The Supreme Court has confirmed the sentence of 7 years, 5 months and 29 months in prison for a former Unicaja employee who defrauded relatives and close friends who she led to believe that they were investing in the entity's financial products reserved for senior managers. It has also ratified the condemnation of Unicaja Banco as subsidiary civil liability so that it pays -as compensation along with its former employee- the 5.6 million euros defrauded.

The magistrates have concluded that it was not a "true investment", but a crime of fraud in which the injured parties -- "given the appearance of a fruitful investment and false promise that they would obtain large interest"- "had certain amounts of money" in favor of the defendant "that otherwise they would not have delivered and of which they were finally dispossessed".

The Supreme Court has considered that the activity of the former worker "could only be carried out because the internal control systems of the bank, if not non-existent, were certainly insufficient or inadequate."

In a sentence, to which Europa Press has had access, the court has dismissed the appeal filed by the woman and has confirmed the sentence of the Provincial Court of León, which sentenced her for a continued crime of falsifying a commercial document in medial bankruptcy with a continued crime of fraud of special gravity for the amount defrauded and with abuse of personal relationships.

In 93 pages, the Supreme Court has reviewed the proven facts, which date back to the period between 2000 and 2002, when the Unicaja worker "devised a system to obtain cash from relatives and close friends, to whom she informed of certain investments in financial products, which would be reserved for senior managers and which, being located in tax havens, produced a high return".

According to the sentence, these people gave her "significant sums of cash" that the defendant used "without signing any financial product in the name of those people or delivering it to Caja España."

The woman provided them with some documents that she had prepared and in which she had stamped or scanned the distinctive signs of Caja de España and Caja Duero, as well as the seal of the entity with an "illegible signature." "All this with the purpose that the documents devised were credible," said the court.

At the end of 2011 the situation became "untenable" for the defendant. "Since they were unable to partially meet the reimbursement requests of many of the investors, some of them made claims to Caja España, which led to an internal audit," she stated in the sentence. In total she owed 5.6 million euros.

The Provincial Court of León sentenced the woman who, dissatisfied with the ruling, brought the case before the Supreme Court, which has now dismissed the arguments outlined in her appeal.

The court has also rejected the bank's claims. Unicaja assured that the actions of the former employee were "absolutely alien to her duties and responsibilities" in the entity, "having bypassed all the controls established by Unicaja" and "without said illegal activity having generated any benefit" for the bank. Thus, she requested that no subsidiary civil liability be required of her.

The Criminal Chamber has supported the decision of the León magistrates and has stressed that the position of the convicted woman in the bank was, "together with personal closeness", which "determined her family and friends, and even co-workers to make the investments that I was proposing".

The court has emphasized that "the organization of the company's personal and material resources had a decisive influence on the criminal act." "The fact of working very close to senior officials of the entity, even for a time at the headquarters of the central services, helped to create an external appearance of legitimacy in their relationship with third parties, who trusted that the accused was acting on their behalf. condition of employee or dependent of Caja España", the magistrates have pointed out.

In the resolution, for which Judge Carmen Lamela has been a rapporteur, the court has also ratified the calculation that the Provincial Court made of the compensation.

"It can be verified how the court has taken into consideration to reach the conclusions that it reflects in the sentence and to establish, based on this, each one of the compensations that corresponds to each one of the injured parties, not only what was stated by them, but also the documentary evidence in the proceedings, the defendant's acknowledgment of the investments made, and the information itself provided at the time by the entity".

On the sidelines, the Supreme Court has upheld Unicaja's request that the former worker's son also be considered as a lucrative participant, given that "he suffered an irregular and disproportionate increase in his assets" when he was 23 years old, "as a result of the acquisition of goods in his name acquired" with the money obtained from the scam.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

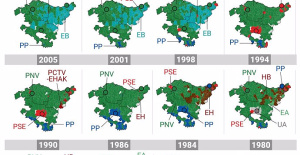

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Historical results of the 2024 Basque elections, municipality by municipality

Historical results of the 2024 Basque elections, municipality by municipality Iran assures that any action by Israel will have an "immediate and highest level" response: "They will regret it"

Iran assures that any action by Israel will have an "immediate and highest level" response: "They will regret it" The Ciudad Real Court sentences the man who killed a thief with two shots in his home to 6 years

The Ciudad Real Court sentences the man who killed a thief with two shots in his home to 6 years PP and PSOE clash in the Senate over Koldo's appearance after a socialist writing on a work plan

PP and PSOE clash in the Senate over Koldo's appearance after a socialist writing on a work plan How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Valencia displays its "innovative and technological potential" at the Emerge Americas event in Miami

Valencia displays its "innovative and technological potential" at the Emerge Americas event in Miami The CSIC incorporates the challenges of robotics, nanotechnology and AI in the new strategic plan for biomedicine

The CSIC incorporates the challenges of robotics, nanotechnology and AI in the new strategic plan for biomedicine Innovation allocates 9.1 million to train 74,000 people and guarantee digital inclusion

Innovation allocates 9.1 million to train 74,000 people and guarantee digital inclusion LIFE SPOT manages to develop new green treatments that eliminate groundwater contamination

LIFE SPOT manages to develop new green treatments that eliminate groundwater contamination A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness